Next Bank (將來銀行) has allegedly acquired an overpriced IT system developed by its biggest shareholder, Chunghwa Telecom Co (中華電信), despite the doubts of former general manager Liu I-cheng (劉奕成) and the bank’s compliance and financial departments, Chinese Nationalist Party (KMT) Legislator Alex Fai (費鴻泰) said yesterday.

Liu on March 18 resigned over the deal, Fai told a meeting of the legislature’s Finance Committee in Taipei, citing a source at the Web-only bank who objected to the purchase.

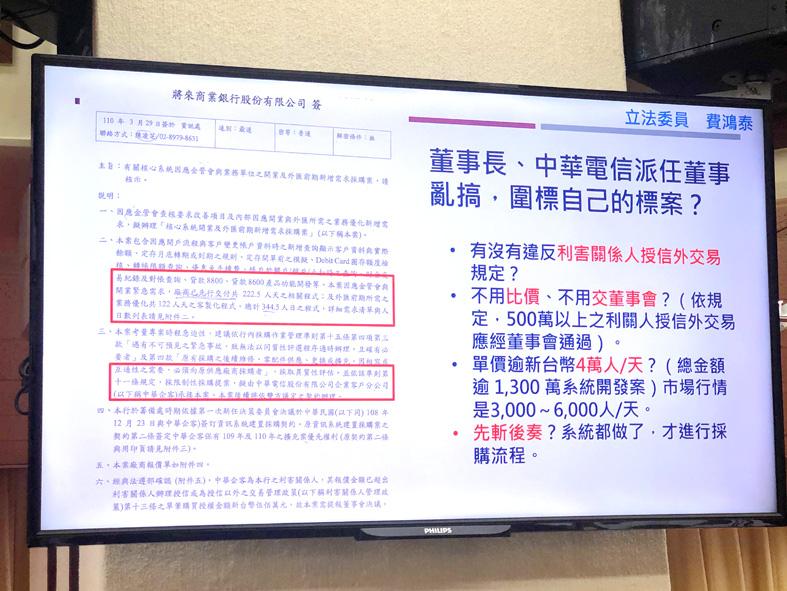

Chunghwa Telecom, which holds a 41.9 percent stake in Next Bank, has appointed five directors to the bank’s board, including the telecom’s business group president Wu Li-show (吳麗秀), Fai said.

Photo: Kelson Wang, Taipei Times

Wu allegedly urged the bank to buy a NT$13.78 million (US$484,614) IT system developed by the telecom to address flaws in the bank’s system, Fai said.

The project’s development time totaled 344.5 worker days, priced at NT$40,021 per day, he said.

“That is almost the market price in the US. In Taiwan, the usual price per worker day is NT$3,000 to NT$6,000,” Fai said.

Following an on-site inspection, the Financial Supervisory Commission (FSC) mandated an update to the bank’s system.

However, Next Bank has not opened a public tender, nor has it formally employed the telecom for the task, Fai said, adding that it was unreasoanble for Wu to urge the bank to buy from the telecom.

The bank’s internal rules stipulate that purchases of more than NT$5 million require approval by the board, Fai said, adding that the board did not discuss the matter.

Liu, as well as the bank’s compliance and finance departments, disapproved the deal, but chairman Chung Fu-kuei (鍾福貴) asked to “find ways to address the deal,” Fai said, adding that Chung previously worked for the telecom as president of data communication.

Liu aimed to review the then-proposed purchase at a board meeting in early February, where directors appointed by the telecom and one director appointed by Mega International Commercial Bank (兆豐銀行) pressured Liu to resign, Fai said.

Fai urged the FSC to investigate the matter, saying that his source inside the bank might need protection, “as the bank is already trying to find out who the whistle-blowers are.”

FSC Chairman Thomas Huang (黃天牧) said that the commission received reports from the same source, and that it would investigate whether Next Bank or the telecom have breached regulations or internal controls.

However, Liu said in a statement that he was not pressured to step down, nor did he know of an IT purchase from the telecom.

“The board meeting in February did not discuss the matter,” Liu said.

Next Bank said in a statement that it is still in the procurement process for the improvement of its IT system, adding that it would proceed in line with internal control requirements.

When an apartment comes up for rent in Germany’s big cities, hundreds of prospective tenants often queue down the street to view it, but the acute shortage of affordable housing is getting scant attention ahead of today’s snap general election. “Housing is one of the main problems for people, but nobody talks about it, nobody takes it seriously,” said Andreas Ibel, president of Build Europe, an association representing housing developers. Migration and the sluggish economy top the list of voters’ concerns, but analysts say housing policy fails to break through as returns on investment take time to register, making the

EARLY TALKS: Measures under consideration include convincing allies to match US curbs, further restricting exports of AI chips or GPUs, and blocking Chinese investments US President Donald Trump’s administration is sketching out tougher versions of US semiconductor curbs and pressuring key allies to escalate their restrictions on China’s chip industry, an early indication the new US president plans to expand efforts that began under former US president Joe Biden to limit Beijing’s technological prowess. Trump officials recently met with their Japanese and Dutch counterparts about restricting Tokyo Electron Ltd and ASML Holding NV engineers from maintaining semiconductor gear in China, people familiar with the matter said. The aim, which was also a priority for Biden, is to see key allies match China curbs the US

NOT TO WORRY: Some people are concerned funds might continue moving out of the country, but the central bank said financial account outflows are not unusual in Taiwan Taiwan’s outbound investments hit a new high last year due to investments made by contract chipmaker Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) and other major manufacturers to boost global expansion, the central bank said on Thursday. The net increase in outbound investments last year reached a record US$21.05 billion, while the net increase in outbound investments by Taiwanese residents reached a record US$31.98 billion, central bank data showed. Chen Fei-wen (陳斐紋), deputy director of the central bank’s Department of Economic Research, said the increase was largely due to TSMC’s efforts to expand production in the US and Japan. Investments by Vanguard International

STRUGGLING TO SURVIVE: The group is proposing a consortium of investors, with Tesla as the largest backer, and possibly a minority investment by Hon Hai Precision Nissan Motor Co shares jumped after the Financial Times reported that a high-level Japanese group has drawn up plans to seek investment from Elon Musk’s Tesla Inc to aid the struggling automaker. The group believes the electric vehicle (EV) maker is interested in acquiring Nissan’s plants in the US, the newspaper reported, citing people it did not identify. The proposal envisions a consortium of investors, with Tesla as the largest backer, but also includes the possibility of a minority investment by Hon Hai Precision Industry Co (鴻海精密) to prevent a full takeover by the Apple supplier, the report said. The group is