Industries affected by a semiconductor shortage, from automakers to consumer electronics, might need to wait a little longer for components, as delays in filling orders continue to worsen.

Chip lead times, the gap between ordering a semiconductor and taking delivery, last month increased by seven days to 18 weeks from April, an indication that chipmakers’ struggles to keep up with demand are worsening, Susquehanna Financial Group said a report.

That gap, the longest wait time since the firm began tracking the data in 2017, is more than four weeks longer than the previous peak in 2018.

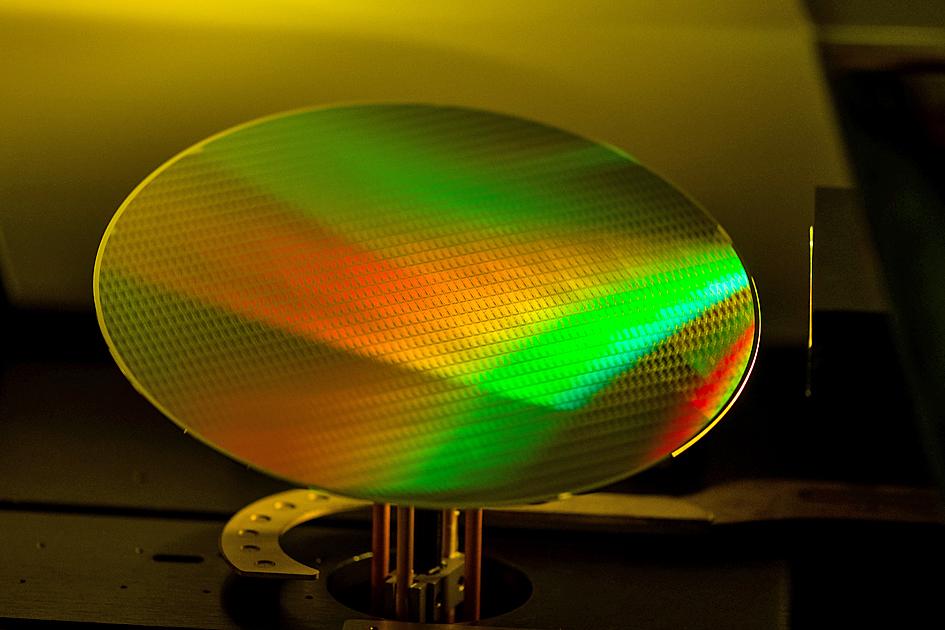

Photo: Bloomberg

Power management chips, semiconductors that regulate the flow of electricity in everything from industrial machinery to smartphones, are a primary reason for the overall increase.

Lead times for those chips hit 25.6 weeks, nearly two weeks longer than in April.

Still, the crunch is widespread.

“The broad-based nature of the shortages is highlighted by the data, as most key product categories (power management, discretes, analogs, passives) have seen LT [lead time] expansion,” Susquehanna analyst Chris Rolland wrote.

Investors watch lead times looking for clues about how demand is trending, but also as a sign that chip users might be panicking and ordering too much, which would mean the industry is headed for a glut.

That point has passed, Rolland said, adding that his concern is that there is not enough demand for the end devices that rely on the electronic components to support current ordering levels.

While overall lead times stretched for firms such as Broadcom Inc, NXP Semiconductors NV, STMicroelectronics NV and Texas Instruments Inc, some areas are beginning to catch up with demand.

Lead times for microcontrollers, small processors that direct functions in everything from vehicles to washing machines, decreased by more than one week, Rolland said.

Lead times for analog chips, devices that convert real-world phenomena such as touch and sound into electronic signals, increased, but at a slower pace than previously, Susquehanna data showed.

Optoelectronic components, including chips that help convert solar energy into electricity in solar panels, are increasingly difficult to find, the report said.

While most of the firms listed as struggling to keep up with orders count automakers as major customers, other areas have felt the pinch, too, with many electronics makers, including the biggest companies such as Apple Inc, unable to meet all of the demand for their products.

Semiconductor business between Taiwan and the US is a “win-win” model for both sides given the high level of complementarity, the government said yesterday responding to tariff threats from US President Donald Trump. Home to the world’s largest contract chipmaker, Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), Taiwan is a key link in the global technology supply chain for companies such as Apple Inc and Nvidia Corp. Trump said on Monday he plans to impose tariffs on imported chips, pharmaceuticals and steel in an effort to get the producers to make them in the US. “Taiwan and the US semiconductor and other technology industries

SMALL AND EFFICIENT: The Chinese AI app’s initial success has spurred worries in the US that its tech giants’ massive AI spending needs re-evaluation, a market strategist said Chinese artificial intelligence (AI) start-up DeepSeek’s (深度求索) eponymous AI assistant rocketed to the top of Apple Inc’s iPhone download charts, stirring doubts in Silicon Valley about the strength of the US’ technological dominance. The app’s underlying AI model is widely seen as competitive with OpenAI and Meta Platforms Inc’s latest. Its claim that it cost much less to train and develop triggered share moves across Asia’s supply chain. Chinese tech firms linked to DeepSeek, such as Iflytek Co (科大訊飛), surged yesterday, while chipmaking tool makers like Advantest Corp slumped on the potential threat to demand for Nvidia Corp’s AI accelerators. US stock

SUBSIDIES: The nominee for commerce secretary indicated the Trump administration wants to put its stamp on the plan, but not unravel it entirely US President Donald Trump’s pick to lead the agency in charge of a US$52 billion semiconductor subsidy program declined to give it unqualified support, raising questions about the disbursement of funds to companies like Intel Corp and Taiwan Semiconductor Manufacturing Co (台積電). “I can’t say that I can honor something I haven’t read,” Howard Lutnick, Trump’s nominee for commerce secretary, said of the binding CHIPS and Science Act awards in a confirmation hearing on Wednesday. “To the extent monies have been disbursed, I would commit to rigorously enforcing documents that have been signed by those companies to make sure we get

UNUSUAL TIMING: The success of DeepSeek has prompted a scramble among its domestic competitors to upgrade their own AI models Chinese technology company Alibaba Group Holding Ltd (阿里巴巴) yesterday released a new version of its Qwen 2.5 artificial intelligence (AI) model that it said surpassed the highly acclaimed DeepSeek-V3. The unusual timing of the Qwen 2.5-Max’s release, on the first day of the Lunar New Year when most Chinese people are off work and with their families, points to the pressure Chinese AI start-up DeepSeek’s (深度求索) meteoric rise in the past three weeks has placed on not just overseas rivals, but also its domestic competition. “Qwen 2.5-Max outperforms ... almost across the board GPT-4o, DeepSeek-V3 and Llama-3.1-405B,” Alibaba’s cloud unit said in