CPC Corp, Taiwan (CPC, 台灣中油) and Formosa Petrochemical Corp (台塑石化) yesterday announced that they would increase gasoline and diesel prices for an eighth consecutive week, effective today.

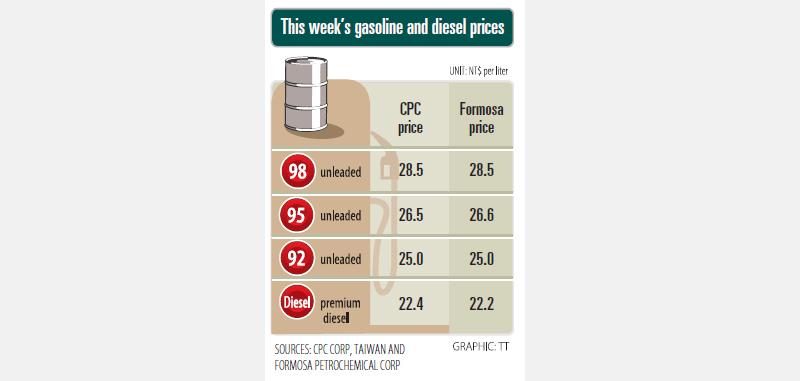

CPC said that it would raise gasoline prices by NT$0.3 per liter to NT$25, NT$26.5 and NT$28.5 for 92, 95 and 98-octane unleaded gasoline respectively, while premium diesel would increase by NT$0.1 per liter to NT$22.4.

Based on CPC’s floating oil price formula, the cost of crude oil last week increased 3.8 percent from a week earlier, after Saudi Arabia raised crude oil prices for Asian shipments next month and US commercial crude inventories dropped for a fifth consecutive week, the state-run refiner said in a statement.

Formosa said that it would also increase its prices for 92, 95 and 98-octane unleaded gasoline by NT$0.3 per liter to NT$25, NT$26.6 and NT$28.5 respectively, while premium diesel would also rise by NT$0.1 to NT$22.2 per liter.

The company attributed its price hikes to a positive market sentiment after Saudi Arabia pledged to cut more crude oil output from next month.

Oil prices were also higher last week amid hopes of additional economic aid after US president-elect Joe Biden takes office, it said.

United Microelectronics Corp (UMC, 聯電) expects its addressable market to grow by a low single-digit percentage this year, lower than the overall foundry industry’s 15 percent expansion and the global semiconductor industry’s 10 percent growth, the contract chipmaker said yesterday after reporting the worst profit in four-and-a-half years in the fourth quarter of last year. Growth would be fueled by demand for artificial intelligence (AI) servers, a moderate recovery in consumer electronics and an increase in semiconductor content, UMC said. “UMC’s goal is to outgrow our addressable market while maintaining our structural profitability,” UMC copresident Jason Wang (王石) told an online earnings

Gudeng Precision Industrial Co (家登精密), the sole extreme ultraviolet (EUV) pod supplier to Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), is aiming to expand revenue to NT$10 billion (US$304.8 million) this year, as it expects the artificial intelligence (AI) boom to drive demand for wafer delivery pods and pods used in advanced packaging technology. That suggests the firm’s revenue could grow as much as 53 percent this year, after it posted a 28.91 percent increase to NT$6.55 billion last year, exceeding its 20 percent growth target. “We usually set an aggressive target internally to drive further growth. This year, our target is to

The TAIEX ended the Year of the Dragon yesterday up about 30 percent, led by contract chipmaker Taiwan Semiconductor Manufacturing Co (TSMC, 台積電). The benchmark index closed up 225.40 points, or 0.97 percent, at 23,525.41 on the last trading session of the Year of the Dragon before the Lunar New Year holiday ushers in the Year of the Snake. During the Year of the Dragon, the TAIEX rose 5,429.34 points, the highest ever, while the 30 percent increase in the year was the second-highest behind only a 30.84 percent gain in the Year of the Rat from Jan. 25, 2020, to Feb.

Cryptocurrencies gave a lukewarm reception to US President Donald Trump’s first policy moves on digital assets, notching small gains after he commissioned a report on regulation and a crypto reserve. Bitcoin has been broadly steady since Trump took office on Monday and was trading at about US$105,000 yesterday as some of the euphoria around a hoped-for revolution in cryptocurrency regulation ebbed. Smaller cryptocurrency ether has likewise had a fairly steady week, although was up 5 percent in the Asia day to US$3,420. Bitcoin had been one of the most spectacular “Trump trades” in financial markets, gaining 50 percent to break above US$100,000 and