Intel Corp’s decision to consider outsourcing manufacturing heralds the end of an era in which the company, and the US, dominated the semiconductor industry. The move could reverberate well beyond Silicon Valley, influencing global trade and geopolitics.

The Santa Clara, California-based company has been the largest chipmaker for most of the past 30 years by combining the best designs with cutting-edge factories, several of which are still based in the US.

Most other US chip companies shut or sold domestic plants years ago, and had other firms make the components, mostly in Asia. Intel held out, arguing that doing both improved each side of its operation and created better semiconductors.

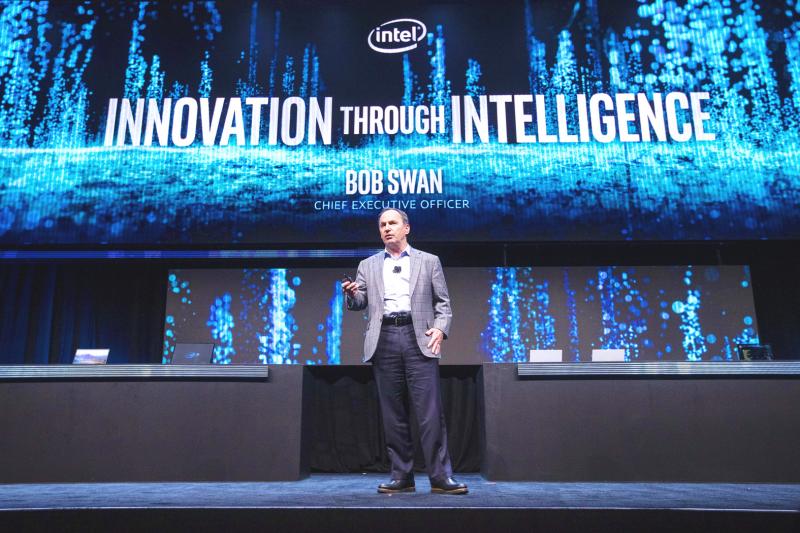

Photo: EPA-EFE

That strategy is in tatters now, with the company’s factories struggling to keep up with the latest 7-nanometer production process.

After chief executive officer Bob Swan said Intel is considering outsourcing, the company’s shares slumped 16 percent on Friday, the most since March, when the stock market plummeted in the early days of the COVID-19 pandemic.

“We view the roadmap missteps to be a stunning failure for a company once known for flawless execution, and could well represent the end of Intel’s computing dominance,” Raymond James Financial analyst Chris Caso wrote in a research note on Friday.

Swan has said that where a semiconductor is made is not that important.

However, domestic chip production has become a national priority for China, and some US politicians and national security experts consider sending this technical know-how overseas to be a potentially dangerous mistake.

“We’ve seen how vulnerable we are,” US Senator John Cornyn said last month, when US lawmakers proposed an estimated US$25 billion in funding and tax credits to strengthen domestic semiconductor production.

Intel’s Xeon chips run computers and data centers that support the design of nuclear power stations, spacecraft and jets, while helping governments quickly understand intelligence and other crucial information.

Many of these processors are made at facilities in Oregon, Arizona and New Mexico.

If Intel outsources this work, it would likely be done by Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), which focuses on production and is currently the world leader.

“With the latest push out of process technology, we believe that Intel has zero-to-no chance of catching or surpassing TSMC at least for the next half-decade, if not ever,” Susquehanna analyst Chris Rolland wrote in a research note.

He said Intel should sell its plants to TSMC, although he added that is unlikely.

Over the years, Intel has spent tens of billions of US dollars updating its factories, and all of Swan’s predecessors touted them as a crucial advantage that kept the company ahead of the rest of the industry. As the largest chip producer, Intel benefited from economies of scale and attracted the most experienced engineers and scientists.

The rise of smartphones and other mobile devices changed all that. Intel dabbled in mobile chips, but never committed its best production and design to the area, preferring to prioritize its existing PC and server chip businesses.

When smartphone sales took off, phone makers used other processors from companies such as Qualcomm Inc or they designed their own, like Apple Inc — and TSMC factories churned these components out.

While Intel makes hundreds of millions of chips a year now, TSMC produces more than a billion annually. That has given the Taiwanese company more experience to improve its factories, helping TSMC’s engineers overtake their Intel counterparts in technical execution.

Swan on Friday said that Intel’s products are still the best, despite the manufacturing delays.

However, by opening the door to outsourcing, he endangers one of the last bastions of US technology leadership.

“By outsourcing leading edge technology, presumably to TSMC, Intel would give up what has been its main source of competitive advantage for 50 years,” Caso said.

CHIP RACE: Three years of overbroad export controls drove foreign competitors to pursue their own AI chips, and ‘cost US taxpayers billions of dollars,’ Nvidia said China has figured out the US strategy for allowing it to buy Nvidia Corp’s H200s and is rejecting the artificial intelligence (AI) chip in favor of domestically developed semiconductors, White House AI adviser David Sacks said, citing news reports. US President Donald Trump on Monday said that he would allow shipments of Nvidia’s H200 chips to China, part of an administration effort backed by Sacks to challenge Chinese tech champions such as Huawei Technologies Co (華為) by bringing US competition to their home market. On Friday, Sacks signaled that he was uncertain about whether that approach would work. “They’re rejecting our chips,” Sacks

It is challenging to build infrastructure in much of Europe. Constrained budgets and polarized politics tend to undermine long-term projects, forcing officials to react to emergencies rather than plan for the future. Not in Austria. Today, the country is to officially open its Koralmbahn tunnel, the 5.9 billion euro (US$6.9 billion) centerpiece of a groundbreaking new railway that will eventually run from Poland’s Baltic coast to the Adriatic Sea, transforming travel within Austria and positioning the Alpine nation at the forefront of logistics in Europe. “It is Austria’s biggest socio-economic experiment in over a century,” said Eric Kirschner, an economist at Graz-based Joanneum

BUBBLE? Only a handful of companies are seeing rapid revenue growth and higher valuations, and it is not enough to call the AI trend a transformation, an analyst said Artificial intelligence (AI) is entering a more challenging phase next year as companies move beyond experimentation and begin demanding clear financial returns from a technology that has delivered big gains to only a small group of early adopters, PricewaterhouseCoopers (PwC) Taiwan said yesterday. Most organizations have been able to justify AI investments through cost recovery or modest efficiency gains, but few have achieved meaningful revenue growth or long-term competitive advantage, the consultancy said in its 2026 AI Business Predictions report. This growing performance gap is forcing executives to reconsider how AI is deployed across their organizations, it said. “Many companies

France is developing domestic production of electric vehicle (EV) batteries with an eye on industrial independence, but Asian experts are proving key in launching operations. In the Verkor factory outside the northern city of Dunkirk, which was inaugurated on Thursday, foreign specialists, notably from South Korea and Malaysia, are training the local staff. Verkor is the third battery gigafactory to open in northern France in a region that has become known as “Battery Valley.” At the Automotive Energy Supply Corp (AESC) factory near the city of Douai, where production has been under way for several months, Chinese engineers and technicians supervise French recruits. “They