Wire harness maker BizLink Holding Inc (貿聯控股) on Friday announced that it had reached a binding agreement with Leoni AG to acquire the German company’s Leoni Industrial Solutions for 451 million euros (US$522.9 million) in an all-cash transaction.

BizLink’s board of directors approved the acquisition and the company is planning to fund the deal with cash and bank financing, the company said in a regulatory filing.

BizLink has NT$9.062 billion (US$325 million) in working capital, it said.

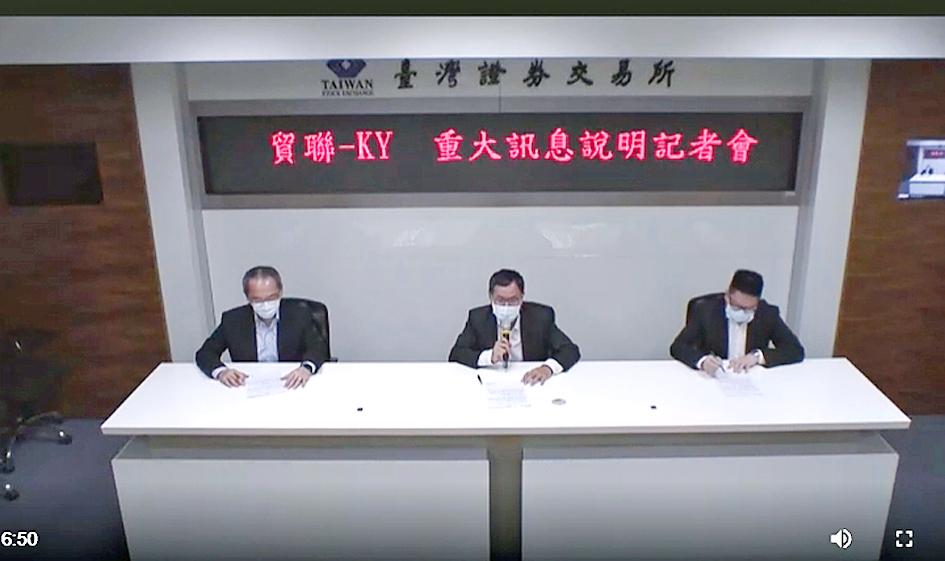

Photo: Chen Rou-chen, Taipei Times

Leoni Industrial Solutions last year reported revenue of 430 million euros.

It is a leading supplier of cables and cable systems for a wide range of sector, including telecom, healthcare, robotics, factory automation, e-mobility and rolling stock.

BizLink said the acquisition would help expand its market presence in Europe, North America and Asia, boost its position in global interconnect solutions, and drive greater earnings accretion and meaningful synergies in the long term.

“BizLink’s acquisition of Leoni Industrial Solutions will boost our technical and service capabilities, solidify our global scale, bring us closer to customers and gain access to new industrial customers,” BizLink chairman Roger Liang (梁華哲) said in a statement. “The acquisition brings forward our long-term diversification plan and will provide BizLink with immediate gains within multiple secular growth industries.”

The Leoni Industrial Solutions deal comes after BizLink completed the acquisition of Leoni’s electrical appliance business in 2017 and Speedy Industrial Supplies Pte Ltd last year.

The deal is expected to be completed early next year after customary closing conditions are met and gaining approval from regulatory bodies, the company said.

BizLink — whose products range from cable assemblies to wiring harnesses for use in the information technology, data communications, medical, consumer electronic, motor vehicle and industrial equipment industries — reported an increase of cumulative revenue in the first eight months of 26.07 percent year-on-year to NT$17.95 billion.

Despite tight component supply in the near term, the company has since last year posted rising contributions from its electric vehicle, energy storage, datacenter and semiconductor equipment businesses, analysts have said.

BizLink’s improved product mix is expected to add momentum to its earnings recovery, the analysts said.

COMPETITION: AMD, Intel and Qualcomm are unveiling new laptop and desktop parts in Las Vegas, arguing their technologies provide the best performance for AI workloads Advanced Micro Devices Inc (AMD), the second-biggest maker of computer processors, said its chips are to be used by Dell Technologies Inc for the first time in PCs sold to businesses. The chipmaker unveiled new processors it says would make AMD-based PCs the best at running artificial intelligence (AI) software. Dell has decided to use the chips in some of its computers aimed at business customers, AMD executives said at CES in Las Vegas on Monday. Dell’s embrace of AMD for corporate PCs — it already uses the chipmaker for consumer devices — is another blow for Intel Corp as the company

STIMULUS PLANS: An official said that China would increase funding from special treasury bonds and expand another program focused on key strategic sectors China is to sharply increase funding from ultra-long treasury bonds this year to spur business investment and consumer-boosting initiatives, a state planner official told a news conference yesterday, as Beijing cranks up fiscal stimulus to revitalize its faltering economy. Special treasury bonds would be used to fund large-scale equipment upgrades and consumer goods trade-ins, said Yuan Da (袁達), deputy secretary-general of the Chinese National Development and Reform Commission. “The size of ultra-long special government bond funds will be sharply increased this year to intensify and expand the implementation of the two new initiatives,” Yuan said. Under the program launched last year, consumers can

TECH PULL: Electronics heavyweights also attracted strong buying ahead of the CES, analysts said. Meanwhile, Asian markets were mixed amid Trump’s incoming presidency Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) shares yesterday closed at a new high in the wake of a rally among tech stocks on Wall Street on Friday, moving the TAIEX sharply higher by more than 600 points. TSMC, the most heavily weighted stock in the TAIEX, rose 4.65 percent to close at a new high of NT$1,125, boosting its market value to NT$29.17 trillion (US$888 billion) and contributing about 400 points to the TAIEX’s rise. The TAIEX ended up 639.41 points, or 2.79 percent, at 23,547.71. Turnover totaled NT$406.478 billion, Taiwan Stock Exchange data showed. The surge in TSMC follows a positive performance

MediaTek Inc (聯發科) yesterday said it is teaming up with Nvidia Corp to develop a new chip for artificial intelligence (AI) supercomputers that uses architecture licensed from Arm Holdings PLC. The new product is targeting AI researchers, data scientists and students rather than the mass PC market, the company said. The announcement comes as MediaTek makes efforts to add AI capabilities to its Dimensity chips for smartphones and tablets, Genio family for the Internet of Things devices, Pentonic series of smart TVs, Kompanio line of Arm-based Chromebooks, along with the Dimensity auto platform for vehicles. MeidaTek, the world’s largest chip designer for smartphones