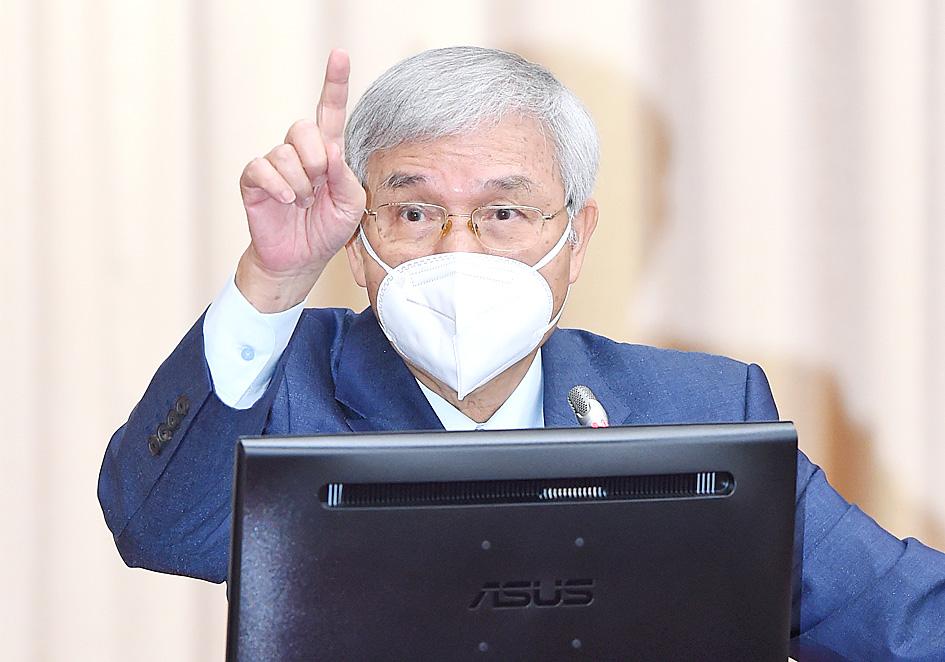

Credit control measures have achieved the goal of maintaining the nation’s financial stability, but are unlikely to make houses more affordable, central bank Governor Yang Chin-long (楊金龍) said yesterday.

Yang made the comments while fielding questions on the central bank’s operations at a meeting of the legislature’s Finance Committee.

“The series of credit controls were intended to prevent money from overflowing into the real-estate market and straining the financial system in times of credit tightening,” the governor said, adding that the US Federal Reserve has indicated plans to taper its bond-buying program later this year and to hike interest rates following better employment figures.

Photo: Liao Chen-huei, Taipei Times

Barring lenders from granting grace periods on second-home purchases in the six special municipalities, as well as Hsinchu City and Hsinchu County, was intended to prevent overleveraging on the part of individual buyers, Yang said.

Wealth management analysts have encouraged people to acquire real estate and take advantage of record-low interest rates, which average 1.31 percent for house loans.

“Micro adjustments” are necessary after two previous waves of credit controls failed to cool real-estate lending, Yang said.

The governor said that he partially agreed with the opinion of Highwealth Construction Corp (興富發) founder Cheng Chin-tien (鄭欽天) that credit controls reflect a boom in the property market.

However, developers would like to portray the market in a way that helps boost property sales and prices, Yang said.

Asked whether tightening measures would help make houses affordable again for ordinary people, the governor said that the goal has proved “unachievable” over the years and the central bank has instead sought to “induce a soft landing.”

Toward that end, the central bank is closely monitoring the market and would introduce adjustments if necessary, he added.

A central bank report shows that in the first half of the year, the bank intervened in the foreign-exchange market by buying US$8.73 billion of US dollars to slow the appreciation of the New Taiwan dollar.

Exporters have said that profit erosion caused by a strong NT dollar, which has outperformed other Asian currencies this year.

The NT dollar has hovered between NT$27.5 and NT$28 against the US dollar in the past three months, the central bank said, adding that the NT dollar’s direction hinges on global demand for the US dollar and Taiwanese exports.

Strong exports would lend support to the local currency, while bond-buying tapering and interest rate hikes by the US Fed would bolster the US dollar, Yang said.

TECH CLUSTER: The US company’s new office is in the Shalun Smart Green Energy Science City, a new AI industry base and cybersecurity hub in southern Taiwan US chip designer Advanced Micro Devices Inc (AMD) yesterday launched an office in Tainan’s Gueiren District (歸仁), marking a significant milestone in the development of southern Taiwan’s artificial intelligence (AI) industry, the Tainan City Government said in a statement. AMD Taiwan general manager Vincent Chern (陳民皓) presided over the opening ceremony for the company’s new office at the Shalun Smart Green Energy Science City (沙崙智慧綠能科學城), a new AI industry base and cybersecurity hub in southern Taiwan. Facilities in the new office include an information processing center, and a research and development (R&D) center, the Tainan Economic Development Bureau said. The Ministry

ADVERSARIES: The new list includes 11 entities in China and one in Taiwan, which is a local branch of Chinese cloud computing firm Inspur Group The US added dozens of entities to a trade blacklist on Tuesday, the US Department of Commerce said, in part to disrupt Beijing’s artificial intelligence (AI) and advanced computing capabilities. The action affects 80 entities from countries including China, the United Arab Emirates and Iran, with the commerce department citing their “activities contrary to US national security and foreign policy.” Those added to the “entity list” are restricted from obtaining US items and technologies without government authorization. “We will not allow adversaries to exploit American technology to bolster their own militaries and threaten American lives,” US Secretary of Commerce Howard Lutnick said. The entities

Minister of Finance Chuang Tsui-yun (莊翠雲) yesterday told lawmakers that she “would not speculate,” but a “response plan” has been prepared in case Taiwan is targeted by US President Donald Trump’s reciprocal tariffs, which are to be announced on Wednesday next week. The Trump administration, including US Secretary of the Treasury Scott Bessent, has said that much of the proposed reciprocal tariffs would focus on the 15 countries that have the highest trade surpluses with the US. Bessent has referred to those countries as the “dirty 15,” but has not named them. Last year, Taiwan’s US$73.9 billion trade surplus with the US

The Taipei International Cycle Show (Taipei Cycle) yesterday opened at the Taipei Nangang Exhibition Center, with the event’s organizer expecting a steady recovery in the industry this year following a tough last year. This year, 980 companies from 35 countries are participating in the annual bicycle trade show, showcasing technological breakthroughs and market development trends of the bicycle industry at 3,600 booths, the Taiwan External Trade Development Council (TAITRA, 外貿協會) said in a statement. Under the theme “Ride the Revolution,” the exhibition has attracted more than 3,500 international buyers from 80 countries to preregister for the four-day event, which is expected to