The production value in Taiwan’s semiconductor industry this year is expected to soar 31.8 percent from last year to NT$3.6 trillion (US$129 billion), outpacing 10.1 percent growth in the global semiconductor industry, market researcher the Market Intelligence and Consulting Institute (產業情報研究所) said yesterday.

The Taipei-based researcher attributed the strong outlook for the local semiconductor industry to demand for chips used in notebook computers amid a COVID-19 pandemic-induced stay-at-home economy, as well as emerging applications from 5G and artificial intelligence to automotive electronics.

Production in the foundry segment, a pillar of Taiwan’s semiconductor industry, is to expand 20 percent annually to NT$1.9 trillion, driven by higher chip prices as demand continues to outstrip supply, the institute said.

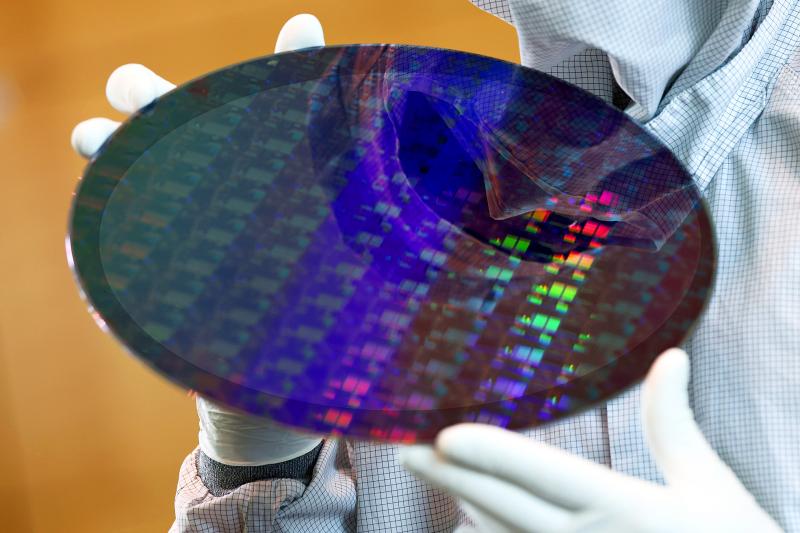

Photo: Bloomberg

Chipmakers would increase prices, passing on increases in manufacturing costs, it said.

“Semiconductor shortages have become a new global norm,” said Cheng Kai-an (鄭凱安), a senior industry analyst at the institute.

“It has become a new business model for foundry companies to ink long-term supply agreements and collect prepayments,” Cheng said in a statement. “Foundry companies are raising prices to reflect higher costs and to boost gross margin. Hiking chip prices will also help avert overbooking, which could lead to supply-demand imbalance.”

For suppliers of DRAM and flash memory chips, prices are to peak in the second half of this year, leaving little room for further upticks, he said.

Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), the world’s biggest foundry service provider, said that it expects its revenue to expand more than 20 percent this year from last year.

TSMC has reportedly raised prices by 10 to 20 percent for new orders.

Local chip testing and packaging service providers are to increase product value by 25 percent this year from last year, benefiting from strong demand, price increases and supply constraints, the institute said.

On top of that, some local companies are to receive orders transferred from peers, as some plants were forced to halt production due to COVID-19 restrictions in Malaysia, the market researcher said.

Chip designers, led by MediaTek Inc (聯發科), are expected to report growth of 33 percent year-on-year this year to cross the NT$1 trillion mark for the first time, to NT$1.1 trillion, it said.

Demand is rising for a wide range of chips, helping to propel revenue growth, Cheng said.

However, supply of microcontroller units, power management ICs and radio frequency ICs might remain tight due to a capacity squeeze at foundries, he said.

The institute said that it expects a global chip crunch to continue next year and in 2023, as it takes time for chipmakers to ramp up new production and for governments to build local supply chains.

Over the next three years, the compound annual growth rate of production value in Taiwan’s foundry sector is expected to be 10.5 percent, it said.

Chip designers and memorychip makers are expected to grow 7.9 percent and 7.5 percent respectively, while chip testers and packagers would expand 7.2 percent, it said.

NEW IDENTITY: Known for its software, India has expanded into hardware, with its semiconductor industry growing from US$38bn in 2023 to US$45bn to US$50bn India on Saturday inaugurated its first semiconductor assembly and test facility, a milestone in the government’s push to reduce dependence on foreign chipmakers and stake a claim in a sector dominated by China. Indian Prime Minister Narendra Modi opened US firm Micron Technology Inc’s semiconductor assembly, test and packaging unit in his home state of Gujarat, hailing the “dawn of a new era” for India’s technology ambitions. “When young Indians look back in the future, they will see this decade as the turning point in our tech future,” Modi told the event, which was broadcast on his YouTube channel. The plant would convert

Nanya Technology Corp (南亞科技) yesterday said the DRAM supply crunch could extend through 2028, as the artificial intelligence (AI) boom has led the world’s major memory makers to dramatically reduce production of standard DRAM and allocate a significant portion of their capacity for high-bandwidth memory (HBM) chips. The most severe supply constraints would stretch to the first half of next year due to “very limited” increases in new DRAM capacity worldwide, Nanya Technology president Lee Pei-ing (李培瑛) told a news briefing. The company plans to increase monthly 12-inch wafer capacity to 20,000 in the first half of 2028 after a

Property transactions in the nation’s six special municipalities plunged last month, as a lengthy Lunar New Year holiday combined with ongoing credit tightening dampened housing market activity, data compiled by local land administration offices released on Monday showed. The six cities recorded a total of 10,480 property transfers last month, down 42.5 percent from January and marking the second-lowest monthly level on record, the data showed. “The sharp drop largely reflected seasonal factors and tighter credit conditions,” Evertrust Rehouse Co (永慶房屋) deputy research manager Chen Chin-ping (陳金萍) said. The nine-day Lunar New Year holiday fell in February this year, reducing

Zimbabwe’s ban on raw lithium exports is forcing Chinese miners to rethink their strategy, speeding up plans to process the metal locally instead of shipping it to China’s vast rechargeable battery industry. The country is Africa’s largest lithium producer and has one of the world’s largest reserves, according to the US Geological Survey (USGS). Zimbabwe already banned the export of lithium ore in 2022 and last year announced it would halt exports of lithium concentrates from January next year. However, on Wednesday it imposed the ban with immediate effect, leaving unclear what the lithium mining sector would do in the