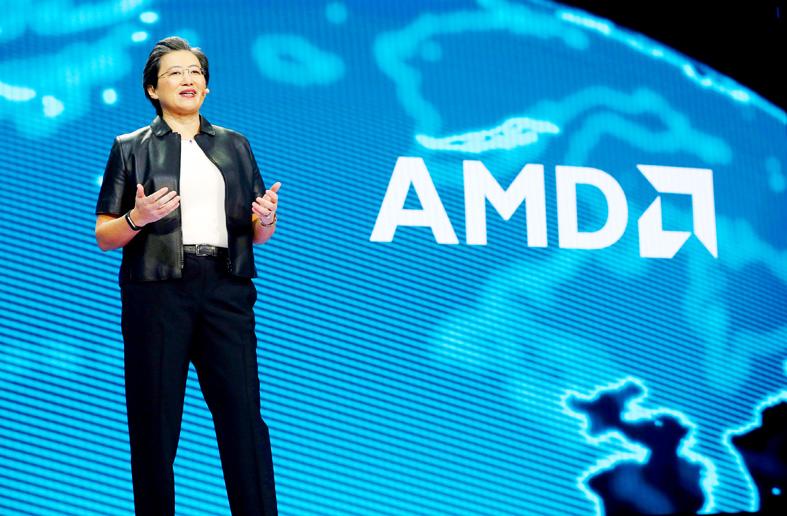

Advanced Micro Devices Inc (AMD) CEO Lisa Su (蘇姿丰) spent her first six years at the helm turning around the troubled chipmaker. She slashed debt, and oversaw products that launched on time and performed as advertised.

Now she is moving beyond cleanup to challenge Intel Corp for the lead in computer chips.

The 51-year-old engineer — among the few female CEOs in technology — on Tuesday unveiled a US$35 billion all-stock acquisition of Xilinx Inc, one of the largest chip deals ever.

Photo: Reuters

In interviews and conference calls, Su said that there are few limits to her ambition.

“We have an even bigger place in the industry over the next five years than we’ve had in the last five,” she said.

Since taking over in 2014, Su has erased AMD’s reputation as an accident-prone supplier of cheap processors struggling to survive in Intel’s shadow — something her predecessors failed to do.

Buying Xilinx, a maker of programmable silicon, would take AMD into new areas such as automotive and communications networking, while bolstering its offerings in the lucrative market for cloud data center components, analysts said.

If the transaction closes next year as planned, the company’s annual research-and-development budget would jump to more than US$2.7 billion, they added.

That is still small compared with Intel’s budget, but it is a crucial ingredient if AMD is to seriously challenge the industry’s leaders.

Born in Taiwan, Su graduated from the Bronx High School of Science in New York City and got her doctorate from the Massachusetts Institute of Technology. She worked at companies including Texas Instruments Inc and International Business Machines Corp, and in 2012 arrived at AMD as a senior vice president.

An early success was getting AMD chips in the dominant gaming consoles, Microsoft Corp’s Xbox One and Sony Corp’s PlayStation. Most of her progress has come from a methodical focus on meeting customer demands — a stark contrast to former AMD CEOs who were known for splashy product launches that often did not deliver.

While she has been involved in chip industry innovation, Su dislikes portrayals of her as a lab-bound technical genius, describing herself as an OK engineer, and saying that one of her main skills is the ability to understand engineers and help them make the best high-level decisions, not do the work for them.

In her usual practical fashion, she presented the Xilinx deal to investors as a transaction that would improve AMD’s finances first and then transition the combined company to future technical leadership.

“I haven’t talked a lot about M&A [mergers and acquisitions] because I didn’t think there was a need to do M&A for M&A’s sake,” she said. “This is about what’s the next step for AMD and Xilinx is the best franchise in the industry.”

Su wants her company to be more than just another supplier of components. She sees Xilinx helping AMD set the industry’s agenda by defining new technology, something that has mostly been the preserve of Intel in computing for half a century.

