The S&P 500 and Dow on Friday rose in a broad-based rally with technology, healthcare and financial stocks providing the biggest lift as investors bet on a recovery that is expected to deliver the fastest economic growth since 1984.

The S&P 500 and the Dow ended a seesaw week higher as investors rebalancing their portfolios at the quarter’s end continued to buy stocks that stand to benefit from a growing economy, while they added some beaten-down technology shares.

The NASDAQ also ended higher as less popular tech shares advanced, but posted its second weekly decline in a row.

Wall Street surged in the last half hour of trading, lifting all three indicies more than 1 percent. The S&P 500 and Dow eked out record closing highs.

The Russell 1000 value index, which includes energy, banks and industrial stocks, has gained more than 10 percent this year, outperforming its counterpart the Russell 1000 growth index, which is just above break-even for the year.

Some of the tech heavyweights slid, such as Tesla Inc and Google parent Alphabet Inc, but Microsoft Corp and Facebook Inc bucked the trend, helping lift the S&P 500 and NASDAQ higher.

“It is less a move out of technology than a move that evidences a broader appetite for equities to include both growth and value,” said John Stoltzfus, chief investment strategist at Oppenheimer Asset Management in New York.

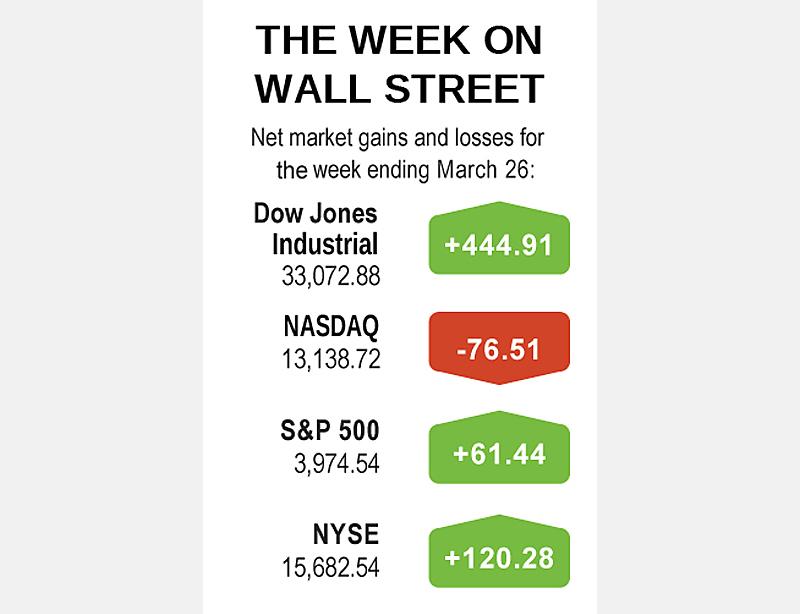

The Dow Jones Industrial Average rose 453.4 points, or 1.39 percent, to 33,072.88. The S&P 500 gained 65.02 points, or 1.66 percent, to 3,974.54 and the NASDAQ Composite added 161.05 points, or 1.24 percent, to 13,138.72.

For the week, the S&P rose 1.57 percent and the Dow 1.36 percent, while the NASDAQ slipped 0.58 percent.

Volume on US exchanges was 12.23 billion shares, compared with the 13.67 billion average for the full session over the past 20 trading days.

The US Federal Reserve last week raised its GDP estimate for 2021 to 6.5 percent from 4.2 percent and many economists expect still faster growth, which has spurred fears the economy could run too hot and force the Fed to raise interest rates.

“It has been hard to restrain our US growth forecast in recent months. We’ve been upgrading our estimates almost as fast as we lowered them a year ago,” Carl Tannenbaum, chief economist at Northern Trust, told the Reuters Global Markets Forum.

Bank stocks gained 1.9 percent as the Fed said it would lift income-based restrictions on bank dividends and share buybacks for “most firms” in June after its next round of stress tests.

The yield on benchmark 10-year US Treasury notes rose to 1.66 percent, lower than a spike last week to 1.75 percent that sparked a sell-off on inflation fears and a potential Fed rate hike — something the Fed has pledged not to do.

The market is concerned that all of a sudden the Fed is forced to tighten against its repeated mantra that it will not, State Street Global Markets senior global macro strategist Marvin Loh said.

“The real concern is that things overheat and the Fed might be forced to change its mind,” he said.

Energy stocks jumped 2.6 percent, tracking a boost in crude prices after a giant container ship blocking the Suez Canal spurred fears of a supply squeeze.

Ten of the 11 major S&P sectors rose, with only the communication services index in the red.

Advancing issues outnumbered declining ones on the NYSE by a 3.3-to-1 ratio; on NASDAQ, a 1.81-to-1 ratio favored advancers.

The S&P 500 posted 65 new 52-week highs and no new lows; the NASDAQ Composite recorded 82 new highs and 51 new lows.

TAKING STOCK: A Taiwanese cookware firm in Vietnam urged customers to assess inventory or place orders early so shipments can reach the US while tariffs are paused Taiwanese businesses in Vietnam are exploring alternatives after the White House imposed a 46 percent import duty on Vietnamese goods, following US President Donald Trump’s announcement of “reciprocal” tariffs on the US’ trading partners. Lo Shih-liang (羅世良), chairman of Brico Industry Co (裕茂工業), a Taiwanese company that manufactures cast iron cookware and stove components in Vietnam, said that more than 40 percent of his business was tied to the US market, describing the constant US policy shifts as an emotional roller coaster. “I work during the day and stay up all night watching the news. I’ve been following US news until 3am

UNCERTAINTY: Innolux activated a stringent supply chain management mechanism, as it did during the COVID-19 pandemic, to ensure optimal inventory levels for customers Flat-panel display makers AUO Corp (友達) and Innolux Corp (群創) yesterday said that about 12 to 20 percent of their display business is at risk of potential US tariffs and that they would relocate production or shipment destinations to mitigate the levies’ effects. US tariffs would have a direct impact of US$200 million on AUO’s revenue, company chairman Paul Peng (彭雙浪) told reporters on the sidelines of the Touch Taiwan trade show in Taipei yesterday. That would make up about 12 percent of the company’s overall revenue. To cope with the tariff uncertainty, AUO plans to allocate its production to manufacturing facilities in

Six years ago, LVMH’s billionaire CEO Bernard Arnault and US President Donald Trump cut the blue ribbon on a factory in rural Texas that would make designer handbags for Louis Vuitton, one of the world’s best-known luxury brands. However, since the high-profile opening, the factory has faced a host of problems limiting production, 11 former Louis Vuitton employees said. The site has consistently ranked among the worst-performing for Louis Vuitton globally, “significantly” underperforming other facilities, said three former Louis Vuitton workers and a senior industry source, who cited internal rankings shared with staff. The plant’s problems — which have not

COLLABORATION: Given Taiwan’s key position in global supply chains, the US firm is discussing strategies with local partners and clients to deal with global uncertainties Advanced Micro Devices Inc (AMD) yesterday said it is meeting with local ecosystem partners, including Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), to discuss strategies, including long-term manufacturing, to navigate uncertainties such as US tariffs, as Taiwan occupies an important position in global supply chains. AMD chief executive officer Lisa Su (蘇姿丰) told reporters that Taiwan is an important part of the chip designer’s ecosystem and she is discussing with partners and customers in Taiwan to forge strong collaborations on different areas during this critical period. AMD has just become the first artificial-intelligence (AI) server chip customer of TSMC to utilize its advanced