HTC Corp (宏達電) chairwoman and CEO Cher Wang (王雪紅) yesterday said that the company is planning to roll out more 5G mobile phones and virtual-reality (VR) devices next year.

“Prepare to be amazed,” Wang told reporters, referring to the upcoming VR product releases.

HTC launched its first 5G smartphone, code-named HTC U20 5G, in September, giving a boost to its revenue.

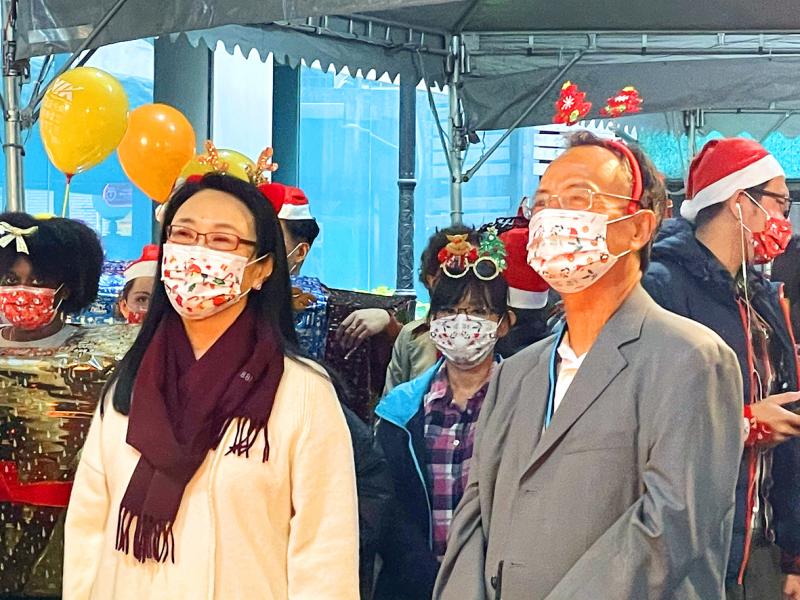

Photo: Grace Hung, Taipei Times

Wang was speaking to reporters at the Christmas concert of VIA Technologies Inc (威盛電子), a chip designer cofounded by Wang.

“The advancement of 5G would be beneficial to HTC, and we have leveled up our VR technology,” she said.

“All this would be positive for the company’s revenue,” she added.

VIA Technologies subsidiary VIA Labs Inc (威鋒電子) yesterday launched its initial public offering (IPO) on the Taiwan Stock Exchange.

The stock surged 60.12 percent to close at NT$269, compared with its listing price of NT$168. VIA Labs designs controllers used in USB and USB Type-C products.

Wang declined to speak about the IPO.

Her husband, Chen Wen-chi (陳文琦), the chairman of VIA Technologies, said: “We’ll work hard to do what needs to be done.”

VIA Technologies and HTC were hugely successful before cratering in value in recent years.

All eyes are on VIA Labs to see if the power couple could create yet another “stock market champion.”

HTC shares were unchanged at NT$30.35 yesterday.

HTC and VIA Technologies have suspended their year-end parties after Taiwan on Tuesday reported its first domestic COVID-19 transmission since April.

PROTECTION: The investigation, which takes aim at exporters such as Canada, Germany and Brazil, came days after Trump unveiled tariff hikes on steel and aluminum products US President Donald Trump on Saturday ordered a probe into potential tariffs on lumber imports — a move threatening to stoke trade tensions — while also pushing for a domestic supply boost. Trump signed an executive order instructing US Secretary of Commerce Howard Lutnick to begin an investigation “to determine the effects on the national security of imports of timber, lumber and their derivative products.” The study might result in new tariffs being imposed, which would pile on top of existing levies. The investigation takes aim at exporters like Canada, Germany and Brazil, with White House officials earlier accusing these economies of

Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) would not produce its most advanced technologies in the US next year, Minister of Economic Affairs J.W. Kuo (郭智輝) said yesterday. Kuo made the comment during an appearance at the legislature, hours after the chipmaker announced that it would invest an additional US$100 billion to expand its manufacturing operations in the US. Asked by Taiwan People’s Party Legislator-at-large Chang Chi-kai (張啟楷) if TSMC would allow its most advanced technologies, the yet-to-be-released 2-nanometer and 1.6-nanometer processes, to go to the US in the near term, Kuo denied it. TSMC recently opened its first US factory, which produces 4-nanometer

Teleperformance SE, the largest call-center operator in the world, is rolling out an artificial intelligence (AI) system that softens English-speaking Indian workers’ accents in real time in a move the company claims would make them more understandable. The technology, called accent translation, coupled with background noise cancelation, is being deployed in call centers in India, where workers provide customer support to some of Teleperformance’s international clients. The company provides outsourced customer support and content moderation to global companies including Apple Inc, ByteDance Ltd’s (字節跳動) TikTok and Samsung Electronics Co Ltd. “When you have an Indian agent on the line, sometimes it’s hard

‘SACRED MOUNTAIN’: The chipmaker can form joint ventures abroad, except in China, but like other firms, it needs government approval for large investments Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) needs government permission for any overseas joint ventures (JVs), but there are no restrictions on making the most advanced chips overseas other than for China, Minister of Economic Affairs J.W. Kuo (郭智輝) said yesterday. US media have said that TSMC, the world’s largest contract chipmaker and a major supplier to companies such as Apple Inc and Nvidia Corp, has been in talks for a stake in Intel Corp. Neither company has confirmed the talks, but US President Donald Trump has accused Taiwan of taking away the US’ semiconductor business and said he wants the industry back