The TAIEX yesterday took a beating, tumbling more than 200 points, with large-cap stocks in focus, as Taiwan reported its first locally transmitted case of COVID-19 in 253 days.

Heavy selling emerged across the board in the late session, in particular in the bellwether electronics sector, and pushed the TAIEX below 14,200 points by the end of trading, dealers said.

“The first indigenous COVID-19 case since April 12 struck a nerve with many investors,” Cathay Futures Consultant Co (國泰證期顧問) analyst Tsai Ming-han (蔡明翰) said. “Moreover, the escalation in the number of infections in the UK has made the market more concerned.”

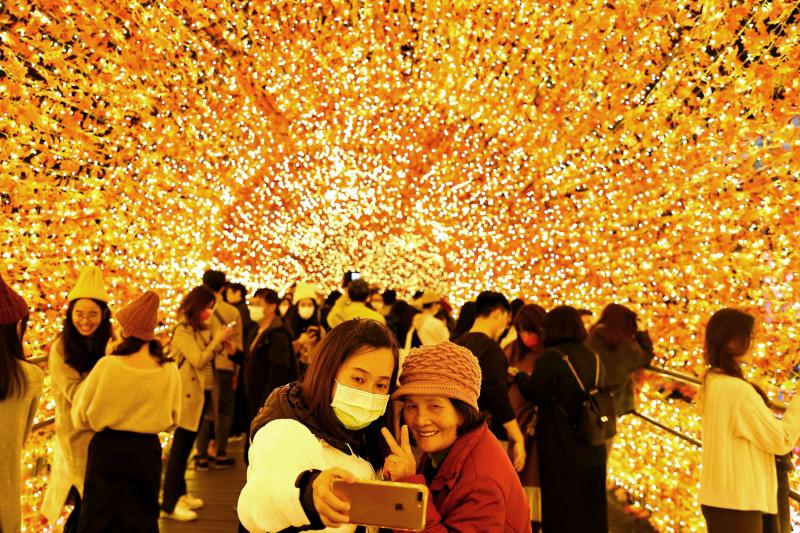

Photo: Ann Wang, Reuters

The TAIEX ended down 207.50 points, or 1.44 percent, at 14,177.46, on turnover of NT$288.247 billion (US$10.098 billion), compared with NT$250.02 billion the previous session.

Foreign institutional investors sold a net NT$9.99 billion of shares on the main board.

“Today’s expanded turnover was evidence of panic selling, in particular in the late trading session,” Tsai said. “It is possible that the US markets will head south tonight, so investors in the region simply cut their holdings now to avoid more losses on Wednesday [today].”

The electronics sector declined 1.49 percent.

“After the sector’s recent strong gains, investors simply seized on virus fears to take profits,” Tsai said.

Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) fell 1.36 percent to close at the day’s low of NT$509. Led by TSMC, the semiconductor sub-index ended down 1.57 percent.

Quanta Computer Inc (廣達電腦) ended down 1.51 percent at NT$78.3, after the company said that the latest domestic COVID-19 case involved an employee from its affiliate firm.

“It appears that the situation in Europe has been severe after the UK reported a new virus variant, prompting many investors to worry about the economy,” Tsai said.

Such worries plunged international crude oil futures contracts by 2.77 percent in New York and 2.89 percent in London.

In the wake of the falling crude prices, petrochemical stocks came under pressure, but COVID-19 fears boosted biotech stocks, dealers said.

Among them, drug brand Sinphar Pharmaceutical Co Ltd (杏輝藥品) soared 10 percent, the maximum daily amount, to close at NT$32.75, while vaccine developer Adimmune Corp (國光生技) rose 6.73 percent to end at NT$60.3 and fast test kit maker Panion & BF Biotech Inc (寶齡富錦) increased 5.46 percent to end at NT$88.9.

“The bright spot is that some countries have started to administer vaccines against COVID-19 and the US has passed a new round of stimulus measures, so I think the TAIEX will see technical support at about 14,116 points, the 20-day moving average,” Tsai said.

Intel Corp chief executive officer Lip-Bu Tan (陳立武) is expected to meet with Taiwanese suppliers next month in conjunction with the opening of the Computex Taipei trade show, supply chain sources said on Monday. The visit, the first for Tan to Taiwan since assuming his new post last month, would be aimed at enhancing Intel’s ties with suppliers in Taiwan as he attempts to help turn around the struggling US chipmaker, the sources said. Tan is to hold a banquet to celebrate Intel’s 40-year presence in Taiwan before Computex opens on May 20 and invite dozens of Taiwanese suppliers to exchange views

Application-specific integrated circuit designer Faraday Technology Corp (智原) yesterday said that although revenue this quarter would decline 30 percent from last quarter, it retained its full-year forecast of revenue growth of 100 percent. The company attributed the quarterly drop to a slowdown in customers’ production of chips using Faraday’s advanced packaging technology. The company is still confident about its revenue growth this year, given its strong “design-win” — or the projects it won to help customers design their chips, Faraday president Steve Wang (王國雍) told an online earnings conference. “The design-win this year is better than we expected. We believe we will win

Chizuko Kimura has become the first female sushi chef in the world to win a Michelin star, fulfilling a promise she made to her dying husband to continue his legacy. The 54-year-old Japanese chef regained the Michelin star her late husband, Shunei Kimura, won three years ago for their Sushi Shunei restaurant in Paris. For Shunei Kimura, the star was a dream come true. However, the joy was short-lived. He died from cancer just three months later in June 2022. He was 65. The following year, the restaurant in the heart of Montmartre lost its star rating. Chizuko Kimura insisted that the new star is still down

While China’s leaders use their economic and political might to fight US President Donald Trump’s trade war “to the end,” its army of social media soldiers are embarking on a more humorous campaign online. Trump’s tariff blitz has seen Washington and Beijing impose eye-watering duties on imports from the other, fanning a standoff between the economic superpowers that has sparked global recession fears and sent markets into a tailspin. Trump says his policy is a response to years of being “ripped off” by other countries and aims to bring manufacturing to the US, forcing companies to employ US workers. However, China’s online warriors