The NASDAQ Composite closed lower on Friday, although well above its session low as selling eased late in the day after investors dumped heavyweight technology stocks due to concerns about high valuations and a patchy economic recovery.

The major indices regained some ground in late afternoon, although trading was still volatile.

At its lowest point of the day the tech-heavy NASDAQ fell as much as 9.9 percent from its record high reached on Wednesday and the S&P 500 dipped briefly below its pre-crisis record, reached in February, although it too closed well off session lows.

Mega-cap companies, such as Apple Inc Microsoft Inc, Amazon.com Inc and Facebook Inc, also pared losses, although of that group only Apple managed a very tiny gain for the day.

“You had a significant selloff on Thursday, some follow-through in the morning and then we stabilized. The selling was pretty fierce,” said Michael Antonelli, market strategist at Robert W. Baird & Co in Milwaukee.

“Corrections like this have been quick and severe lately. We don’t know if its over,” he said. “The fact we stabilized today could be a good sign.”

While Thursday’s selloff already reflected investor fears that valuations for the NASDAQ high-fliers had overheated, the worries were exacerbated on Friday by the Financial Times (FT) and others reporting that options trading by Japan’s Softbank Group Corp had inflated these stocks.

“We’ve started to see signs of weakness in the last few days, notably yesterday. Then you get a headline like the FT story. That really adds fuel to the fire on the downside,” said Jeffrey Kleintop, chief global investment strategist at Charles Schwab Corp in Boston.

The NASDAQ had powered the stock market’s stellar recovery from the pandemic-led crash, climbing as much as 82 percent from March lows.

The benchmark S&P 500 and the Dow Jones Industrial Average had surged about 60 percent from their troughs.

Earlier on Friday, the US Department of Labor’s closely watched employment report showed that the unemployment rate last month improved to 8.4 percent from 10.2 percent in July, better than analysts had anticipated. However, non-farm payrolls increased less than expected.

Kleintop said that the jobs news did little to help the progress of stalled talks for a fresh COVID-19 stimulus package among sharply divided lawmakers in Washington.

“It wasn’t wonderful enough to get the market excited enough that we don’t need any more stimulus. On the other hand it wasn’t weak enough to bring the two sides in Washington together to extend that stimulus package,” he said.

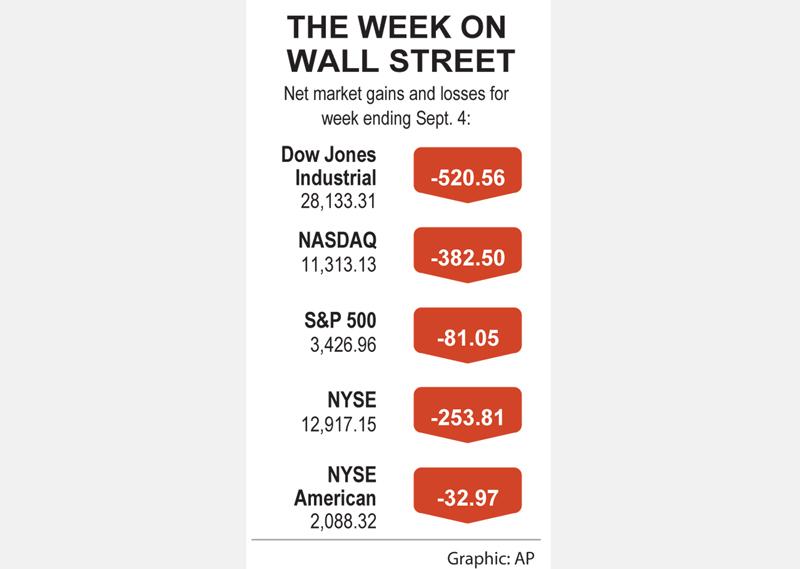

The Dow Jones Industrial Average on Friday fell 159.42 points, or 0.56 percent, to close at 28,133.31, the S&P 500 lost 28.1 points, or 0.81 percent, to 3,426.96 and the NASDAQ Composite dropped 144.97 points, or 1.27 percent, to 11,313.13.

