Deepening financial imbalances in South Korea due to rapid asset price gains and excessive borrowing threaten to hurt the economy, the Bank of Korea (BOK) said yesterday.

Such imbalances could affect the economy negatively if there is a shock triggering a correction in the asset market and a rapid deleveraging of debt, the South Korean central bank said in a semi-annual report on financial stability.

South Korea is facing larger mid-to-long term financial risks than it did before the COVID-19 pandemic, it said.

Real estate, in particular, is believed to “significantly overpriced” considering the country’s economic conditions, it said. The burden of debt repayment is growing among households as they struggle to improve income.

The report follows a series of comments by BOK Governor Lee Ju-yeol and other board members suggesting they would rein in the unprecedented stimulus unleashed during the pandemic at some point.

A majority of private economists surveyed by Bloomberg expect the central bank to start raising its benchmark rate by early next year as it grows more confident of the economy’s recovery.

On assets, the BOK said that while the gains partly reflect optimism over the economy once the pandemic recedes, some are likely overpriced.

Considering long-term trends, Seoul home prices are excessive relative to people’s incomes, it said.

While risk appetite in the equity market has increased, price-to-earnings ratios remain low compared with other major economies, the bank said.

On cryptocurrencies, the BOK said that it was difficult to find “rational grounds” to explain the rally during the pandemic.

The central bank trimmed its rate by a total of 75 basis points last year, and has kept it at a record low of 0.5 percent since May last year.

The ratio of South Korea’s debt-to-disposable income reached 171.5 percent at the end of the first quarter, an 11.4 percentage point jump from a year earlier, the report showed.

The bank also weighed in on climate issues. It said the risks to the economy and banks’ capital adequacy ratios should grow significantly from 2040, when costs to reduce greenhouse gas are set to rise rapidly.

South Korea aims to become carbon neutral by 2050.

By 2050, the BOK expects a 2.7 to 7.4 percent loss in GDP compared with last year from implementing policies to reduce greenhouse gas emissions.

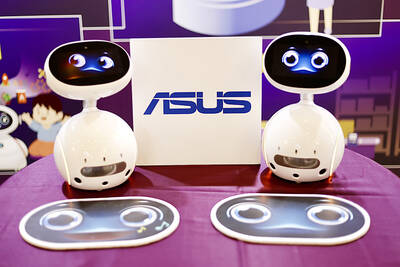

STILL HOPEFUL: Delayed payment of NT$5.35 billion from an Indian server client sent its earnings plunging last year, but the firm expects a gradual pickup ahead Asustek Computer Inc (華碩), the world’s No. 5 PC vendor, yesterday reported an 87 percent slump in net profit for last year, dragged by a massive overdue payment from an Indian cloud service provider. The Indian customer has delayed payment totaling NT$5.35 billion (US$162.7 million), Asustek chief financial officer Nick Wu (吳長榮) told an online earnings conference. Asustek shipped servers to India between April and June last year. The customer told Asustek that it is launching multiple fundraising projects and expected to repay the debt in the short term, Wu said. The Indian customer accounted for less than 10 percent to Asustek’s

‘DECENT RESULTS’: The company said it is confident thanks to an improving world economy and uptakes in new wireless and AI technologies, despite US uncertainty Pegatron Corp (和碩) yesterday said it plans to build a new server manufacturing factory in the US this year to address US President Donald Trump’s new tariff policy. That would be the second server production base for Pegatron in addition to the existing facilities in Taoyuan, the iPhone assembler said. Servers are one of the new businesses Pegatron has explored in recent years to develop a more balanced product lineup. “We aim to provide our services from a location in the vicinity of our customers,” Pegatron president and chief executive officer Gary Cheng (鄭光治) told an online earnings conference yesterday. “We

LEAK SOURCE? There would be concern over the possibility of tech leaks if TSMC were to form a joint venture to operate Intel’s factories, an analyst said Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) yesterday stayed mum after a report said that the chipmaker has pitched chip designers Nvidia Corp, Advanced Micro Devices Inc and Broadcom Inc about taking a stake in a joint venture to operate Intel Corp’s factories. Industry sources told the Central News Agency (CNA) that the possibility of TSMC proposing to operate Intel’s wafer fabs is low, as the Taiwanese chipmaker has always focused on its core business. There is also concern over possible technology leaks if TSMC were to form a joint venture to operate Intel’s factories, Concord Securities Co (康和證券) analyst Kerry Huang (黃志祺)

It was late morning and steam was rising from water tanks atop the colorful, but opaque-windowed, “soapland” sex parlors in a historic Tokyo red-light district. Walking through the narrow streets, camera in hand, was Beniko — a former sex worker who is trying to capture the spirit of the area once known as Yoshiwara through photography. “People often talk about this neighborhood having a ‘bad history,’” said Beniko, who goes by her nickname. “But the truth is that through the years people have lived here, made a life here, sometimes struggled to survive. I want to share that reality.” In its mid-17th to