Stocks on Wall Street closed near break-even on Friday as investors sold technology shares that have rallied through the COVID-19 pandemic and rotated into cyclical stocks set to benefit from pent-up demand once the pandemic is subdued.

Industrials led rising sectors in the S&P 500, spurred by a 9.9 percent surge in Deere & Co and Caterpillar Inc’s 5 percent gain to an all-time peak of US$211.40 a share.

Financials, materials and energy, along with industrials, rose more than 1 percent.

Photo: Reuters

The S&P 1500 airlines index jumped 3.5 percent, with post-pandemic travel in focus.

The stay-at-home winners, including Microsoft Corp, Facebook Inc, Alphabet Inc’s Google and Netflix Inc, fell in a trend seen for most of the week.

Amazon.com Inc also fell, as investors sold the leaders in the big rally since March last year.

Value stocks rose 0.6 percent, while growth fell 0.6 percent. Advancing stocks led declining shares by about a ratio of two to one.

A battle continues between tech-led growth stocks and cyclicals, companies that are heavily affected by economic conditions, said Tim Ghriskey, chief investment strategist at Inverness Counsel in New York.

“When the economy is roaring, they’re roaring. When the economy is weakening, they’re weakening,” Ghriskey said of cyclicals. “The economy will roar, at least for a period of time. There’s huge pent-up demand, whether just for travel or going back to work.”

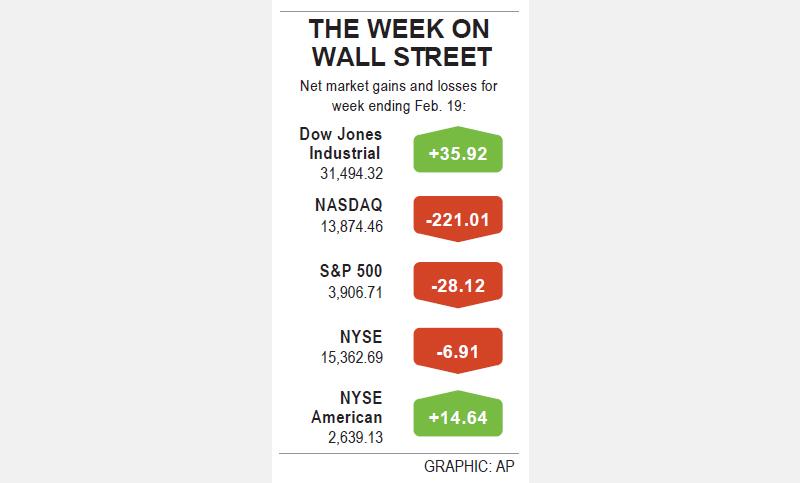

The Dow Jones Industrial Average edged up 0.98 points, or 0 percent, to 31,494.32 and the NASDAQ Composite added 9.11 points, or 0.07 percent, to 13,874.46. The S&P 500 dropped 7.26 points, or 0.19 percent, to 3,906.71.

Volume on US exchanges was 13.47 billion shares.

Healthy earnings, progress in COVID-19 vaccination rollouts and hopes of a US$1.9 trillion federal coronavirus relief package helped US stock indices hit record highs at the beginning of the week.

The Dow Jones hit an all-time intraday peak, led by Caterpillar, after Deere raised its earnings forecast for this year.

Deere reported that profit more than doubled in the first quarter on rising demand for farm and construction machinery.

The benchmark S&P 500 and the tech-heavy NASDAQ posted their first weekly declines this month on concerns over higher stock market valuations, and expectations of rising inflation led to fears of a short-term pullback in equities.

For the week, the Dow rose 0.11 percent, while the S&P 500 fell 0.71 percent and the NASDAQ slid 1.57 percent as big tech sold off.

Bank of America expects a more than 10 percent pullback in stocks, which are trading at more than 22 times 12-month forward earnings, the most expensive since the dot-com bubble of the late 1990s.

“What we saw [this week] represents a market that is tired and may not do very much. So we are headed for some sort of a pullback, but I don’t think we’re there just yet,” said Peter Cardillo, chief market economist at Spartan Capital Securities in New York.

On the economic front, data showed that IHS Markit’s flash US composite purchasing manager’s index, which tracks the manufacturing and services sectors, inched up to 58.8 in this month.

Merida Industry Co (美利達) has seen signs of recovery in the US and European markets this year, as customers are gradually depleting their inventories, the bicycle maker told shareholders yesterday. Given robust growth in new orders at its Taiwanese factory, coupled with its subsidiaries’ improving performance, Merida said it remains confident about the bicycle market’s prospects and expects steady growth in its core business this year. CAUTION ON CHINA However, the company must handle the Chinese market with great caution, as sales of road bikes there have declined significantly, affecting its revenue and profitability, Merida said in a statement, adding that it would

MARKET LEADERSHIP: Investors are flocking to Nvidia, drawn by the company’s long-term fundamntals, dominant position in the AI sector, and pricing and margin power Two years after Nvidia Corp made history by becoming the first chipmaker to achieve a US$1 trillion market capitalization, an even more remarkable milestone is within its grasp: becoming the first company to reach US$4 trillion. After the emergence of China’s DeepSeek (深度求索) sent the stock plunging earlier this year and stoked concerns that outlays on artificial intelligence (AI) infrastructure were set to slow, Nvidia shares have rallied back to a record. The company’s biggest customers remain full steam ahead on spending, much of which is flowing to its computing systems. Microsoft Corp, Meta Platforms Inc, Amazon.com Inc and Alphabet Inc are

RISING: Strong exports, and life insurance companies’ efforts to manage currency risks indicates the NT dollar would eventually pass the 29 level, an expert said The New Taiwan dollar yesterday rallied to its strongest in three years amid inflows to the nation’s stock market and broad-based weakness in the US dollar. Exporter sales of the US currency and a repatriation of funds from local asset managers also played a role, said two traders, who asked not to be identified as they were not authorized to speak publicly. State-owned banks were seen buying the greenback yesterday, but only at a moderate scale, the traders said. The local currency gained 0.77 percent, outperforming almost all of its Asian peers, to close at NT$29.165 per US dollar in Taipei trading yesterday. The

The US overtaking China as Taiwan’s top export destination could boost industrial development and wage growth, given the US is a high-income economy, an economist said yesterday. However, Taiwan still needs to diversify its export markets due to the unpredictability of US President Donald Trump’s administration, said Chiou Jiunn-rong (邱俊榮), an economics professor at National Central University. Taiwan’s exports soared to a record US$51.74 billion last month, driven by strong demand for artificial intelligence (AI) products and continued orders, with information and communication technology (ICT) and audio/video products leading all sectors. The US reclaimed its position as Taiwan’s top export market, accounting for