The communication services, consumer discretionary and technology indexes posted the day’s steepest percentage declines among the 11 major S&P sectors.

Only three S&P sectors ended the day higher, including financials, which was powered by a 2.2 percent gain in its bank sub-sector index.

Also, the S&P 1500 airlines sub-index rose 1.85 percent for the day.

For the week, the S&P 500 fell 2.31 percent after five consecutive weeks of gains. The Dow dropped 1.82 percent and the NASDAQ lost 3.27 percent, and clocked its biggest two-day drop since March 17 between Thursday and Friday.

Some fund managers have warned that the declines could be a preview of a rocky two months ahead of the Nov. 3 US presidential election, as institutional investors return from summer vacations and also refocus on potential economic pitfalls.

Wall Street’s fear gauge, after hitting a more than 11-week high in late morning trading, ended the day lower.

Broadcom Inc gained 3 percent after the Apple supplier forecast fourth-quarter revenue above analysts’ estimates.

Declining issues outnumbered advancing ones on the New York Stock Exchange by a 1.53-to-1 ratio; on NASDAQ, a 1.63-to-1 ratio favored decliners.

The S&P 500 posted no new 52-week highs and 1 new low; the NASDAQ Composite recorded 21 new highs and 88 new lows.

On US exchanges 11.31 billion shares changed hands, compared with the 9.29 billion average for the past 20 sessions.

TAKING STOCK: A Taiwanese cookware firm in Vietnam urged customers to assess inventory or place orders early so shipments can reach the US while tariffs are paused Taiwanese businesses in Vietnam are exploring alternatives after the White House imposed a 46 percent import duty on Vietnamese goods, following US President Donald Trump’s announcement of “reciprocal” tariffs on the US’ trading partners. Lo Shih-liang (羅世良), chairman of Brico Industry Co (裕茂工業), a Taiwanese company that manufactures cast iron cookware and stove components in Vietnam, said that more than 40 percent of his business was tied to the US market, describing the constant US policy shifts as an emotional roller coaster. “I work during the day and stay up all night watching the news. I’ve been following US news until 3am

UNCERTAINTY: Innolux activated a stringent supply chain management mechanism, as it did during the COVID-19 pandemic, to ensure optimal inventory levels for customers Flat-panel display makers AUO Corp (友達) and Innolux Corp (群創) yesterday said that about 12 to 20 percent of their display business is at risk of potential US tariffs and that they would relocate production or shipment destinations to mitigate the levies’ effects. US tariffs would have a direct impact of US$200 million on AUO’s revenue, company chairman Paul Peng (彭雙浪) told reporters on the sidelines of the Touch Taiwan trade show in Taipei yesterday. That would make up about 12 percent of the company’s overall revenue. To cope with the tariff uncertainty, AUO plans to allocate its production to manufacturing facilities in

Six years ago, LVMH’s billionaire CEO Bernard Arnault and US President Donald Trump cut the blue ribbon on a factory in rural Texas that would make designer handbags for Louis Vuitton, one of the world’s best-known luxury brands. However, since the high-profile opening, the factory has faced a host of problems limiting production, 11 former Louis Vuitton employees said. The site has consistently ranked among the worst-performing for Louis Vuitton globally, “significantly” underperforming other facilities, said three former Louis Vuitton workers and a senior industry source, who cited internal rankings shared with staff. The plant’s problems — which have not

COLLABORATION: Given Taiwan’s key position in global supply chains, the US firm is discussing strategies with local partners and clients to deal with global uncertainties Advanced Micro Devices Inc (AMD) yesterday said it is meeting with local ecosystem partners, including Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), to discuss strategies, including long-term manufacturing, to navigate uncertainties such as US tariffs, as Taiwan occupies an important position in global supply chains. AMD chief executive officer Lisa Su (蘇姿丰) told reporters that Taiwan is an important part of the chip designer’s ecosystem and she is discussing with partners and customers in Taiwan to forge strong collaborations on different areas during this critical period. AMD has just become the first artificial-intelligence (AI) server chip customer of TSMC to utilize its advanced