The number of COVID-19 infections in Malaysia is threatening to aggravate shortages of semiconductors and other components that have hammered automakers for months.

The Southeast Asian nation has not historically had the kind of importance to technology supply chains that Taiwan, South Korea or Japan do, but Malaysia has emerged as a major center for chip testing and packaging, with Infineon Technologies AG, NXP Semiconductors NV and STMicroelectronics NV among the key suppliers operating plants there.

Now COVID-19 infections are soaring in the nation, jeopardizing plans to lift lockdowns and restore full production capacity.

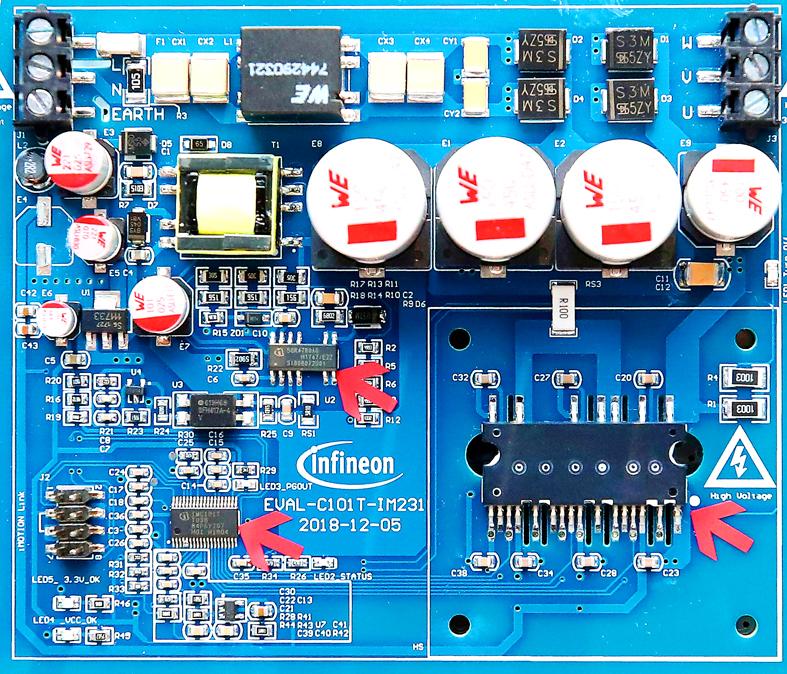

Photo: Reuters

Ford Motor Co last week said that it would temporarily suspend production of its popular F-150 pickup truck at one US plant because of “a semiconductor-related part shortage as a result of the COVID-19 pandemic in Malaysia.”

The Malaysian government is racing to address the outbreak and has granted exemptions to certain manufacturers in an effort to keep the economy on track. Companies were allowed to keep operating with 60 percent of their workforces during June lockdowns and they are able to move back to 100 percent when more than 80 percent of their workers are fully vaccinated.

On Monday, the number of daily reported infections dropped to 17,672, but the situation on the ground remains volatile. Factories have to shut down completely for as long as two weeks for sanitation if more than three workers contract COVID-19 under unofficial guidelines and the Delta variant of SARS-CoV-2 is proving particularly infectious and difficult to stop.

“This could be very disruptive for Infineon and other companies that have plants of a few thousand workers,” Kuala Lumpur-based Kenanga Investment Bank Bhd semiconductor analyst Samuel Tan said.

Local firms are reporting such closures through exchange filings. STMicro and Infineon, both key auto suppliers, have had to close facilities.

The situation could aggravate semiconductor shortages already at crisis levels.

Chip lead times, the gap between ordering a semiconductor and taking delivery, increased by more than eight days to 20.2 weeks last month from June, research by the Susquehanna Financial Group showed.

That gap was already the longest wait time since the firm began tracking the data in 2017.

Automakers have lost sales after a series of unexpected blows in the past year, including a cold snap in Texas that hobbled factories and a fire in Japan at a critical auto chip plant.

Toyota Motor Corp last week said that it would suspend production at 14 plants because suppliers, particularly in Southeast Asia, have been hit by COVID-19 infections and lockdowns. It has partners clustered in Thailand, Vietnam and Malaysia.

Thailand and Vietnam are also seeing sharp increases in reported infections.

Malaysia’s position as a prime base for testing and packaging chips is critical because those are the last steps of semiconductor production. Electronics and electrical products account for 39 percent of the nation’s exports, according to Malaysian Ministry of International Trade and Industry data.

“Malaysia is a key player in the global semiconductor trade,” Malaysia Semiconductor Industry Association president Wong Siew Hai said. “Thus, any disruption anywhere along the supply chain will have knock-on effects elsewhere in the ecosystem.”

ADVERSARIES: The new list includes 11 entities in China and one in Taiwan, which is a local branch of Chinese cloud computing firm Inspur Group The US added dozens of entities to a trade blacklist on Tuesday, the US Department of Commerce said, in part to disrupt Beijing’s artificial intelligence (AI) and advanced computing capabilities. The action affects 80 entities from countries including China, the United Arab Emirates and Iran, with the commerce department citing their “activities contrary to US national security and foreign policy.” Those added to the “entity list” are restricted from obtaining US items and technologies without government authorization. “We will not allow adversaries to exploit American technology to bolster their own militaries and threaten American lives,” US Secretary of Commerce Howard Lutnick said. The entities

‘SWASTICAR’: Tesla CEO Elon Musk’s close association with Donald Trump has prompted opponents to brand him a ‘Nazi’ and resulted in a dramatic drop in sales Demonstrators descended on Tesla Inc dealerships across the US, and in Europe and Canada on Saturday to protest company chief Elon Musk, who has amassed extraordinary power as a top adviser to US President Donald Trump. Waving signs with messages such as “Musk is stealing our money” and “Reclaim our country,” the protests largely took place peacefully following fiery episodes of vandalism on Tesla vehicles, dealerships and other facilities in recent weeks that US officials have denounced as terrorism. Hundreds rallied on Saturday outside the Tesla dealership in Manhattan. Some blasted Musk, the world’s richest man, while others demanded the shuttering of his

Minister of Finance Chuang Tsui-yun (莊翠雲) yesterday told lawmakers that she “would not speculate,” but a “response plan” has been prepared in case Taiwan is targeted by US President Donald Trump’s reciprocal tariffs, which are to be announced on Wednesday next week. The Trump administration, including US Secretary of the Treasury Scott Bessent, has said that much of the proposed reciprocal tariffs would focus on the 15 countries that have the highest trade surpluses with the US. Bessent has referred to those countries as the “dirty 15,” but has not named them. Last year, Taiwan’s US$73.9 billion trade surplus with the US

Prices of gasoline and diesel products at domestic gas stations are to fall NT$0.2 and NT$0.1 per liter respectively this week, even though international crude oil prices rose last week, CPC Corp, Taiwan (台灣中油) and Formosa Petrochemical Corp (台塑石化) said yesterday. International crude oil prices continued rising last week, as the US Energy Information Administration reported a larger-than-expected drop in US commercial crude oil inventories, CPC said in a statement. Based on the company’s floating oil price formula, the cost of crude oil rose 2.38 percent last week from a week earlier, it said. News that US President Donald Trump plans a “secondary