Taiwan’s GDP is forecast to expand 5.6 percent this year, faster than a 3.1 percent increase last year, driven by strong global demand for semiconductors, aggressive private investment by local tech firms and an expected recovery in consumer spending, S&P Global Ratings said yesterday.

Improving external demand and COVID-19 curbs would lend support to credit profiles across economic sectors, even though their paces of recovery vary, said the agency’s local arm, Taiwan Ratings Corp (中華信評).

The nation’s economic growth is closely tied to the recovery in the Asia-Pacific region and the world as a whole, S&P said, predicting that economic stimulus programs in the US and growing global demand for technology products would continue to fuel strong recovery in the region and Taiwan’s exports for the rest of this year.

COVID-19 vaccine rollouts might be off to a slow start in the region, but a gradual catch-up in vaccine coverage would lift consumer confidence and spending later this year or next year, it said.

Taiwan would follow a trajectory similar to its regional peers, S&P said, adding that consumer activity in the nation is taking a hard hit from a local outbreak of COVID-19.

Taiwan’s export-oriented economy, despite its bright outlook, remains susceptible to global and regional shocks, as well as domestic risks, it said.

Risks include the threat of a worsening COVID-19 situation and government control measures such as abrupt lockdowns or tight social distancing requirements, it said.

Draconian measures by different nations to combat the pandemic could derail the region’s economic recovery, and shrink demand for Taiwan’s goods and services, S&P said.

In addition, escalating tension between the US and China could weigh on Taiwan, especially its technology access, it said.

Taiwanese firms have thus far showed signs of an uneven revenue recovery, accompanied by mounting leverage, foreign exchange rate swings, volatile commodity prices, and the possibility of water and power shortages, S&P said.

Credit ratios for most sectors are unlikely to return to pre-pandemic levels until the second half of next year, it said.

However, active investment in information technology and 5G infrastructure, as well as stable construction demand, would boost credit metrics in the high-tech, cement and steel sectors, it said.

As a result, firms in the retail, telecom and technology sectors would lead the recovery, while companies in the aviation, oil, gas and automotive sectors would lag behind, it said.

Soaring shipping freight rates would more than offset elevated operating costs and bolster credit profiles for the container shipping sector, S&P said.

Airlines would face a protracted recovery due to a stalled passenger increase, despite strong demand, it said.

Adequate-to-strong capitalization and abundant liquidity would buttress credit profiles in the banking sector and help lenders cushion against a potential rise in credit costs as the pandemic persists, it said.

Insurers continue to face flat recurring yields and foreign exchange risks, but strong trading gains help support capitalization, aided by a rebound in equity valuation and adequate risk controls, S&P said.

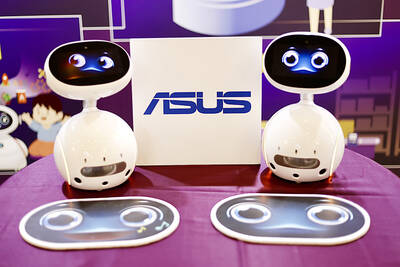

STILL HOPEFUL: Delayed payment of NT$5.35 billion from an Indian server client sent its earnings plunging last year, but the firm expects a gradual pickup ahead Asustek Computer Inc (華碩), the world’s No. 5 PC vendor, yesterday reported an 87 percent slump in net profit for last year, dragged by a massive overdue payment from an Indian cloud service provider. The Indian customer has delayed payment totaling NT$5.35 billion (US$162.7 million), Asustek chief financial officer Nick Wu (吳長榮) told an online earnings conference. Asustek shipped servers to India between April and June last year. The customer told Asustek that it is launching multiple fundraising projects and expected to repay the debt in the short term, Wu said. The Indian customer accounted for less than 10 percent to Asustek’s

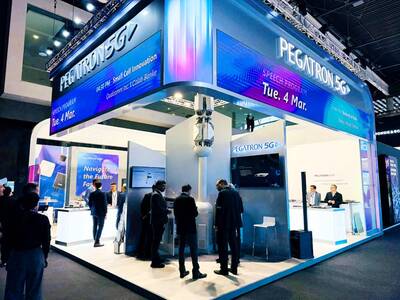

‘DECENT RESULTS’: The company said it is confident thanks to an improving world economy and uptakes in new wireless and AI technologies, despite US uncertainty Pegatron Corp (和碩) yesterday said it plans to build a new server manufacturing factory in the US this year to address US President Donald Trump’s new tariff policy. That would be the second server production base for Pegatron in addition to the existing facilities in Taoyuan, the iPhone assembler said. Servers are one of the new businesses Pegatron has explored in recent years to develop a more balanced product lineup. “We aim to provide our services from a location in the vicinity of our customers,” Pegatron president and chief executive officer Gary Cheng (鄭光治) told an online earnings conference yesterday. “We

LEAK SOURCE? There would be concern over the possibility of tech leaks if TSMC were to form a joint venture to operate Intel’s factories, an analyst said Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) yesterday stayed mum after a report said that the chipmaker has pitched chip designers Nvidia Corp, Advanced Micro Devices Inc and Broadcom Inc about taking a stake in a joint venture to operate Intel Corp’s factories. Industry sources told the Central News Agency (CNA) that the possibility of TSMC proposing to operate Intel’s wafer fabs is low, as the Taiwanese chipmaker has always focused on its core business. There is also concern over possible technology leaks if TSMC were to form a joint venture to operate Intel’s factories, Concord Securities Co (康和證券) analyst Kerry Huang (黃志祺)

It was late morning and steam was rising from water tanks atop the colorful, but opaque-windowed, “soapland” sex parlors in a historic Tokyo red-light district. Walking through the narrow streets, camera in hand, was Beniko — a former sex worker who is trying to capture the spirit of the area once known as Yoshiwara through photography. “People often talk about this neighborhood having a ‘bad history,’” said Beniko, who goes by her nickname. “But the truth is that through the years people have lived here, made a life here, sometimes struggled to survive. I want to share that reality.” In its mid-17th to