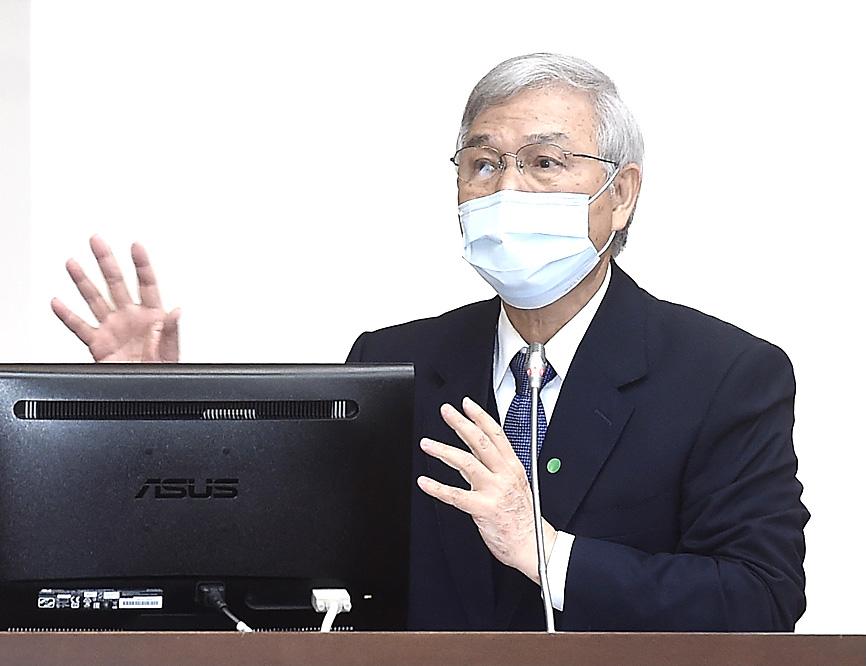

A huge increase in foreign-exchange interventions could lead to the US labeling Taiwan a currency manipulator, central bank Governor Yang Chin-long (楊金龍) said yesterday, but he added that the designation is unlikely to have any immediate negative impact on the nation’s export-dependent economy.

“It is possible that Taiwan might be listed as a manipulator,” Yang told lawmakers in Taipei as he delivered a report.

However, Yang said that the US’ criteria for labeling another economy a currency manipulator are no longer suitable, as the global economy has changed over the past year.

Photo: Chien Jung-fong, Taipei Times

Taiwan’s high-trade surplus with the US, one of the US Department of the Treasury’s three criteria, is due to strong demand from US companies for semiconductors, rather than any perceived unfair advantage Taiwan has gained from its currency intervention, Yang said.

“If they want to reduce our trade surplus with them, then we could just stop selling them our chips,” he told lawmakers. “But they need them.”

The central bank stepped up its intervention in markets in the second half of last year as it tried to stop the New Taiwan dollar from strengthening on the back of the booming economy and trade.

Although being listed as a manipulator by the US has no immediate or specific consequences, Yang said the central bank would discuss its interventions and trade surplus with US Treasury officials.

The central bank’s net currency purchases surged more than 600 percent to US$39.1 billion last year, according to the report Yang delivered to lawmakers.

That equals 5.8 percent of Taiwan’s GDP, according to Bloomberg calculations, well above the US Treasury’s 2 percent threshold. In 2019, the central bank reported net purchases of US$5.5 billion.

Yang said that capital inflows had slowed since mid-January.

The central bank reported conducting what it calls currency “smoothing” operations in January, but not in the past month, according to earlier statements.

The US Treasury has three criteria for listing an economy as a currency manipulator: a current-account surplus equivalent to 2 percent of GDP, a bilateral trade surplus of at least US$20 billion and “persistent, one-sided” foreign-exchange interventions worth at least 2 percent of GDP.

Taiwan was added to the currency watch list in the latest US report in December last year, but was not listed a currency manipulator.

The US cited the “persistently large” current account surplus of 10.9 percent of GDP in the year to June and a US$25 billion trade surplus with the US as reasons for its addition to the watch list.

Being designated a currency manipulator requires the US to engage with the perceived offender to address the imbalance.

Yang said the central bank would revise upward its economic growth forecast on Thursday next week, when the bank’s board of directors is set to meet at its quarterly meeting to decide if it is necessary to adjust the bank’s monetary policy.

The bank on Dec. 17 last year predicted the economy to expand 3.68 percent this year, while the Directorate-General of Budget, Accounting and Statistics on Feb. 20 upgraded the GDP growth forecast for this year to 4.64 percent, up from the previous forecast of 3.83 percent.

The nation’s economy has grown steadily and the inflation outlook remains mild, but Taiwan still faces potential external risks, such as the effectiveness of COVID-19 vaccines, fluctuations in global financial markets and uncertainties in the international trade environment, Yang said.

Additional reporting by staff writer

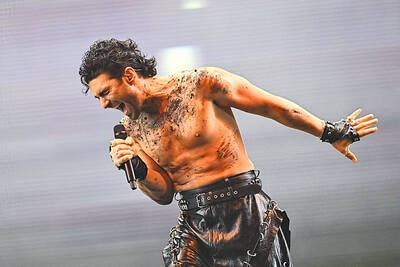

The Eurovision Song Contest has seen a surge in punter interest at the bookmakers, becoming a major betting event, experts said ahead of last night’s giant glamfest in Basel. “Eurovision has quietly become one of the biggest betting events of the year,” said Tomi Huttunen, senior manager of the Online Computer Finland (OCS) betting and casino platform. Betting sites have long been used to gauge which way voters might be leaning ahead of the world’s biggest televised live music event. However, bookmakers highlight a huge increase in engagement in recent years — and this year in particular. “We’ve already passed 2023’s total activity and

Nvidia Corp CEO Jensen Huang (黃仁勳) today announced that his company has selected "Beitou Shilin" in Taipei for its new Taiwan office, called Nvidia Constellation, putting an end to months of speculation. Industry sources have said that the tech giant has been eyeing the Beitou Shilin Science Park as the site of its new overseas headquarters, and speculated that the new headquarters would be built on two plots of land designated as "T17" and "T18," which span 3.89 hectares in the park. "I think it's time for us to reveal one of the largest products we've ever built," Huang said near the

China yesterday announced anti-dumping duties as high as 74.9 percent on imports of polyoxymethylene (POM) copolymers, a type of engineering plastic, from Taiwan, the US, the EU and Japan. The Chinese Ministry of Commerce’s findings conclude a probe launched in May last year, shortly after the US sharply increased tariffs on Chinese electric vehicles, computer chips and other imports. POM copolymers can partially replace metals such as copper and zinc, and have various applications, including in auto parts, electronics and medical equipment, the Chinese ministry has said. In January, it said initial investigations had determined that dumping was taking place, and implemented preliminary

Intel Corp yesterday reinforced its determination to strengthen its partnerships with Taiwan’s ecosystem partners including original-electronic-manufacturing (OEM) companies such as Hon Hai Precision Industry Co (鴻海精密) and chipmaker United Microelectronics Corp (UMC, 聯電). “Tonight marks a new beginning. We renew our new partnership with Taiwan ecosystem,” Intel new chief executive officer Tan Lip-bu (陳立武) said at a dinner with representatives from the company’s local partners, celebrating the 40th anniversary of the US chip giant’s presence in Taiwan. Tan took the reins at Intel six weeks ago aiming to reform the chipmaker and revive its past glory. This is the first time Tan