The central bank yesterday denied acting to unfairly boost Taiwan’s exports, as it attributed the nation’s widening trade surpluses with the US to the fallout from US-China trade tensions.

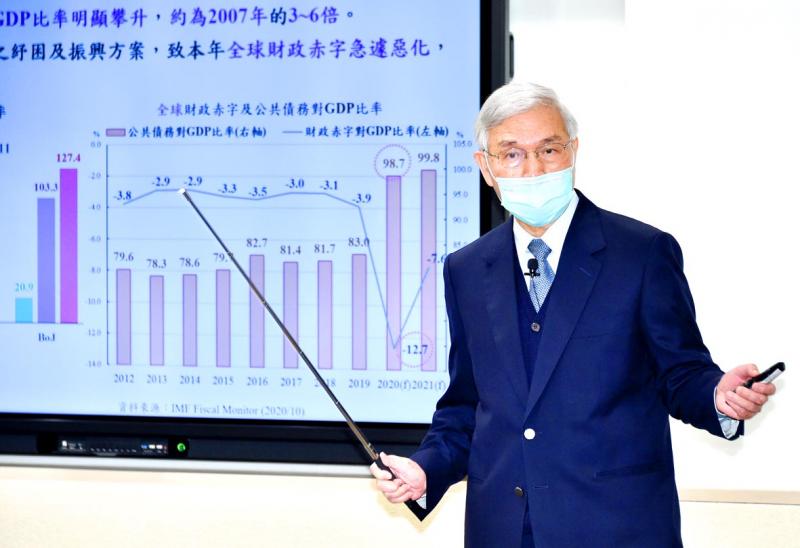

Central bank Governor Yang Chin-long (楊金龍) made the statement after the bank left its policy rediscount rate unchanged at the record low 1.125 percent saying that Taiwan cannot buck the global trend of monetary easing, given its small and open economy.

“Taiwan’s interest comes first when the central bank carries out its duty,” Yang told a news conference in Taipei, one day after the US Department of the Treasury placed Taiwan on its watch list for currency manipulation.

Photo: Tu Chien-jung, Taipei Times

Taiwan could be labeled a currency manipulator in April if its current account surpluses escalate and the central bank’s intervention exceeds 2 percent of the GDP.

However, Yang said it was difficult, if not impossible, to define currency manipulation, and the US watch list is designed to prevent attempts by trade partners to engage in unfair competition through weakening their currency.

The bank would explain how it moderates the foreign exchange market during a briefing to the legislature in the spring, he said.

“We will make known details of the operation and the amount involved,” Yang said.

The US had exaggerated the sum in its report, based on external projections, while the central bank’s figures would be based on facts, he said.

Taiwan has seen massive fund inflows because of US-China trade tensions and global monetary easing, forcing the central bank to step in to slow their effects, Yang said.

Taiwanese firms have moved manufacturing facilities home from China to circumvent punitive tariffs on Chinese goods and the decoupling of US-China trade ties has allowed them to benefit from order transfers, he said.

That helped explain Taiwan’s strong exports and sharpening current account surpluses, he said.

Ongoing global quantitative easing, three to six times the size during the global financial crisis, has driven excessive funds worldwide — including Taiwan — pushing up the New Taiwan dollar and asset prices noticeably, Yang said.

The central bank has no choice but to intervene in times of massive fund inflows, as on Nov. 30 when MSCI weighting adjustments took place, the governor said.

The central bank would try to understand the US’ reasoning for its actions, but it has to give top priority to Taiwan’s currency and financial market stability, Yang said, adding that the US quantitative policy has eased the central bank’s headache.

The bank raised its forecast for Taiwan’s GDP growth for this year from 1.6 percent to 2.58 percent and expects the expansion to reach 3.68 percent next year, due to better-than-expected exports.

Private consumption would replace exports as the main growth driver next year, it said.

Yang dismissed interest rate hikes as imprudent measures to rein in housing prices, saying that tightening loan-to-value ratios is a better policy tool because it would not affect the economy.

Taiwan’s rapidly aging population is fueling a sharp increase in homes occupied solely by elderly people, a trend that is reshaping the nation’s housing market and social fabric, real-estate brokers said yesterday. About 850,000 residences were occupied by elderly people in the first quarter, including 655,000 that housed only one resident, the Ministry of the Interior said. The figures have nearly doubled from a decade earlier, Great Home Realty Co (大家房屋) said, as people aged 65 and older now make up 20.8 percent of the population. “The so-called silver tsunami represents more than just a demographic shift — it could fundamentally redefine the

The US government on Wednesday sanctioned more than two dozen companies in China, Turkey and the United Arab Emirates, including offshoots of a US chip firm, accusing the businesses of providing illicit support to Iran’s military or proxies. The US Department of Commerce included two subsidiaries of US-based chip distributor Arrow Electronics Inc (艾睿電子) on its so-called entity list published on the federal register for facilitating purchases by Iran’s proxies of US tech. Arrow spokesman John Hourigan said that the subsidiaries have been operating in full compliance with US export control regulations and his company is discussing with the US Bureau of

Businesses across the global semiconductor supply chain are bracing themselves for disruptions from an escalating trade war, after China imposed curbs on rare earth mineral exports and the US responded with additional tariffs and restrictions on software sales to the Asian nation. China’s restrictions, the most targeted move yet to limit supplies of rare earth materials, represent the first major attempt by Beijing to exercise long-arm jurisdiction over foreign companies to target the semiconductor industry, threatening to stall the chips powering the artificial intelligence (AI) boom. They prompted US President Donald Trump on Friday to announce that he would impose an additional

China Airlines Ltd (CAL, 中華航空) said it expects peak season effects in the fourth quarter to continue to boost demand for passenger flights and cargo services, after reporting its second-highest-ever September sales on Monday. The carrier said it posted NT$15.88 billion (US$517 million) in consolidated sales last month, trailing only September last year’s NT$16.01 billion. Last month, CAL generated NT$8.77 billion from its passenger flights and NT$5.37 billion from cargo services, it said. In the first nine months of this year, the carrier posted NT$154.93 billion in cumulative sales, up 2.62 percent from a year earlier, marking the second-highest level for the January-September