MediaTek Inc (聯發科) yesterday raised its revenue growth forecast for this year for the second time, buoyed by higher average selling prices and market share gains amid increasing 5G penetration worldwide.

The chip designer now expects revenue to grow 52 percent from last year, up from the 45 percent growth it estimated three months ago.

As a result, revenue this year would surpass NT$480 billion (US$17.24 billion), a new record and up from NT$322.15 billion last year.

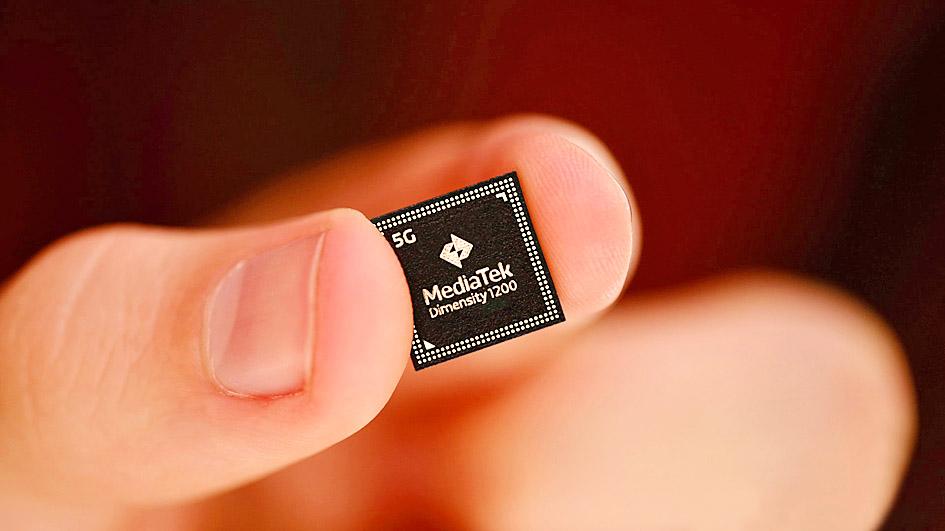

Photo courtesy of MediaTek Inc

“The strong performance in both revenue growth and gross margin” improvement will not be limited to next year only, MediaTek chief executive officer Rick Tsai (蔡力行) told a teleconference yesterday. “We also believe the same strengths during the past few years will carry us through 2022. We expect 2022 will be another year of solid revenue growth with healthy profitability.”

MediaTek has secured “good enough [chip] supply” to meet business targets next year, although chip supply constraints are expected to last for another year, Tsai said.

Gross margin is expected to climb to 46.2 percent this year, compared with 43.9 percent last year, the company said.

The launch of higher-margin flagship 5G chips would help lift gross margin, it said.

MediaTek expects strong growth in its 5G chip shipments and increases in blended average selling price next year, Tsai said.

The company also sees a broader uptake of its 5G chips in the US, Europe, India and other regions by global brands, following adoption of its chips by all major mobile phone vendors in China, he said.

MediaTek said it expects further market share expansion in the North American market to 35 percent of Android-powered smartphones this year, nibbling at the turf of San Diego, California-based Qualcomm Inc.

Asked about the impact from a growing trend of mobile phone and computer makers designing their own chips — for example Oppo Mobile Telecommunications Corp (歐珀) and Google — Tsai said that MediaTek’s rich intellectual property library would be helpful, given how complicated chip design is.

“We see it as a new business opportunity,” he said.

For this quarter, MediaTek expects weak seasonality, mostly due to faltering smartphone chip demand, but said growth momentum would resume next quarter.

Mobile phone chips made up 56 percent of its revenue last quarter, it said.

Revenue this quarter is forecast to be between NT$120.6 billion and NT$131.1 billion, or flat to a quarterly slide of 8 percent, Tsai said.

However, revenue would expand from last year by about 25 percent, he said.

Gross margin is expected to climb to about 47.5 percent this quarter, he said.

In the third quarter, MediaTek reported net profit surged 112.2 percent to NT$28.36 billion from NT$13.37 billion a year earlier and 2.8 percent from NT$27.59 billion the previous quarter.

Earnings per share jumped to NT$17.92 last quarter, compared with NT$8.4 a year earlier and NT$17.44 in the second quarter.

Gross margin in the third quarter was 46.7 percent, up from 44.2 percent at the same time last year and 46.2 percent in the prior quarter.

The New Taiwan dollar is on the verge of overtaking the yuan as Asia’s best carry-trade target given its lower risk of interest-rate and currency volatility. A strategy of borrowing the New Taiwan dollar to invest in higher-yielding alternatives has generated the second-highest return over the past month among Asian currencies behind the yuan, based on the Sharpe ratio that measures risk-adjusted relative returns. The New Taiwan dollar may soon replace its Chinese peer as the region’s favored carry trade tool, analysts say, citing Beijing’s efforts to support the yuan that can create wild swings in borrowing costs. In contrast,

Nvidia Corp’s demand for advanced packaging from Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) remains strong though the kind of technology it needs is changing, Nvidia CEO Jensen Huang (黃仁勳) said yesterday, after he was asked whether the company was cutting orders. Nvidia’s most advanced artificial intelligence (AI) chip, Blackwell, consists of multiple chips glued together using a complex chip-on-wafer-on-substrate (CoWoS) advanced packaging technology offered by TSMC, Nvidia’s main contract chipmaker. “As we move into Blackwell, we will use largely CoWoS-L. Of course, we’re still manufacturing Hopper, and Hopper will use CowoS-S. We will also transition the CoWoS-S capacity to CoWos-L,” Huang said

Nvidia Corp CEO Jensen Huang (黃仁勳) is expected to miss the inauguration of US president-elect Donald Trump on Monday, bucking a trend among high-profile US technology leaders. Huang is visiting East Asia this week, as he typically does around the time of the Lunar New Year, a person familiar with the situation said. He has never previously attended a US presidential inauguration, said the person, who asked not to be identified, because the plans have not been announced. That makes Nvidia an exception among the most valuable technology companies, most of which are sending cofounders or CEOs to the event. That includes

INDUSTRY LEADER: TSMC aims to continue outperforming the industry’s growth and makes 2025 another strong growth year, chairman and CEO C.C. Wei says Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), a major chip supplier to Nvidia Corp and Apple Inc, yesterday said it aims to grow revenue by about 25 percent this year, driven by robust demand for artificial intelligence (AI) chips. That means TSMC would continue to outpace the foundry industry’s 10 percent annual growth this year based on the chipmaker’s estimate. The chipmaker expects revenue from AI-related chips to double this year, extending a three-fold increase last year. The growth would quicken over the next five years at a compound annual growth rate of 45 percent, fueled by strong demand for the high-performance computing