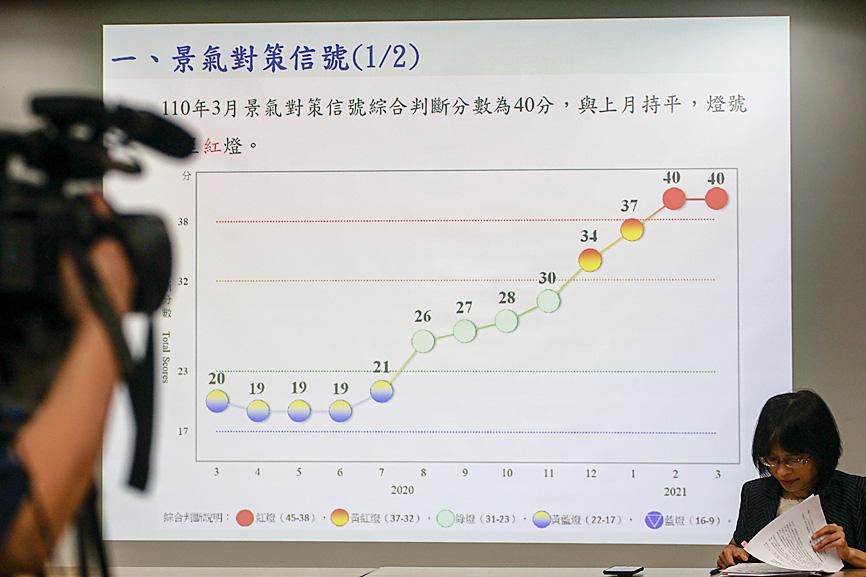

The government’s business climate monitor last month was “red” for the second consecutive month, suggesting a boom amid signs that the world is emerging from the COVID-19 pandemic, despite an escalation of infections in India and other countries, the National Development Council said yesterday.

The overall reading was steady at 40, while the nine constituent gauges consolidated at high levels, the council said, adding that the monitor is expected to remain red this quarter, with major economic barometers tipped to be strong.

“Taiwan’s exports still have room to move upward as they move forward with the world on track for recovery from the pandemic,” NDC research director Wu Ming-huei (吳明蕙) told a media briefing.

Photo: CNA

The council uses a five-color system to depict the nation’s economic situation, with “green” indicating steady growth, “red” suggesting a boom and “blue” signaling a recession. Dual colors indicate a transition.

Wu dismissed overheating concerns, as red reflects healthy economic fundamentals, primarily impressive corporate earnings.

That explains why the local bourse has repeatedly reached records this month, Wu said.

All of the measures rose, except non-farm payrolls, Wu said.

The index of leading indicators, which aims to portray the economic situation for the subsequent six months, increased 0.12 percent to 105.35, as readings on imports of semiconductor capital equipment, manufacturing business confidence and labor entry rates rose, the council said.

The leading index has increased for 11 months in a row, with a cumulative gain of 9.15 percent, lending support to the council’s upbeat sentiment, Wu said.

The index of coincident indicators, which reflects the current economic state, increased 0.84 percent to 105.98, while the index has risen 9.18 percent in the past 10 months, the council said.

Industrial output, manufacturing sales, imports of machinery and electrical equipment, as well as wholesale and restaurant revenue, all gained ground, it said.

Exports and domestic demand have bolstered the economy, Wu said.

MULTIFACETED: A task force has analyzed possible scenarios and created responses to assist domestic industries in dealing with US tariffs, the economics minister said The Executive Yuan is tomorrow to announce countermeasures to US President Donald Trump’s planned reciprocal tariffs, although the details of the plan would not be made public until Monday next week, Minister of Economic Affairs J.W. Kuo (郭智輝) said yesterday. The Cabinet established an economic and trade task force in November last year to deal with US trade and tariff related issues, Kuo told reporters outside the legislature in Taipei. The task force has been analyzing and evaluating all kinds of scenarios to identify suitable responses and determine how best to assist domestic industries in managing the effects of Trump’s tariffs, he

TIGHT-LIPPED: UMC said it had no merger plans at the moment, after Nikkei Asia reported that the firm and GlobalFoundries were considering restarting merger talks United Microelectronics Corp (UMC, 聯電), the world’s No. 4 contract chipmaker, yesterday launched a new US$5 billion 12-inch chip factory in Singapore as part of its latest effort to diversify its manufacturing footprint amid growing geopolitical risks. The new factory, adjacent to UMC’s existing Singapore fab in the Pasir Res Wafer Fab Park, is scheduled to enter volume production next year, utilizing mature 22-nanometer and 28-nanometer process technologies, UMC said in a statement. The company plans to invest US$5 billion during the first phase of the new fab, which would have an installed capacity of 30,000 12-inch wafers per month, it said. The

Taiwan’s official purchasing managers’ index (PMI) last month rose 0.2 percentage points to 54.2, in a second consecutive month of expansion, thanks to front-loading demand intended to avoid potential US tariff hikes, the Chung-Hua Institution for Economic Research (CIER, 中華經濟研究院) said yesterday. While short-term demand appeared robust, uncertainties rose due to US President Donald Trump’s unpredictable trade policy, CIER president Lien Hsien-ming (連賢明) told a news conference in Taipei. Taiwan’s economy this year would be characterized by high-level fluctuations and the volatility would be wilder than most expect, Lien said Demand for electronics, particularly semiconductors, continues to benefit from US technology giants’ effort

‘SWASTICAR’: Tesla CEO Elon Musk’s close association with Donald Trump has prompted opponents to brand him a ‘Nazi’ and resulted in a dramatic drop in sales Demonstrators descended on Tesla Inc dealerships across the US, and in Europe and Canada on Saturday to protest company chief Elon Musk, who has amassed extraordinary power as a top adviser to US President Donald Trump. Waving signs with messages such as “Musk is stealing our money” and “Reclaim our country,” the protests largely took place peacefully following fiery episodes of vandalism on Tesla vehicles, dealerships and other facilities in recent weeks that US officials have denounced as terrorism. Hundreds rallied on Saturday outside the Tesla dealership in Manhattan. Some blasted Musk, the world’s richest man, while others demanded the shuttering of his