European stocks fell on Friday, as worries about troubled property developer China Evergrande Group (恆大集團) and weak German business confidence data prompted investors to book some profits after a mid-week rally.

European sportswear makers Adidas AG, Puma SE and JD Sports Fashion PLC fell about 3 percent each after US rival Nike Inc cut its fiscal 2022 sales expectations and predicted delays during the holiday shopping season due to a supply chain crunch.

Retail stocks were the top decliners in Europe, down 1.7 percent, while the region-wide STOXX 600 fell 0.9 percent to 463.29, but a three-day rally put the index 0.31 percent higher for the week.

“Equities have rallied to take a pause early this morning faced with the likely default of Evergrande,” Nordea Asset Management senior macro strategist Sebastien Galy said.

Meanwhile, a survey by Ifo Institute showed German business morale this month fell for a third straight month, hit by supply chain woes that are causing a “bottleneck recession” for manufacturers in Europe’s largest economy.

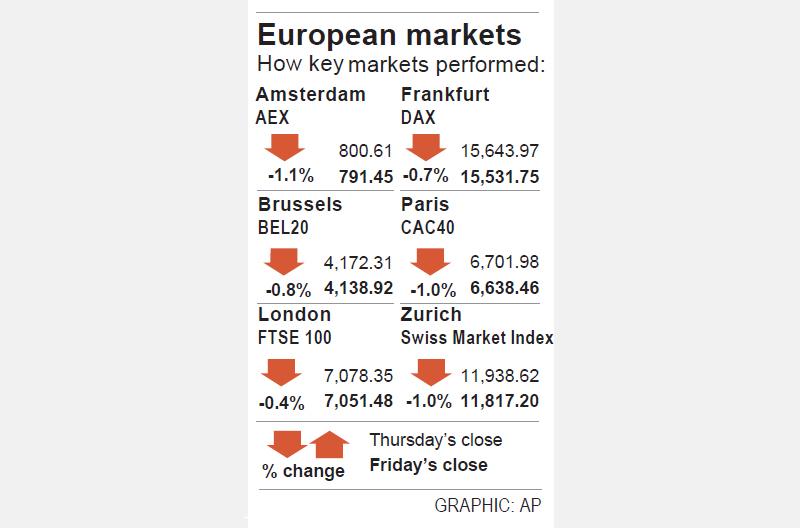

Germany’s DAX fell 0.72 percent to 15,531.75, up 0.27 percent from a week earlier, heading into the weekend when the country votes to elect German Chancellor Angela Merkel’s successor.

“Some of the hesitancy in European markets could also be put down to the German elections, which promise to be the most interesting in some time,” IG chief market analyst Chris Beauchamp said.

“Markets are facing a change of direction in Germany unlike anything seen in the past decade or more, and the end of Merkel’s tenure promises to be a watershed moment for the EU and global investors alike,” Beauchamp added.

The benchmark STOXX 600 is on course to end the month in the red after seven consecutive months of gains, as rising energy prices and supply-chain bottlenecks fed into fears of inflation, while major central banks plan to cut COVID-19 stimulus.

However, European Central Bank President Christine Lagarde said in an interview aired on CNBC that many of the drivers of a recent spike in eurozone inflation are temporary and could fade in the next year.

London’s FTSE 100 ended lower as concerns about a slowdown in global economic growth outweighed gains in healthcare and energy stocks.

It eased 0.38 percent to 7,051.48, but posted a weekly increase of 1.26 percent, snapping a three-week losing streak.

Retailers, industrial miners and life insurers were the top losers.

The FTSE 100 has gained nearly 9.5 percent so far this year on higher energy prices and accommodative central bank policies.

However, it has significantly underperformed a 17 percent rise among its European peers.

UNCERTAINTY: Innolux activated a stringent supply chain management mechanism, as it did during the COVID-19 pandemic, to ensure optimal inventory levels for customers Flat-panel display makers AUO Corp (友達) and Innolux Corp (群創) yesterday said that about 12 to 20 percent of their display business is at risk of potential US tariffs and that they would relocate production or shipment destinations to mitigate the levies’ effects. US tariffs would have a direct impact of US$200 million on AUO’s revenue, company chairman Paul Peng (彭雙浪) told reporters on the sidelines of the Touch Taiwan trade show in Taipei yesterday. That would make up about 12 percent of the company’s overall revenue. To cope with the tariff uncertainty, AUO plans to allocate its production to manufacturing facilities in

TAKING STOCK: A Taiwanese cookware firm in Vietnam urged customers to assess inventory or place orders early so shipments can reach the US while tariffs are paused Taiwanese businesses in Vietnam are exploring alternatives after the White House imposed a 46 percent import duty on Vietnamese goods, following US President Donald Trump’s announcement of “reciprocal” tariffs on the US’ trading partners. Lo Shih-liang (羅世良), chairman of Brico Industry Co (裕茂工業), a Taiwanese company that manufactures cast iron cookware and stove components in Vietnam, said that more than 40 percent of his business was tied to the US market, describing the constant US policy shifts as an emotional roller coaster. “I work during the day and stay up all night watching the news. I’ve been following US news until 3am

COLLABORATION: Given Taiwan’s key position in global supply chains, the US firm is discussing strategies with local partners and clients to deal with global uncertainties Advanced Micro Devices Inc (AMD) yesterday said it is meeting with local ecosystem partners, including Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), to discuss strategies, including long-term manufacturing, to navigate uncertainties such as US tariffs, as Taiwan occupies an important position in global supply chains. AMD chief executive officer Lisa Su (蘇姿丰) told reporters that Taiwan is an important part of the chip designer’s ecosystem and she is discussing with partners and customers in Taiwan to forge strong collaborations on different areas during this critical period. AMD has just become the first artificial-intelligence (AI) server chip customer of TSMC to utilize its advanced

Six years ago, LVMH’s billionaire CEO Bernard Arnault and US President Donald Trump cut the blue ribbon on a factory in rural Texas that would make designer handbags for Louis Vuitton, one of the world’s best-known luxury brands. However, since the high-profile opening, the factory has faced a host of problems limiting production, 11 former Louis Vuitton employees said. The site has consistently ranked among the worst-performing for Louis Vuitton globally, “significantly” underperforming other facilities, said three former Louis Vuitton workers and a senior industry source, who cited internal rankings shared with staff. The plant’s problems — which have not