GlobalWafers Co (環球晶圓), the world’s third-largest silicon wafer supplier, yesterday said it has signed a US$800 million deal with GlobalFoundries Inc to supply 300mm and 200mm specialized wafers from its US factory.

The Hsinchu-based company expects to spend US$210 million on capital expenditure in the next few years to expand capacity for the specialized silicon wafers, or silicon-on-insulator (SOI) wafers, at its MEMC facility in O’Fallon, Missouri, the company said in a statement.

The long-term supply agreement with GlobalFoundries, the world’s No. 4 foundry service provider, is one of the biggest deals secured by GlobalWafers.

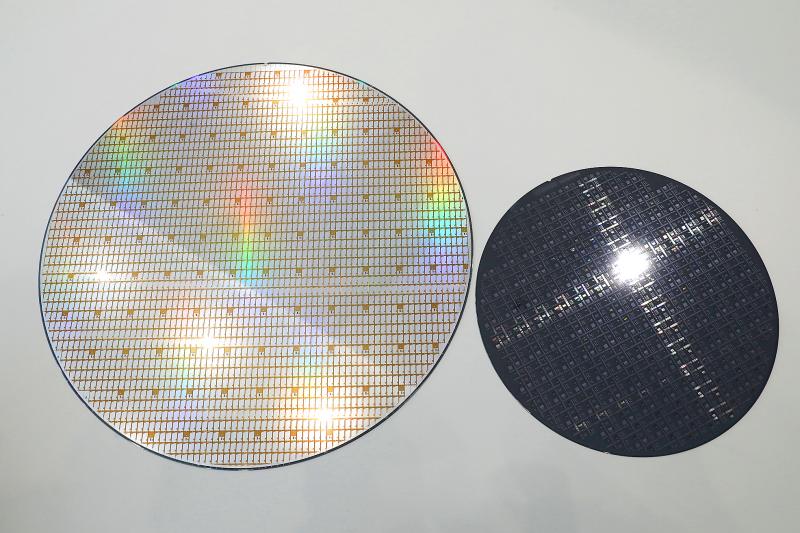

Photo: Bloomberg

The two companies in February last year announced their intention to collaborate closely to significantly expand GlobalWafers’ 300mm SOI wafer manufacturing capacity. Yesterday’s announcement signals a significant step forward in their collaboration.

GlobalWafers said in the statement that the 300mm pilot line in Missouri is on track to be completed in the fourth quarter of this year.

The silicon wafers would be used at GlobalFoundries’ most advanced manufacturing facility, Fab 8, in Malta, New York, while the 200mm wafers would be used at GlobalFoundries’ Fab 9 in Essex Junction, Vermont, it said.

GlobalWafers said the SOI wafers would be used by GlobalFoundries to develop semiconductors, as demand increases for advanced radio frequency technologies across a range of applications, including 5G smartphones, wireless connectivity, automotive radar and aerospace.

“We are proud to deepen our strategic partnership with GlobalFoundries, and to expand our important role in the US semiconductor supply chain,” GlobalWafers chairman Doris Hsu (徐秀蘭) said in the statement. “We look forward to ramping up our 300mm pilot line this year.”

Separately, GlobalWafers yesterday posted revenue of NT$4.81 billion (US$173.63 million) for last month, up 10.9 percent from NT$4.33 billion in May last year. That represented a monthly decline of 3.8 percent from NT$5 billion.

During the first five months of this year, GlobalWafers accumulated revenue of NT$24.61 billion, climbing 11.08 percent year-on-year from NT$22.15 billion.

GlobalWafers shares yesterday in Taipei rose 1.17 percent to close at NT$862, the highest since April 29.

SEMICONDUCTORS: The firm has already completed one fab, which is to begin mass producing 2-nanomater chips next year, while two others are under construction Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), the world’s largest contract chipmaker, plans to begin construction of its fourth and fifth wafer fabs in Kaohsiung next year, targeting the development of high-end processes. The two facilities — P4 and P5 — are part of TSMC’s production expansion program, which aims to build five fabs in Kaohsiung. TSMC facility division vice president Arthur Chuang (莊子壽) on Thursday said that the five facilities are expected to create 8,000 jobs. To respond to the fast-changing global semiconductor industry and escalating international competition, TSMC said it has to keep growing by expanding its production footprints. The P4 and P5

DOWNFALL: The Singapore-based oil magnate Lim Oon Kuin was accused of hiding US$800 million in losses and leaving 20 banks with substantial liabilities Former tycoon Lim Oon Kuin (林恩強) has been declared bankrupt in Singapore, following the collapse of his oil trading empire. The name of the founder of Hin Leong Trading Pte Ltd (興隆貿易) and his children Lim Huey Ching (林慧清) and Lim Chee Meng (林志朋) were listed as having been issued a bankruptcy order on Dec. 19, the government gazette showed. The younger Lims were directors at the company. Leow Quek Shiong and Seah Roh Lin of BDO Advisory Pte Ltd are the trustees, according to the gazette. At its peak, Hin Leong traded a range of oil products, made lubricants and operated loading

The growing popularity of Chinese sport utility vehicles and pickup trucks has shaken up Mexico’s luxury car market, hitting sales of traditionally dominant brands such as Mercedes-Benz and BMW. Mexicans are increasingly switching from traditionally dominant sedans to Chinese vehicles due to a combination of comfort, technology and price, industry experts say. It is no small feat in a country home to factories of foreign brands such as Audi and BMW, and where until a few years ago imported Chinese cars were stigmatized, as in other parts of the world. The high-end segment of the market registered a sales drop

Citigroup Inc and Bank of America Corp said they are leaving a global climate-banking group, becoming the latest Wall Street lenders to exit the coalition in the past month. In a statement, Citigroup said while it remains committed to achieving net zero emissions, it is exiting the Net-Zero Banking Alliance (NZBA). Bank of America said separately on Tuesday that it is also leaving NZBA, adding that it would continue to work with clients on reducing greenhouse gas emissions. The banks’ departure from NZBA follows Goldman Sachs Group Inc and Wells Fargo & Co. The largest US financial institutions are under increasing pressure