Wall Street should have seen the GameStop Corp saga coming. Easier access to information, the proliferation of trading apps, zero-fee commissions, the ability to buy fractional shares, and US government stimulus checks to individuals have all led us to this moment. Let us not forget the actions by the US Federal Reserve and government during the early days of the COVID-19 pandemic that not only supported financial markets, but made everyone forget that investing does carry potential risks.

The rise and newfound clout of retail investors has been evident for all to see if they just opened their eyes.

First, this cohort of investors embarrassed Warren Buffett after he sold his airline stocks in May last year and “wished them well.”

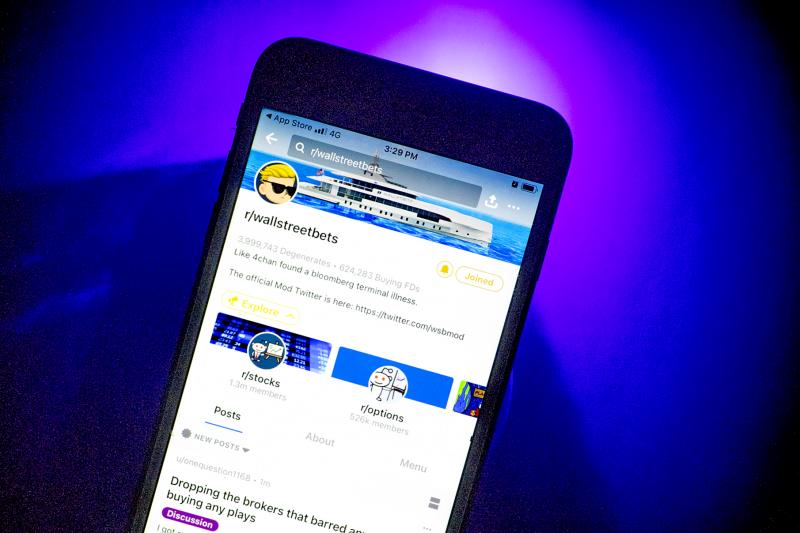

Photo: Bloomberg

Led by Dave “Davey Day Trader” Portnoy, airline stocks almost doubled the next month and are still well above the levels when Buffett exited his positions. The retail investor tugged on Superman’s cape and won. Which is why Buffett should understand what is happening.

Stuck at home, retail investors recognized trends were changing and found a way to profit. They opened brokerage accounts by the millions last year to buy the risky stocks that professional money managers avoided because they believed they were overvalued. These stocks are not in the broad market indices that popular exchange-traded funds mimic. These stocks went on to double and triple in price, with some gaining by even more. The brokers and money managers should understand.

Now it is the retail trader’s turn to take center stage. This crowd is a little different from those the retail investors highlighted above. They are like the professional trader in that they look for opportunities to game the system, hopefully legally.

As we now know, they traffic on Reddit’s WallStreetBets investing forum, which at last count had more than 7.5 million members. There is some very smart analysis in this forum, just like on Wall Street. They also have many “follow the crowd” chasers, also just like on Wall Street. They use screen names like “roaringkitty,” “stonksflyingup” and “veryforestgreen.” That is not very Wall Street-like.

As early as October last year, these and other Redditors were detailing how the “Masters of the Universe” were making an egregious error in GameStop. The number of GameStop shares that were sold short exceeded the amount available for trading, or the “float.” It was the most shorted stock on the New York Stock Exchange. They even singled out hedge fund Melvin Capital, which had shorted most of the shares, as particularly vulnerable.

A massive “squeeze” was possible, but like a good trader they waited for a catalyst. This came in the middle of last month when a surge in the buying of puts preceded a report from Citron Research recommending going short the shares of GameStop. This meant the short squeeze potential was now at its maximum. The Redditors struck with the execution rivaling any of the greatest traders in Wall Street history, and many lawyers say it all looks legal. The “masters” never saw it coming.

