Arabica coffee fell the most in more than a dozen years, paring a monthly surge as concerns eased that severe weather would further damage crops in top shipper Brazil.

Frost overnight reached about 80 percent of south Minas Gerais, the country’s top producing region, but the effect was less than feared, World Weather Inc president Drew Lerner said.

The area might get “patchy frost” this weekend, he said.

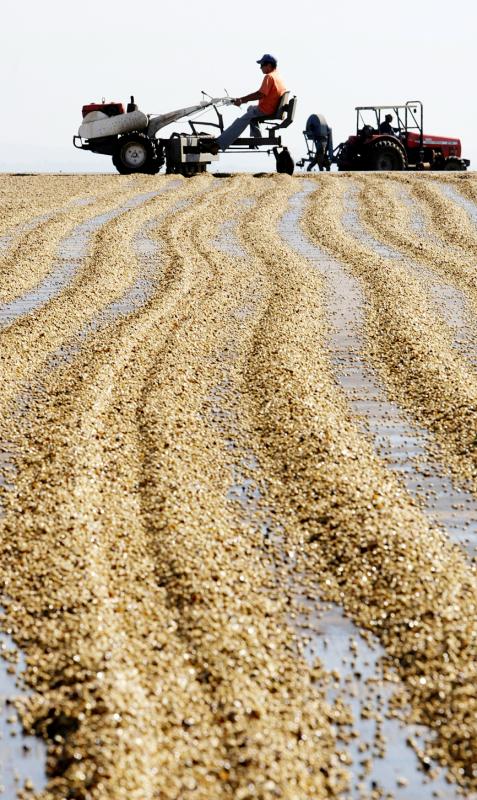

Photo: Reuters

Most sugar and citrus areas were spared the worst readings, and any damage was probably localized, Lerner said.

“Any losses from today’s event will be very limited,” said Carlos Mera, head of agricultural research at Rabobank International. “However, we still see some potential for frosts in the coming three days.”

Even with Friday’s drop, the risk persists that consumers would see higher coffee prices when global food prices in general are on the rise.

A recent cold snap in Brazil is a fresh blow to crops strained by drought and the worst frost seen in two decades. Freezing weather could squeeze global coffee supply for years, as it is particularly harmful to young trees.

Arabica coffee for September delivery tumbled 8.6 percent to settle at US$1.7955 a pound, the biggest drop since March 2008. The price was still up 12 percent for last month and more than 55 percent over the past 12 months after averse weather cut this year’s output and curbed the outlook for next year.

Pressure also came in from the foreign-exchange markets. The Brazilian real fell the most against the US dollar in almost two weeks, boosting incentives for growers to sell commodities priced in the greenback.

Trees in south Minas Gerais have been “affected significantly, and will struggle to recover for next year’s crop,” Lerner said. “The stress will be very high, it hasn’t been this cold in many, many years and the ground is already dry.”

Dry conditions makes it more critical for the timely arrival of rains next month, which could be delayed by La Nina’s return, he said.

“Brazil’s upcoming 2022/23 output has clearly been reduced by this month’s cold weather, so traders may use a sizable near-term pullback for a fresh opportunity to establish long positions,” the Hightower Report in Chicago said.

Other commodities:

‧Gold for August delivery fell US$18.60 to US$1,812.60 an ounce, up 0.6 percent from a week earlier.

‧Silver for September delivery fell US$0.23 to US$25.55 an ounce, while September copper fell US$0.04 to US$4.48 a pound.

Additional reporting by AP

United Microelectronics Corp (UMC, 聯電) expects its addressable market to grow by a low single-digit percentage this year, lower than the overall foundry industry’s 15 percent expansion and the global semiconductor industry’s 10 percent growth, the contract chipmaker said yesterday after reporting the worst profit in four-and-a-half years in the fourth quarter of last year. Growth would be fueled by demand for artificial intelligence (AI) servers, a moderate recovery in consumer electronics and an increase in semiconductor content, UMC said. “UMC’s goal is to outgrow our addressable market while maintaining our structural profitability,” UMC copresident Jason Wang (王石) told an online earnings

Gudeng Precision Industrial Co (家登精密), the sole extreme ultraviolet (EUV) pod supplier to Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), is aiming to expand revenue to NT$10 billion (US$304.8 million) this year, as it expects the artificial intelligence (AI) boom to drive demand for wafer delivery pods and pods used in advanced packaging technology. That suggests the firm’s revenue could grow as much as 53 percent this year, after it posted a 28.91 percent increase to NT$6.55 billion last year, exceeding its 20 percent growth target. “We usually set an aggressive target internally to drive further growth. This year, our target is to

The TAIEX ended the Year of the Dragon yesterday up about 30 percent, led by contract chipmaker Taiwan Semiconductor Manufacturing Co (TSMC, 台積電). The benchmark index closed up 225.40 points, or 0.97 percent, at 23,525.41 on the last trading session of the Year of the Dragon before the Lunar New Year holiday ushers in the Year of the Snake. During the Year of the Dragon, the TAIEX rose 5,429.34 points, the highest ever, while the 30 percent increase in the year was the second-highest behind only a 30.84 percent gain in the Year of the Rat from Jan. 25, 2020, to Feb.

Cryptocurrencies gave a lukewarm reception to US President Donald Trump’s first policy moves on digital assets, notching small gains after he commissioned a report on regulation and a crypto reserve. Bitcoin has been broadly steady since Trump took office on Monday and was trading at about US$105,000 yesterday as some of the euphoria around a hoped-for revolution in cryptocurrency regulation ebbed. Smaller cryptocurrency ether has likewise had a fairly steady week, although was up 5 percent in the Asia day to US$3,420. Bitcoin had been one of the most spectacular “Trump trades” in financial markets, gaining 50 percent to break above US$100,000 and