The NASDAQ ended Friday at a new peak, but the other main Wall Street indices fell, reflecting the mixed sentiment stemming from a disappointing US jobs report, which raised fears about the pace of economic recovery, but weakened the argument for near-term tapering.

On the final day of trading before the Labor Day weekend in the US, the S&P 500 and the Dow Jones Industrial Average benchmark posted marginal declines, tempering the former’s positive weekly performance and extending the latter’s run of losses to four in the past five sessions.

However, for the NASDAQ, registering a fifth win in the past six sessions and a weekly gain of 1.6 percent, investors’ support of heavyweight technology stocks — which tend to perform better in a low interest-rate environment — continues to drive it higher.

Apple Inc, Alphabet Inc and Facebook Inc all rose 0.3 to 0.4 percent.

“Tech has become bullet-proof,” Boston Partners global market research director Mike Mullaney said. “It’s the anti-COVID sector, where you want to be if you think COVID or a lack of growth is going to be an issue.”

The virus, and its impact on the pace of economic recovery in the US, was evident in the US Department of Labor’s closely watched report, which showed that non-farm payrolls increased by 235,000 jobs last month, widely missing economists’ estimate of 750,000. Payrolls had surged 1.05 million in July.

“The number’s a big disappointment and it’s clear the Delta variant [of SARS-CoV-2] had a negative impact on the labor economy this summer,” said Michael Arone, chief investment strategist at State Street Global Advisors in Boston. “You can tell because leisure and hospitality didn’t add any jobs and retail actually lost jobs. Investors will conclude that perhaps this will put the [US Federal Reserve] further on hold in terms of the timing of tapering. Markets may be okay with that.”

The S&P 500 and the NASDAQ had scaled all-time highs over the past few weeks on support from robust corporate earnings, but investors have remained generally cautious as they watch economic indicators and the jump in US infections to see how that might influence the Fed and its tapering plans.

The labor market remains the key touchstone for the Fed, with Fed Chair Jerome Powell hinting last week that reaching full employment was a pre-requisite for the central bank to start paring back its asset purchases.

Among the biggest decliners on the S&P 500 were cruise ship operators, whose businesses are highly susceptible to consumer sentiment around travel and COVID-19. Norwegian Cruise Line Holdings, Carnival Corp and Royal Caribbean Cruises all fell 3.4 to 4.4 percent.

A majority of the 11 S&P sectors closed down, with the utilities index the worst performer at 0.8 percent lower. Economically sensitive manufacturing and industrials slipped 0.7 percent and 0.6 percent respectively.

Banking stocks, which generally perform better when bond yields are higher, dropped 0.4 percent even as the benchmark 10-year US Treasury yield jumped following the report.

“I get the overall market reaction, because it feels a little bit like pricing in a potential policy error from the Fed, but I don’t understand some of the sectors’ reactions today,” Mullaney said.

Despite a labor report number well outside the consensus estimate, the overall reaction of investors was muted, continuing a trend over the past year of a decoupling of significant S&P movement in the wake of a wide miss on the payrolls report.

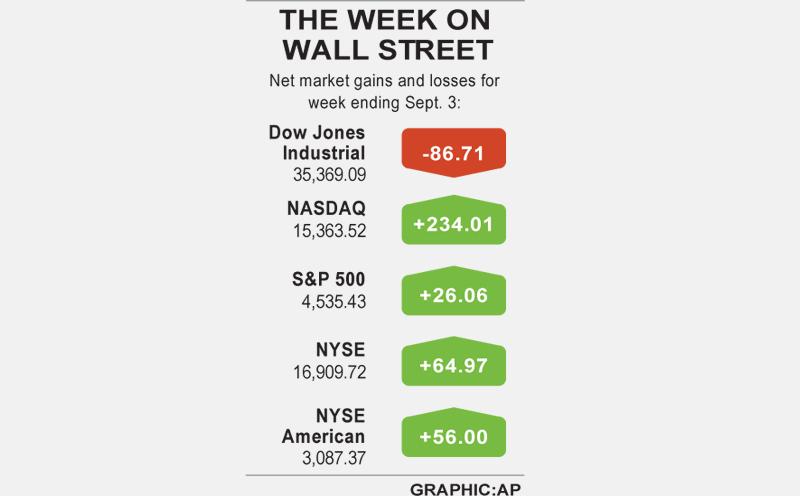

The S&P 500 on Friday lost 1.52 points, or 0.03 percent, to 4,535.43 and the Dow Jones Industrial Average fell 74.73 points, or 0.21 percent, to 35,369.09. The NASDAQ Composite added 32.34 points, or 0.21 percent, to 15,363.52.

For the week, the S&P rose 0.6 percent, the Dow dipped 0.2 percent and the NASDAQ added 1.6 percent.

Volume on US exchanges was 8.37 billion shares on Friday, compared with the 8.99 billion average for the full session over the past 20 trading days.

The S&P 500 posted 50 new 52-week highs and one new low; the NASDAQ Composite recorded 123 new highs and 21 new lows.

China’s Huawei Technologies Co (華為) plans to start mass-producing its most advanced artificial intelligence (AI) chip in the first quarter of next year, even as it struggles to make enough chips due to US restrictions, two people familiar with the matter said. The telecoms conglomerate has sent samples of the Ascend 910C — its newest chip, meant to rival those made by US chipmaker Nvidia Corp — to some technology firms and started taking orders, the sources told Reuters. The 910C is being made by top Chinese contract chipmaker Semiconductor Manufacturing International Corp (SMIC, 中芯) on its N+2 process, but a lack

TECH BOOST: New TSMC wafer fabs in Arizona are to dramatically improve US advanced chip production, a report by market research firm TrendForce said With Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) pouring large funds into Arizona, the US is expected to see an improvement in its status to become the second-largest maker of advanced semiconductors in 2027, Taipei-based market researcher TrendForce Corp (集邦科技) said in a report last week. TrendForce estimates the US would account for a 21 percent share in the global advanced integrated circuit (IC) production market by 2027, sharply up from the current 9 percent, as TSMC is investing US$65 billion to build three wafer fabs in Arizona, the report said. TrendForce defined the advanced chipmaking processes as the 7-nanometer process or more

NVIDIA PLATFORM: Hon Hai’s Mexican facility is to begin production early next year and a Taiwan site is to enter production next month, Nvidia wrote on its blog Hon Hai Precision Industry Co (鴻海精密), the world’s biggest electronics manufacturer, yesterday said it is expanding production capacity of artificial intelligence (AI) servers based on Nvidia Corp’s Blackwell chips in Taiwan, the US and Mexico to cope with rising demand. Hon Hai’s new AI-enabled factories are to use Nvidia’s Omnivores platform to create 3D digital twins to plan and simulate automated production lines at a factory in Hsinchu, the company said in a statement. Nvidia’s Omnivores platform is for developing industrial AI simulation applications and helps bring facilities online faster. Hon Hai’s Mexican facility is to begin production early next year and the

Who would not want a social media audience that grows without new content? During the three years she paused production of her short do-it-yourself (DIY) farmer’s lifestyle videos, Chinese vlogger Li Ziqi (李子柒), 34, has seen her YouTube subscribers increase to 20.2 million from about 14 million. While YouTube is banned in China, her fan base there — although not the size of YouTube’s MrBeast, who has 330 million subscribers — is close to 100 million across the country’s social media platforms Douyin (抖音), Sina Weibo (新浪微博) and Xiaohongshu (小紅書). When Li finally released new videos last week — ending what has