GlobalFoundries Inc asked a judge to rule that it does not owe US$2.5 billion to International Business Machines Corp (IBM) over a 2014 deal in which the semiconductor maker agreed to take an unprofitable chip-manufacturing unit off IBM’s hands.

In a complaint filed on Monday in New York Supreme Court, GlobalFoundries is seeking a declaratory judgment that it did not breach the agreement and said IBM is threatening to sue.

The suit comes as GlobalFoundries works with banks on an initial public offering (IPO) that could value the chipmaker at about US$30 billion.

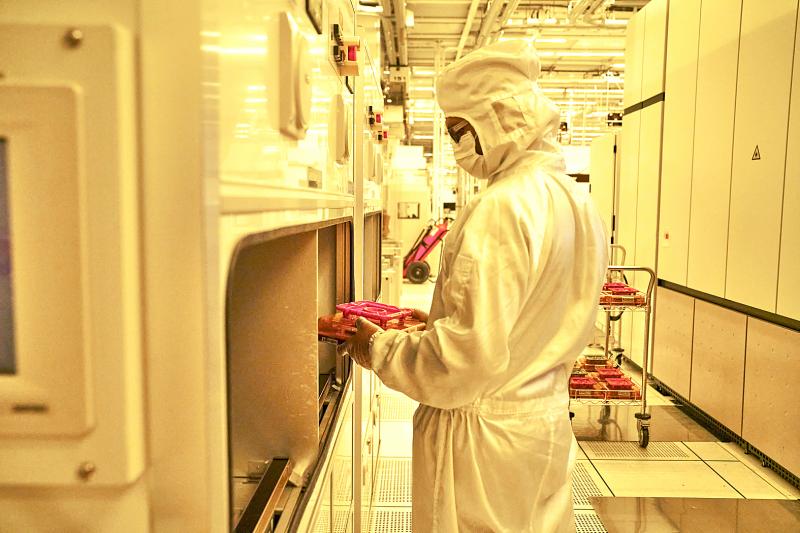

Photo: Bloomberg

“This action arises out of what seems to be a misguided and ill-conceived effort by IBM’s law department to try to extract an outlandish payment,” GlobalFoundries said its in complaint.

IBM agreed in 2014 to pay GlobalFoundries US$1.5 billion for GlobalFoundries to acquire the unit. As part of the deal, GlobalFoundries became IBM’s exclusive provider of certain power processors for the next 10 years, in exchange for access to IBM’s intellectual property. GlobalFoundries acquired manufacturing facilities in East Fishkill, New York, and Essex Junction, Vermont.

In its lawsuit, GlobalFoundries said IBM’s request for damages is “highly suspect,” as it follows news of the potential IPO.

GlobalFoundries also said that IBM “has yet to provide any substantive explanation” to its claims over the alleged breach.

GlobalFoundries said in its lawsuit that it invested billions of dollars to develop cutting-edge chipmaking technology, but that it decided not to pursue IBM’s “failing strategy” and notified IBM in 2018.

According to the filing, development of the chip technology was more challenging and expensive than initially anticipated, causing delays in the project’s targeted milestones.

GlobalFoundries said it spent more money to catch up, but still fell behind competitors including Samsung Electronics Co and Taiwan Semiconductor Manufacturing Co (台積電).

It also said IBM was “well aware” of delays and the switch to Samsung was beneficial for the company, as it was cheaper and faster than GlobalFoundries would have been able to deliver.

IBM did not complain about GlobalFoundries’ actions until news of its potential IPO broke, and it now seeks “a quick payday,” GlobalFoundries said.

A call and e-mail to IBM was not immediately returned.

The US dollar was trading at NT$29.7 at 10am today on the Taipei Foreign Exchange, as the New Taiwan dollar gained NT$1.364 from the previous close last week. The NT dollar continued to rise today, after surging 3.07 percent on Friday. After opening at NT$30.91, the NT dollar gained more than NT$1 in just 15 minutes, briefly passing the NT$30 mark. Before the US Department of the Treasury's semi-annual currency report came out, expectations that the NT dollar would keep rising were already building. The NT dollar on Friday closed at NT$31.064, up by NT$0.953 — a 3.07 percent single-day gain. Today,

‘SHORT TERM’: The local currency would likely remain strong in the near term, driven by anticipated US trade pressure, capital inflows and expectations of a US Fed rate cut The US dollar is expected to fall below NT$30 in the near term, as traders anticipate increased pressure from Washington for Taiwan to allow the New Taiwan dollar to appreciate, Cathay United Bank (國泰世華銀行) chief economist Lin Chi-chao (林啟超) said. Following a sharp drop in the greenback against the NT dollar on Friday, Lin told the Central News Agency that the local currency is likely to remain strong in the short term, driven in part by market psychology surrounding anticipated US policy pressure. On Friday, the US dollar fell NT$0.953, or 3.07 percent, closing at NT$31.064 — its lowest level since Jan.

The New Taiwan dollar and Taiwanese stocks surged on signs that trade tensions between the world’s top two economies might start easing and as US tech earnings boosted the outlook of the nation’s semiconductor exports. The NT dollar strengthened as much as 3.8 percent versus the US dollar to 30.815, the biggest intraday gain since January 2011, closing at NT$31.064. The benchmark TAIEX jumped 2.73 percent to outperform the region’s equity gauges. Outlook for global trade improved after China said it is assessing possible trade talks with the US, providing a boost for the nation’s currency and shares. As the NT dollar

The Financial Supervisory Commission (FSC) yesterday met with some of the nation’s largest insurance companies as a skyrocketing New Taiwan dollar piles pressure on their hundreds of billions of dollars in US bond investments. The commission has asked some life insurance firms, among the biggest Asian holders of US debt, to discuss how the rapidly strengthening NT dollar has impacted their operations, people familiar with the matter said. The meeting took place as the NT dollar jumped as much as 5 percent yesterday, its biggest intraday gain in more than three decades. The local currency surged as exporters rushed to