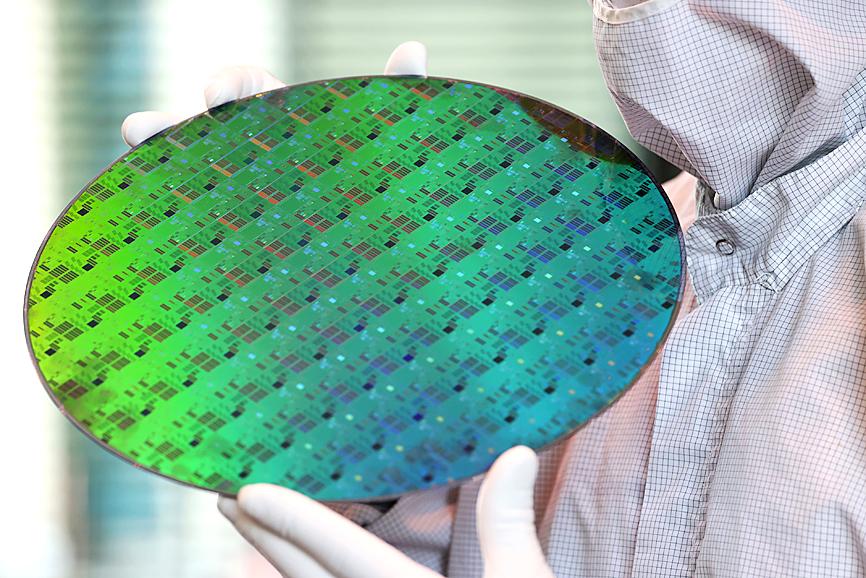

Taiwan has more chip manufacturing capacity than any other economy in the world, US-based market information advisory firm IC Insights said in a research paper last week, cautioning that the nation’s strength could prompt China to attempt to take over Taiwan.

Taiwan commanded 21.4 percent of global installed IC capacity, ahead of South Korea’s 20.4 percent, Japan’s 15.8 percent and China’s 15.3 percent, North America’s 12.6 percent and Europe’s 5.7 percent, IC Insights said.

Taiwan is one of two countries that uses 10-nanometer technology or better to produce wafers, holding 62.8 percent of global capacity, with South Korea holding the remaining 37.2 percent, the report said.

Photo: Bloomberg

China continues to face difficulties in developing its semiconductor sector amid tensions with the US that resulted in Washington imposing sanctions on some of its high-tech companies, it said.

The question of how China would find a competitive edge in the sector is increasingly relevant, as growth is increasingly dependent on the adoption of advanced technology, the report said.

A takeover of Taiwan might be part of China’s strategy, it added.

“It is increasingly apparent that China’s answer to that question centers on its reunification [sic] with Taiwan,” it said. “The bottom line is that, currently, there is no more important base of IC capacity and production than Taiwan.”

If China were to take over Taiwan militarily, the sectors on both sides of the Taiwan Strait would take a hit, although the impact might only be temporary, it said.

“The question is whether China is willing to accept relatively short-term economic pain for the long-term benefit of having the largest amount of the world’s leading edge IC production capacity under its control for many years to come,” it said.

Taiwan’s IC strength stems largely from contract chipmaker Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), which boasts the largest share of cutting-edge technologies, while South Korea depends on Samsung Electronics Co, IC Insights said.

TSMC and smaller Taiwanese contract chipmakers, such as United Microelectronics Corp (聯電), Powerchip Technology Corp (力積電) and Vanguard International Semiconductor Corp (世界先進), are expected to command 80 percent of the global pure-play foundry market this year, the report said.

Although that could be appealing to Beijing, many observers have described TSMC and the nation’s wider semiconductor sector as a “silicon shield,” a term first coined by Craig Addison in his 2001 book Silicon Shield: Taiwan’s Protection Against Chinese Attack.

TSMC chairman Mark Liu (劉德音) in July said that a Chinese takeover would have a larger effect.

“Everybody wants to have a peaceful Taiwan Strait ... because it is to every country’s benefit, [and] also because of the semiconductor supply chain in Taiwan — no one wants to disrupt it,” he said.

MULTIFACETED: A task force has analyzed possible scenarios and created responses to assist domestic industries in dealing with US tariffs, the economics minister said The Executive Yuan is tomorrow to announce countermeasures to US President Donald Trump’s planned reciprocal tariffs, although the details of the plan would not be made public until Monday next week, Minister of Economic Affairs J.W. Kuo (郭智輝) said yesterday. The Cabinet established an economic and trade task force in November last year to deal with US trade and tariff related issues, Kuo told reporters outside the legislature in Taipei. The task force has been analyzing and evaluating all kinds of scenarios to identify suitable responses and determine how best to assist domestic industries in managing the effects of Trump’s tariffs, he

TIGHT-LIPPED: UMC said it had no merger plans at the moment, after Nikkei Asia reported that the firm and GlobalFoundries were considering restarting merger talks United Microelectronics Corp (UMC, 聯電), the world’s No. 4 contract chipmaker, yesterday launched a new US$5 billion 12-inch chip factory in Singapore as part of its latest effort to diversify its manufacturing footprint amid growing geopolitical risks. The new factory, adjacent to UMC’s existing Singapore fab in the Pasir Res Wafer Fab Park, is scheduled to enter volume production next year, utilizing mature 22-nanometer and 28-nanometer process technologies, UMC said in a statement. The company plans to invest US$5 billion during the first phase of the new fab, which would have an installed capacity of 30,000 12-inch wafers per month, it said. The

Taiwan’s official purchasing managers’ index (PMI) last month rose 0.2 percentage points to 54.2, in a second consecutive month of expansion, thanks to front-loading demand intended to avoid potential US tariff hikes, the Chung-Hua Institution for Economic Research (CIER, 中華經濟研究院) said yesterday. While short-term demand appeared robust, uncertainties rose due to US President Donald Trump’s unpredictable trade policy, CIER president Lien Hsien-ming (連賢明) told a news conference in Taipei. Taiwan’s economy this year would be characterized by high-level fluctuations and the volatility would be wilder than most expect, Lien said Demand for electronics, particularly semiconductors, continues to benefit from US technology giants’ effort

‘SWASTICAR’: Tesla CEO Elon Musk’s close association with Donald Trump has prompted opponents to brand him a ‘Nazi’ and resulted in a dramatic drop in sales Demonstrators descended on Tesla Inc dealerships across the US, and in Europe and Canada on Saturday to protest company chief Elon Musk, who has amassed extraordinary power as a top adviser to US President Donald Trump. Waving signs with messages such as “Musk is stealing our money” and “Reclaim our country,” the protests largely took place peacefully following fiery episodes of vandalism on Tesla vehicles, dealerships and other facilities in recent weeks that US officials have denounced as terrorism. Hundreds rallied on Saturday outside the Tesla dealership in Manhattan. Some blasted Musk, the world’s richest man, while others demanded the shuttering of his