European stocks on Friday closed lower, ending three weeks of gains as investors booked profits in technology and commodity-linked shares due to concerns over rising inflation and interest rates on the back of a jump in bond yields.

The benchmark STOXX 600 fell 1.64 percent to 404.99 and shed 2.38 percent for the week — its first weekly loss this month — with technology stocks losing the most as they continued to retreat from 20-year highs.

On the day, resource stocks were the softest-performing European sectors, tumbling 4.2 percent from a near 10-year high in their worst session in five months.

“Equity markets across the US and Europe are quite expensive now, and with bond yields constantly rising, the fixed income market is proving to be more attractive than the riskier equity market,” Societe Generale SA strategist Roland Kaloyan said. “Investors are actually looking at the pace at which yields drop and the current speed is quite concerning for equity markets.”

US and eurozone bond yields retreated slightly, but stayed close to highs hit this week as investors positioned for higher inflation this year. Yields were also set for large monthly gains.

BETTER RETURNS

Sectors such as utilities, healthcare and other staples — usually seen as proxies for government debt due to their similar yields — lagged their European peers for the month as investors sought better returns from actual debt.

Still, the STOXX 600 has gained this month, helped by a rotation into energy, banking and mining stocks on expectations of a pickup in business activity following COVID-19 vaccine rollouts.

Travel and leisure was the strongest sector this month as investors bet on an economic reopening boom. Banks also outperformed their peers thanks to higher bond yields.

Better-than-expected fourth-quarter earnings have also reinforced optimism about a quicker corporate rebound this year.

Of the 194 companies in the STOXX 600 that have reported quarterly earnings so far, 68 percent have beaten analysts’ estimates, according to Refinitiv.

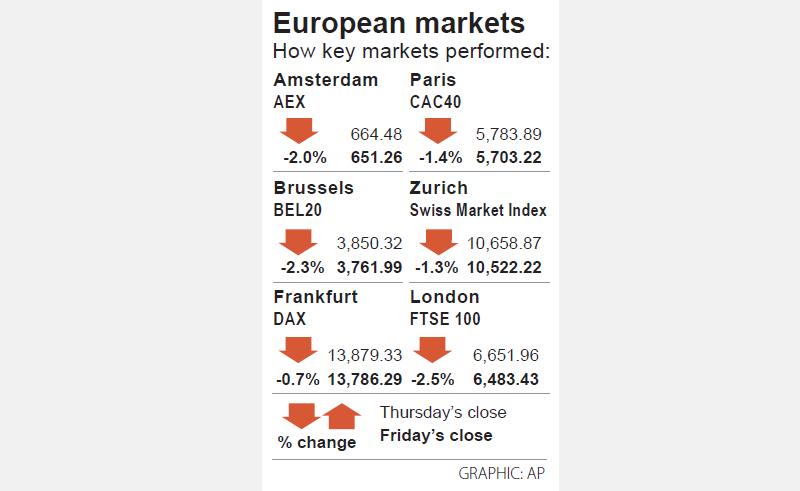

In London, the export-heavy FTSE 100 marked its weakest session since late October last year, snapping three straight weeks of gains.

MINING STOCKS DOWN

The FTSE 100 slipped 2.53 percent to 6,483.43, declining 2.12 percent from a week earlier.

Mining stocks, including Rio Tinto Group, Anglo American PLC and BHP, were the biggest drags on the index, while oil heavyweights BP PLC and Royal Dutch Shell fell, tracking a decline in oil and metal prices.

TECH CLUSTER: The US company’s new office is in the Shalun Smart Green Energy Science City, a new AI industry base and cybersecurity hub in southern Taiwan US chip designer Advanced Micro Devices Inc (AMD) yesterday launched an office in Tainan’s Gueiren District (歸仁), marking a significant milestone in the development of southern Taiwan’s artificial intelligence (AI) industry, the Tainan City Government said in a statement. AMD Taiwan general manager Vincent Chern (陳民皓) presided over the opening ceremony for the company’s new office at the Shalun Smart Green Energy Science City (沙崙智慧綠能科學城), a new AI industry base and cybersecurity hub in southern Taiwan. Facilities in the new office include an information processing center, and a research and development (R&D) center, the Tainan Economic Development Bureau said. The Ministry

ADVERSARIES: The new list includes 11 entities in China and one in Taiwan, which is a local branch of Chinese cloud computing firm Inspur Group The US added dozens of entities to a trade blacklist on Tuesday, the US Department of Commerce said, in part to disrupt Beijing’s artificial intelligence (AI) and advanced computing capabilities. The action affects 80 entities from countries including China, the United Arab Emirates and Iran, with the commerce department citing their “activities contrary to US national security and foreign policy.” Those added to the “entity list” are restricted from obtaining US items and technologies without government authorization. “We will not allow adversaries to exploit American technology to bolster their own militaries and threaten American lives,” US Secretary of Commerce Howard Lutnick said. The entities

Minister of Finance Chuang Tsui-yun (莊翠雲) yesterday told lawmakers that she “would not speculate,” but a “response plan” has been prepared in case Taiwan is targeted by US President Donald Trump’s reciprocal tariffs, which are to be announced on Wednesday next week. The Trump administration, including US Secretary of the Treasury Scott Bessent, has said that much of the proposed reciprocal tariffs would focus on the 15 countries that have the highest trade surpluses with the US. Bessent has referred to those countries as the “dirty 15,” but has not named them. Last year, Taiwan’s US$73.9 billion trade surplus with the US

The Taipei International Cycle Show (Taipei Cycle) yesterday opened at the Taipei Nangang Exhibition Center, with the event’s organizer expecting a steady recovery in the industry this year following a tough last year. This year, 980 companies from 35 countries are participating in the annual bicycle trade show, showcasing technological breakthroughs and market development trends of the bicycle industry at 3,600 booths, the Taiwan External Trade Development Council (TAITRA, 外貿協會) said in a statement. Under the theme “Ride the Revolution,” the exhibition has attracted more than 3,500 international buyers from 80 countries to preregister for the four-day event, which is expected to