Softbank Group Corp plans to keep a stake in the chip designer Arm Ltd, even if it sells a partial interest to Nvidia Corp, the Nikkei reported.

The companies are negotiating terms, the newspaper reported, citing sources.

Softbank might take a stake in Nvidia after it buys Arm, the report said.

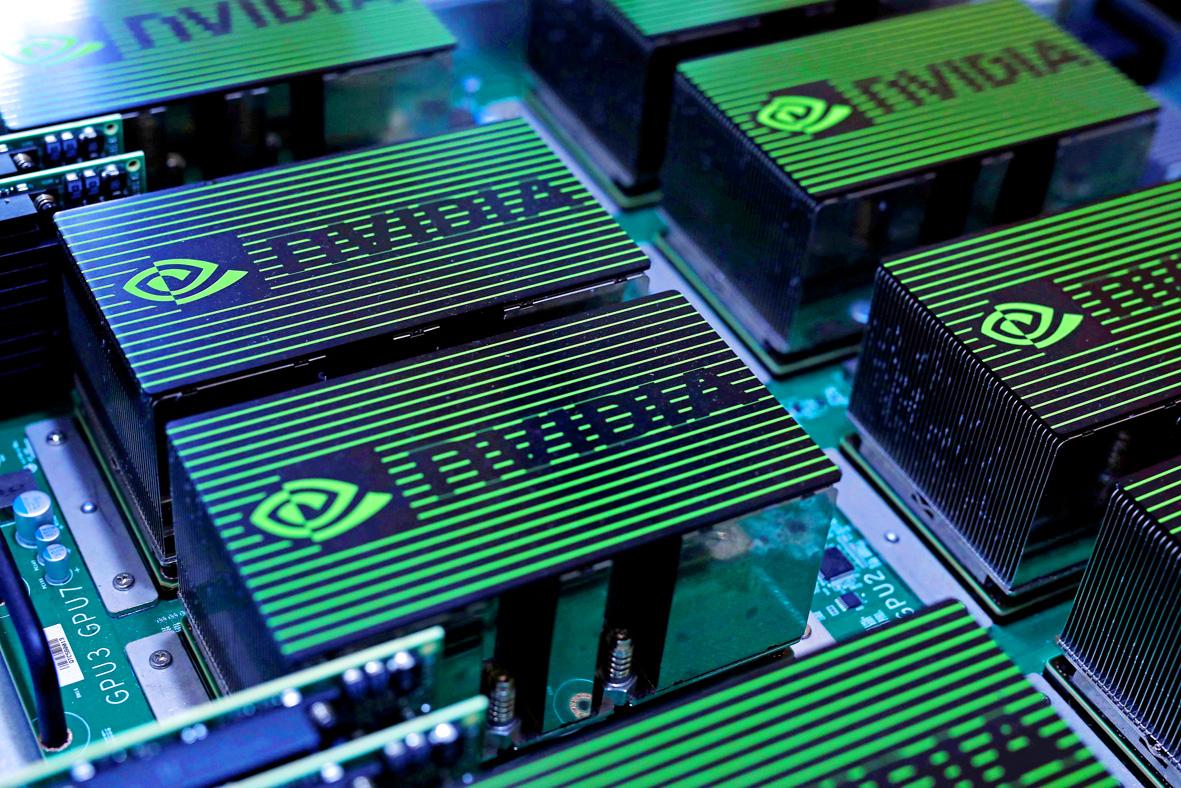

Photo: Reuters

Nvidia and Arm might also merge through a share swap, and Softbank would become a major shareholder in the combined company, it said.

The two parties aim to reach a deal in the next few weeks, the sources said, asking not to be identified because the information is private.

Nvidia is the only suitor in concrete discussions with Softbank, the sources said.

A deal for Arm could be the largest ever in the semiconductor industry, which has been consolidating in the past few years as companies seek to diversify and add scale.

However, any deal with Nvidia, which is a customer of Arm, would likely trigger regulatory scrutiny, as well as a wave of opposition from other users.

