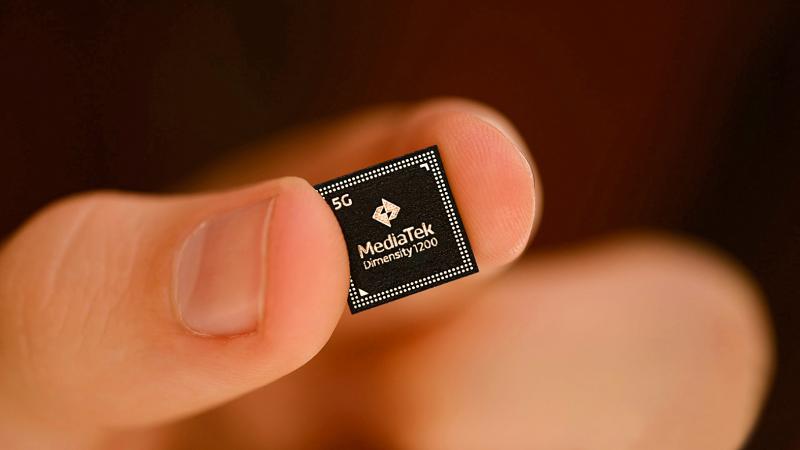

MediaTek Inc (聯發科) yesterday unveiled its premium 5G processors — the Dimensity 1200 and Dimensity 1100 — as it vies for a larger slice of the world’s rapidly growing 5G smartphone market.

Manufactured using Taiwan Semiconductor Manufacturing Co’s (台積電) 6-nanometer process technology, the Dimensity 1200 processor performs 22 percent better than the previous generation Dimensity 1000+ processor, and is 25 percent more power-efficient, MediaTek said.

Chinese smartphone brands Xiaomi Corp (小米) and Realme Mobile Telecommunications (Shenzhen) Co (銳爾覓移動通信) are to be the first adopters of the latest Dimensity chips, the companies said during a virtual media briefing.

Photo courtesy of MediaTek Inc

Xiaomi plans to equip its first flagship gaming smartphone with the new processor and release the phone later this year, said Lu Wei-ping (盧偉冰), who is in charge of Xiaomi’s Redmi family.

It was also one of the first smartphone vendors to use MediaTek’s Dimensity 1000+ in its premium phone — Redmi K30 Ultra — last year, Lu said.

The first devices equipped with the new Dimensity 1200 and 1100 processors are expected to hit the market from the end of this quarter to the beginning of next quarter, MediaTek said.

Two other Chinese brands — Vivo Communication Technology Co (維沃) and Oppo Mobile Telecommunications Corp (歐珀) — said they also intend to deepen their partnerships with MediaTek.

China is the world’s biggest 5G smartphone market, with shipments last year estimated to total nearly 130 million units, MediaTek said.

The company “continues to expand its 5G portfolio, with highly integrated solutions for a range of devices from the high-end to the mid-tier,” J.C. Hsu (徐敬全), corporate vice president and general manager of MediaTek’s wireless communications business unit, told reporters.

With a diversified product portfolio, MediaTek shipped 45 million Dimensity processors last year, Hsu said.

That meant it captured a 22.5 percent share of the world’s 5G market last year, as more than 200 million smartphones were powered by 5G processors.

“We believe the 5G market is set to deliver high-speed growth this year, more than doubling [from last year]. It is a market with plenty of growth opportunities,” Hsu said.

The Hsinchu-based company expects about 500 million phones would support 5G technology this year, as more than 200 telecoms worldwide are to deploy 5G networks this year, up from about 120 companies last year, he said.

Qualcomm Technologies Inc, a subsidiary of Qualcomm Inc, on Tuesday unveiled a new high-end 5G processor, the Snapdragon 870.

“Snapdragon 870 will power a selection of flagship devices from key customers including Motorola Inc, iQOO, OnePlus (一加), Oppo and Xiaomi,” Qualcomm said in a news release.

Commercial devices based on Snapdragon 870 are expected to be announced this quarter, the company said.

SUPPORT: The government said it would help firms deal with supply disruptions, after Trump signed orders imposing tariffs of 25 percent on imports from Canada and Mexico The government pledged to help companies with operations in Mexico, such as iPhone assembler Hon Hai Precision Industry Co (鴻海精密), also known as Foxconn Technology Group (富士康科技集團), shift production lines and investment if needed to deal with higher US tariffs. The Ministry of Economic Affairs yesterday announced measures to help local firms cope with the US tariff increases on Canada, Mexico, China and other potential areas. The ministry said that it would establish an investment and trade service center in the US to help Taiwanese firms assess the investment environment in different US states, plan supply chain relocation strategies and

Hon Hai Precision Industry Co (鴻海精密) is reportedly making another pass at Nissan Motor Co, as the Japanese automaker's tie-up with Honda Motor Co falls apart. Nissan shares rose as much as 6 percent after Taiwan’s Central News Agency reported that Hon Hai chairman Young Liu (劉揚偉) instructed former Nissan executive Jun Seki to connect with French carmaker Renault SA, which holds about 36 percent of Nissan’s stock. Hon Hai, the Taiwanese iPhone-maker also known as Foxconn Technology Group (富士康科技集團), was exploring an investment or buyout of Nissan last year, but backed off in December after the Japanese carmaker penned a deal

WASHINGTON POLICY: Tariffs of 10 percent or more and other new costs are tipped to hit shipments of small parcels, cutting export growth by 1.3 percentage points The decision by US President Donald Trump to ban Chinese companies from using a US tariff loophole would hit tens of billions of dollars of trade and reduce China’s economic growth this year, according to new estimates by economists at Nomura Holdings Inc. According to Nomura’s estimates, last year companies such as Shein (希音) and PDD Holdings Inc’s (拼多多控股) Temu shipped US$46 billion of small parcels to the US to take advantage of the rule that allows items with a declared value under US$800 to enter the US tariff-free. Tariffs of 10 percent or more and other new costs would slash such

SENSOR BUSINESS: The Taiwanese company said that a public tender offer would begin on May 7 through its wholly owned subsidiary Yageo Electronics Japan Yageo Corp (國巨), one of the world’s top three suppliers of passive components, yesterday said it is to launch a tender offer to fully acquire Japan’s Shibaura Electronics Co for up to ¥65.57 billion (US$429.37 million), with an aim to expand its sensor business. The tender offer would be a crucial step for the company to expand its sensor business, Yageo said. Shibaura Electronics is the world’s largest supplier of thermistors, with a market share of 13 percent, research conducted in 2022 by the Japanese firm showed. If a deal goes ahead, it would be the second acquisition of a sensor business since