Getting to this position has not been easy. When Su took the top job, she was AMD’s fourth CEO in a decade. The company had lost money in six of those 10 years as products either launched late, performed below expectations or had to be fixed later.

One of her biggest decisions in 2018 has helped Su keep her promises and set the stage for AMD’s next chapter. The company outsourced production of its best chips to Taiwan Semiconductor Manufacturing Co (TSMC, 台積電). Soon after, TSMC overtook Intel in production technology. Now AMD’s processors are often as capable as Intel’s — sometimes better. When she announced the Xilinx agreement, Su was careful to point out that her acquisition target also relies on TSMC’s production prowess.

Intel is going through an unprecedented series of stumbles with its once peerless manufacturing. It has only just started shipping large numbers of 10-nanometer chips, more than three years late. AMD and its customers are already enjoying the benefits — price, performance and power efficiency — of more advanced 7-nanometer manufacturing.

That type of technical leadership helped persuade Xilinx CEO Victor Peng (彭明博) to join Su.

“We had a great path as a standalone company,” said Peng, who is to become AMD president and continue to run the Xilinx business. “We looked at the landscape and we thought about this carefully. This is about choosing to be part of an even greater company — which is AMD.”

MULTIFACETED: A task force has analyzed possible scenarios and created responses to assist domestic industries in dealing with US tariffs, the economics minister said The Executive Yuan is tomorrow to announce countermeasures to US President Donald Trump’s planned reciprocal tariffs, although the details of the plan would not be made public until Monday next week, Minister of Economic Affairs J.W. Kuo (郭智輝) said yesterday. The Cabinet established an economic and trade task force in November last year to deal with US trade and tariff related issues, Kuo told reporters outside the legislature in Taipei. The task force has been analyzing and evaluating all kinds of scenarios to identify suitable responses and determine how best to assist domestic industries in managing the effects of Trump’s tariffs, he

TIGHT-LIPPED: UMC said it had no merger plans at the moment, after Nikkei Asia reported that the firm and GlobalFoundries were considering restarting merger talks United Microelectronics Corp (UMC, 聯電), the world’s No. 4 contract chipmaker, yesterday launched a new US$5 billion 12-inch chip factory in Singapore as part of its latest effort to diversify its manufacturing footprint amid growing geopolitical risks. The new factory, adjacent to UMC’s existing Singapore fab in the Pasir Res Wafer Fab Park, is scheduled to enter volume production next year, utilizing mature 22-nanometer and 28-nanometer process technologies, UMC said in a statement. The company plans to invest US$5 billion during the first phase of the new fab, which would have an installed capacity of 30,000 12-inch wafers per month, it said. The

Taiwan’s official purchasing managers’ index (PMI) last month rose 0.2 percentage points to 54.2, in a second consecutive month of expansion, thanks to front-loading demand intended to avoid potential US tariff hikes, the Chung-Hua Institution for Economic Research (CIER, 中華經濟研究院) said yesterday. While short-term demand appeared robust, uncertainties rose due to US President Donald Trump’s unpredictable trade policy, CIER president Lien Hsien-ming (連賢明) told a news conference in Taipei. Taiwan’s economy this year would be characterized by high-level fluctuations and the volatility would be wilder than most expect, Lien said Demand for electronics, particularly semiconductors, continues to benefit from US technology giants’ effort

‘SWASTICAR’: Tesla CEO Elon Musk’s close association with Donald Trump has prompted opponents to brand him a ‘Nazi’ and resulted in a dramatic drop in sales Demonstrators descended on Tesla Inc dealerships across the US, and in Europe and Canada on Saturday to protest company chief Elon Musk, who has amassed extraordinary power as a top adviser to US President Donald Trump. Waving signs with messages such as “Musk is stealing our money” and “Reclaim our country,” the protests largely took place peacefully following fiery episodes of vandalism on Tesla vehicles, dealerships and other facilities in recent weeks that US officials have denounced as terrorism. Hundreds rallied on Saturday outside the Tesla dealership in Manhattan. Some blasted Musk, the world’s richest man, while others demanded the shuttering of his