Cambridge, England-based Arm’s technology underpins chips that are crucial to most modern electronics, including those that dominate the smartphone market, an area in which Nvidia has failed to gain a foothold.

Customers including Apple Inc, Qualcomm Inc, Advanced Micro Devices Inc (AMD) and Intel Corp could demand assurances that a new owner would continue providing equal access to Arm’s instruction set.

Such concerns resulted in Softbank, a neutral company, buying Arm the last time it was for sale. It bought Arm for US$32 billion four years ago.

No final decisions have been made, and the negotiations could drag on longer or fall apart, the sources said.

Representatives for Nvidia, Softbank and Arm declined to comment.

“With Nvidia’s low-cost fabless model enabling it to focus on R&D, engineering and programming, the fit with Arm would be perfect,” Mirabaud Securities Ltd analyst Neil Campling said.

Nvidia is the largest maker of graphics processing units (GPU) and it is spreading the use of the gaming component into new areas such as artificial intelligence processing in data centers and self-driving vehicles.

Marrying its own capabilities with central processing units (CPU) designed by Arm could enable it to take on Intel and AMD in a more comprehensive way, Rosenblatt Securities Inc analyst Hans Mosesmann said.

He said that Nvidia would have to pay an estimated US$55 billion for Arm.

“You need control of both CPU and GPU roadmaps and this, of course, includes data centers,” he wrote in a note on Friday. “Strategically, Nvidia needs a scalable CPU that can be integrated into its GPU roadmap, as is the case with AMD and Intel.”

The US dollar was trading at NT$29.7 at 10am today on the Taipei Foreign Exchange, as the New Taiwan dollar gained NT$1.364 from the previous close last week. The NT dollar continued to rise today, after surging 3.07 percent on Friday. After opening at NT$30.91, the NT dollar gained more than NT$1 in just 15 minutes, briefly passing the NT$30 mark. Before the US Department of the Treasury's semi-annual currency report came out, expectations that the NT dollar would keep rising were already building. The NT dollar on Friday closed at NT$31.064, up by NT$0.953 — a 3.07 percent single-day gain. Today,

‘SHORT TERM’: The local currency would likely remain strong in the near term, driven by anticipated US trade pressure, capital inflows and expectations of a US Fed rate cut The US dollar is expected to fall below NT$30 in the near term, as traders anticipate increased pressure from Washington for Taiwan to allow the New Taiwan dollar to appreciate, Cathay United Bank (國泰世華銀行) chief economist Lin Chi-chao (林啟超) said. Following a sharp drop in the greenback against the NT dollar on Friday, Lin told the Central News Agency that the local currency is likely to remain strong in the short term, driven in part by market psychology surrounding anticipated US policy pressure. On Friday, the US dollar fell NT$0.953, or 3.07 percent, closing at NT$31.064 — its lowest level since Jan.

Hong Kong authorities ramped up sales of the local dollar as the greenback’s slide threatened the foreign-exchange peg. The Hong Kong Monetary Authority (HKMA) sold a record HK$60.5 billion (US$7.8 billion) of the city’s currency, according to an alert sent on its Bloomberg page yesterday in Asia, after it tested the upper end of its trading band. That added to the HK$56.1 billion of sales versus the greenback since Friday. The rapid intervention signals efforts from the city’s authorities to limit the local currency’s moves within its HK$7.75 to HK$7.85 per US dollar trading band. Heavy sales of the local dollar by

The Financial Supervisory Commission (FSC) yesterday met with some of the nation’s largest insurance companies as a skyrocketing New Taiwan dollar piles pressure on their hundreds of billions of dollars in US bond investments. The commission has asked some life insurance firms, among the biggest Asian holders of US debt, to discuss how the rapidly strengthening NT dollar has impacted their operations, people familiar with the matter said. The meeting took place as the NT dollar jumped as much as 5 percent yesterday, its biggest intraday gain in more than three decades. The local currency surged as exporters rushed to