Local printed circuit board (PCB) manufacturers are worried that power cuts in China will reduce factory utilization and throttle revenue growth as the industry enters its peak season, the Taiwan Printed Circuit Association (台灣電路板協會) said yesterday.

The warning came as association members expect to be affected by power rationing in China, which has ordered factories to halt operations for seven to 10 days.

Apple Inc supplier Unimicron Technology Corp (欣興電子) on Monday said that its factories in Suzhou and Kunshan in Jiangsu Province were told to stop production from midday on Sunday through tomorrow.

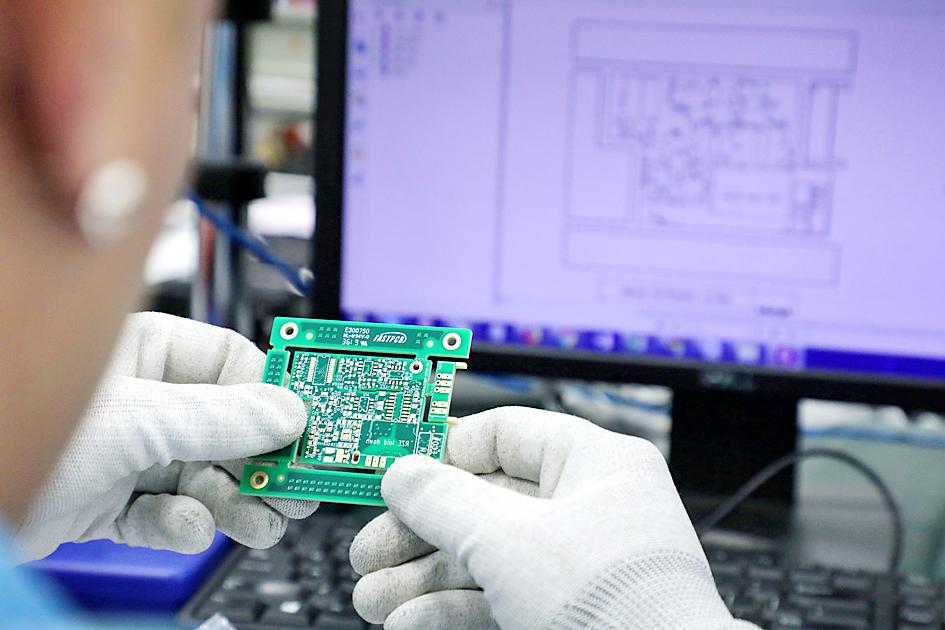

Photo: Reuters

The two cities are manufacturing hubs for Taiwanese PCB makers and face the most stringent electricity curbs.

“It is challenging for PCB suppliers to allocate manufacturing activities, as the industry is entering the peak season, with demand surging ahead of the Christmas shopping season in the US and Europe, and Lunar New Year gift buying China,” the association said.

Some association members plan to ask employees to start a long vacation before China’s National Day holiday on Friday, it said.

Others have proposed cutting utilization to cope with the energy crunch, it said.

Some PCB firms are also in talks with customers to reschedule shipments or to deliver from manufacturing sites outside of China, the association said.

Its members are also concerned about a potential shortage of raw materials and chemicals if upstream suppliers are affected by the power cuts, it said.

That could lead to a decline in factory utilization, it added.

PCB manufacturers are closely watching whether the power crunch would extend into next month and whether the Chinese government would further tighten energy use, it said.

Longer blackouts and stricter rules would threaten PCB companies’ factory utilization and revenue growth, it said.

China is a major production site for Taiwanese multilayer PCB manufacturers, accounting for 37.3 percent of their combined production, association data showed.

Flexible PCBs are next at 26.7 percent, followed by high-density interconnected boards at 19.1 percent, the data showed.

In Taipei trading yesterday, PCB stocks continued to be affected, with Unimicron Technology closing down 0.72 percent at NT$137, Tripod Technology Corp (健鼎科技) falling 1.71 percent to NT$115 and Compeq Manufacturing Co (華通電腦) dropping 1.57 percent to NT$37.6.

That compared with a 1.28 percent decline in the electronic components subindex and the TAIEX’s 0.76 percent loss.

Sweeping policy changes under US Secretary of Health and Human Services Robert F. Kennedy Jr are having a chilling effect on vaccine makers as anti-vaccine rhetoric has turned into concrete changes in inoculation schedules and recommendations, investors and executives said. The administration of US President Donald Trump has in the past year upended vaccine recommendations, with the country last month ending its longstanding guidance that all children receive inoculations against flu, hepatitis A and other diseases. The unprecedented changes have led to diminished vaccine usage, hurt the investment case for some biotechs, and created a drag that would likely dent revenues and

Global semiconductor stocks advanced yesterday, as comments by Nvidia Corp chief executive officer Jensen Huang (黃仁勳) at Davos, Switzerland, helped reinforce investor enthusiasm for artificial intelligence (AI). Samsung Electronics Co gained as much as 5 percent to an all-time high, helping drive South Korea’s benchmark KOSPI above 5,000 for the first time. That came after the Philadelphia Semiconductor Index rose more than 3 percent to a fresh record on Wednesday, with a boost from Nvidia. The gains came amid broad risk-on trade after US President Donald Trump withdrew his threat of tariffs on some European nations over backing for Greenland. Huang further

Macronix International Co (旺宏), the world’s biggest NOR flash memory supplier, yesterday said it would spend NT$22 billion (US$699.1 million) on capacity expansion this year to increase its production of mid-to-low-density memory chips as the world’s major memorychip suppliers are phasing out the market. The company said its planned capital expenditures are about 11 times higher than the NT$1.8 billion it spent on new facilities and equipment last year. A majority of this year’s outlay would be allocated to step up capacity of multi-level cell (MLC) NAND flash memory chips, which are used in embedded multimedia cards (eMMC), a managed

CULPRITS: Factors that affected the slip included falling global crude oil prices, wait-and-see consumer attitudes due to US tariffs and a different Lunar New Year holiday schedule Taiwan’s retail sales ended a nine-year growth streak last year, slipping 0.2 percent from a year earlier as uncertainty over US tariff policies affected demand for durable goods, data released on Friday by the Ministry of Economic Affairs showed. Last year’s retail sales totaled NT$4.84 trillion (US$153.27 billion), down about NT$9.5 billion, or 0.2 percent, from 2024. Despite the decline, the figure was still the second-highest annual sales total on record. Ministry statistics department deputy head Chen Yu-fang (陳玉芳) said sales of cars, motorcycles and related products, which accounted for 17.4 percent of total retail rales last year, fell NT$68.1 billion, or