HSBC Bank Taiwan Ltd (匯豐台灣商銀) is committed to enhancing corporate social responsibility by cutting carbon emissions, boosting sustainable financing and conducting projects that result in positive social impacts such as wild bird protection, the bank said in an interview in Taipei on Friday.

The bank aims to reduce its carbon emissions as its parent company, HSBC Holdings PLC, earlier this month said it targets to reduce emissions in its daily operations and supply chains to net zero by 2030, as well as net zero emissions of its portfolio of customers by 2050, it said.

HSBC Taiwan has adopted measures to make its branches and offices eco-friendly and cut their power consumption, such as installing automatic sensors that turn off lights when there is enough daylight and after business hours, HSBC Taiwan corporate sustainability head Ruth Lee (李清如) said.

Photo: Kao Shih-ching, Taipei Times

The measures helped the lender reduce its annual carbon emissions per employee to 1.8 tonnes last year, ahead of the parent company’s goal to reduce annual emissions per employee to 2 tonnes by the end of this year from 3.5 tonnes in 2011, Lee said.

HSBC Taiwan is considering to use more renewable energy sources to further improve its carbon footprint, although it still needs to talk to the landlords of its offices and persuade them to purchase green energy, Lee said.

Another option is buying renewable energy certificates, she said.

HSBC Taiwan would continue granting loans to local renewable energy developers such as wind or solar power developers, as well as providing financing to companies in other sectors to help them reduce carbon emissions, the bank’s chief risk officer Angus Tsang (曾德誼) said.

“While risk assessment for sustainable financing takes a similar approach as that for regular corporate loans, we provide our clients who apply for sustainable financing special financial incentives such as lower interest rates if they meet their target emission improvement,” Tsang said.

HSBC Holdings said it aims to provide US$750 billion to US$1 trillion by 2030 to customers to help them become more sustainable.

Meanwhile, the bank would continue supporting the protection of wild birds, and the conservation of wetlands and biological habitat in Taipei’s Guandu Nature Park (關渡自然公園), not only through funding, but also through its staff’s volunteer efforts, Lee said, adding that employees have thus far clocked 31,050 volunteer hours at the park.

The bank also conducts other projects such as boosting financial education in rural areas, Lee said.

It allows staff to take two days paid leave per year for volunteering, she said, adding that only 22 percent of employees last year took the leave, as most of them preferred participating in the company’s volunteer activities on weekends or during their regular leave.

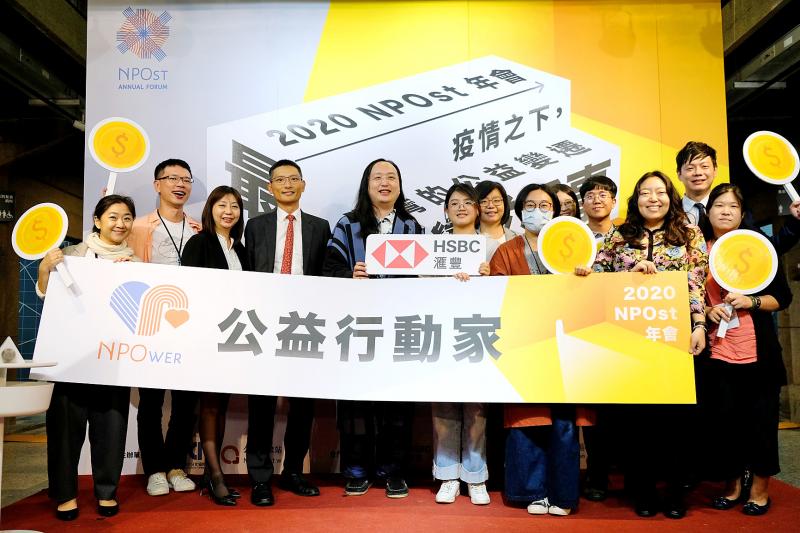

HSBC Taiwan works with NPOst, a charity-focused platform launched by the Association of Digital Culture, Taiwan, a non-profit organization, and would provide financial support for social actors to help those affected by the COVID-19 pandemic, the bank said.

Hon Hai Precision Industry Co (鴻海精密) yesterday said that its research institute has launched its first advanced artificial intelligence (AI) large language model (LLM) using traditional Chinese, with technology assistance from Nvidia Corp. Hon Hai, also known as Foxconn Technology Group (富士康科技集團), said the LLM, FoxBrain, is expected to improve its data analysis capabilities for smart manufacturing, and electric vehicle and smart city development. An LLM is a type of AI trained on vast amounts of text data and uses deep learning techniques, particularly neural networks, to process and generate language. They are essential for building and improving AI-powered servers. Nvidia provided assistance

GREAT SUCCESS: Republican Senator Todd Young expressed surprise at Trump’s comments and said he expects the administration to keep the program running US lawmakers who helped secure billions of dollars in subsidies for domestic semiconductor manufacturing rejected US President Donald Trump’s call to revoke the 2022 CHIPS and Science Act, signaling that any repeal effort in the US Congress would fall short. US Senate Minority Leader Chuck Schumer, who negotiated the law, on Wednesday said that Trump’s demand would fail, while a top Republican proponent, US Senator Todd Young, expressed surprise at the president’s comments and said he expects the administration to keep the program running. The CHIPS Act is “essential for America leading the world in tech, leading the world in AI [artificial

DOMESTIC SUPPLY: The probe comes as Donald Trump has called for the repeal of the US$52.7 billion CHIPS and Science Act, which the US Congress passed in 2022 The Office of the US Trade Representative is to hold a hearing tomorrow into older Chinese-made “legacy” semiconductors that could heap more US tariffs on chips from China that power everyday goods from cars to washing machines to telecoms equipment. The probe, which began during former US president Joe Biden’s tenure in December last year, aims to protect US and other semiconductor producers from China’s massive state-driven buildup of domestic chip supply. A 50 percent US tariff on Chinese semiconductors began on Jan. 1. Legacy chips use older manufacturing processes introduced more than a decade ago and are often far simpler than

Gasoline and diesel prices this week are to decrease NT$0.5 and NT$1 per liter respectively as international crude prices continued to fall last week, CPC Corp, Taiwan (CPC, 台灣中油) and Formosa Petrochemical Corp (台塑石化) said yesterday. Effective today, gasoline prices at CPC and Formosa stations are to decrease to NT$29.2, NT$30.7 and NT$32.7 per liter for 92, 95 and 98-octane unleaded gasoline respectively, while premium diesel is to cost NT$27.9 per liter at CPC stations and NT$27.7 at Formosa pumps, the companies said in separate statements. Global crude oil prices dropped last week after the eight OPEC+ members said they would