Selling more than 100 percent of the float of a stock is what is known as a “naked short,” or selling stock with no intention of delivering the shares. Such activity is illegal under US Securities and Exchange Commission (SEC) rules and stopping it was a principal reason the SEC was created in 1933.

As the investigation into the GameStop saga gets under way, the SEC might want to start with why it failed its own basic mission. The SEC’s job is to see these things coming and it failed.

However, even more disturbing is Wall Street itself. Plenty of smart people must have known that this big a short position put the masters in a position of vulnerability.

However, they did not believe the situation was dangerous, because it was unlikely that any large institution would take advantage of it and attempt a massive short squeeze. Self-regulation keeps the entire financial system honest, but it seems to have gone missing here and in many other corners of Wall Street.

Questions about why these masters were not called out by other masters need to be asked. Is this just “the way the game is played” on Wall Street? In other words, collusion? Rushing to bail out Melvin Capital is consistent with this idea.

The masters did not see the many thousands of retail traders banding together as a large enough force to halt their best-laid plans. As a result, a big new player with lots of money and sophistication has entered the game and is probably not going away. They are outsiders who use the masters’ own practices to change the rules and win.

So many on Wall Street and elsewhere could not, or did not, want to see this coming. They have a vested interest in the “status quo” that clouds their judgement. Many of those same people are now saying that there is elevated risk in the markets due to the rising power and participation of retail investors. The truth is that they might be looking at the wrong risks and at the wrong players.

Jim Bianco is the president and founder of Bianco Research, a provider of data-driven insights into the global economy and financial markets. He might have a stake in the areas he writes about.

This column does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners.

The US dollar was trading at NT$29.7 at 10am today on the Taipei Foreign Exchange, as the New Taiwan dollar gained NT$1.364 from the previous close last week. The NT dollar continued to rise today, after surging 3.07 percent on Friday. After opening at NT$30.91, the NT dollar gained more than NT$1 in just 15 minutes, briefly passing the NT$30 mark. Before the US Department of the Treasury's semi-annual currency report came out, expectations that the NT dollar would keep rising were already building. The NT dollar on Friday closed at NT$31.064, up by NT$0.953 — a 3.07 percent single-day gain. Today,

‘SHORT TERM’: The local currency would likely remain strong in the near term, driven by anticipated US trade pressure, capital inflows and expectations of a US Fed rate cut The US dollar is expected to fall below NT$30 in the near term, as traders anticipate increased pressure from Washington for Taiwan to allow the New Taiwan dollar to appreciate, Cathay United Bank (國泰世華銀行) chief economist Lin Chi-chao (林啟超) said. Following a sharp drop in the greenback against the NT dollar on Friday, Lin told the Central News Agency that the local currency is likely to remain strong in the short term, driven in part by market psychology surrounding anticipated US policy pressure. On Friday, the US dollar fell NT$0.953, or 3.07 percent, closing at NT$31.064 — its lowest level since Jan.

The New Taiwan dollar and Taiwanese stocks surged on signs that trade tensions between the world’s top two economies might start easing and as US tech earnings boosted the outlook of the nation’s semiconductor exports. The NT dollar strengthened as much as 3.8 percent versus the US dollar to 30.815, the biggest intraday gain since January 2011, closing at NT$31.064. The benchmark TAIEX jumped 2.73 percent to outperform the region’s equity gauges. Outlook for global trade improved after China said it is assessing possible trade talks with the US, providing a boost for the nation’s currency and shares. As the NT dollar

The Financial Supervisory Commission (FSC) yesterday met with some of the nation’s largest insurance companies as a skyrocketing New Taiwan dollar piles pressure on their hundreds of billions of dollars in US bond investments. The commission has asked some life insurance firms, among the biggest Asian holders of US debt, to discuss how the rapidly strengthening NT dollar has impacted their operations, people familiar with the matter said. The meeting took place as the NT dollar jumped as much as 5 percent yesterday, its biggest intraday gain in more than three decades. The local currency surged as exporters rushed to