Chunghwa Telecom Co (中華電信) yesterday became the nation’s first telecom to debut its 5G services, offering tiered tariffs that include a threshold of NT$599 and flat rates, as it aims to switch half of its subscribers to the 5G network within three years.

Subscribers would have unlimited data transmission for monthly fees starting at NT$1,399 — the same flat rate as when the company launched its 4G service in 2014 — and they can subscribe to the highest-rate plan for NT$2,699 per month for faster data transmission speeds and larger bandwidth, the company said.

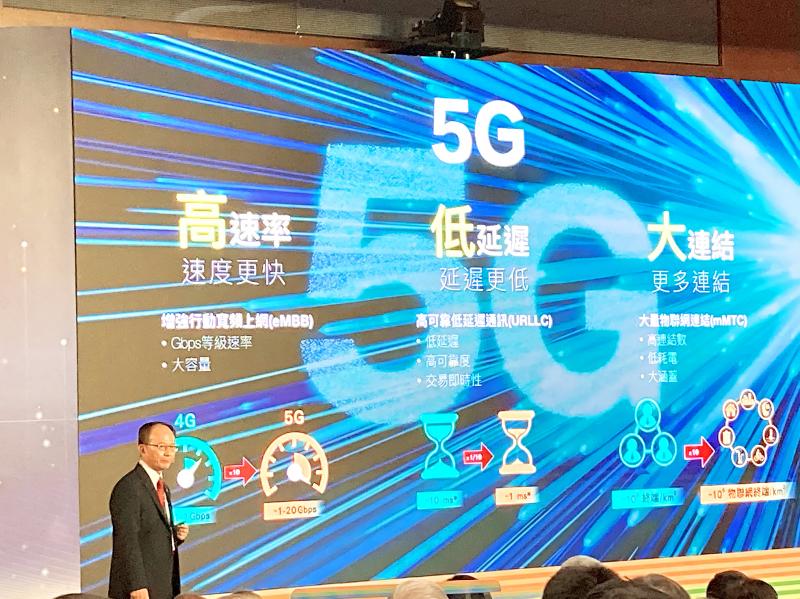

Data transmission speeds would be within the range of 500 megabytes per second to 1.5 gigabytes per second, the company said.

Photo: CNA

Hotspot sharing volume would be limited to 50 gigabytes, it said.

“To some extent, a flat rate is a requirement in Taiwan’s market. However, the tariffs are very, very low, compared with those offered in South Korea or Japan,” Chunghwa Telecom chairman Sheih Chi-mau (謝繼茂) told reporters on the sidelines of the launch event.

South Korea’s KT Corp charges fees equivalent to at least NT$2,040 per month and SK Telecom Co offers a monthly rate of NT$2,400 for unlimited data transmission, according to information provided by Chunghwa Telecom.

Photo: Lisa Wang, Taipei Times

The company expects half of its 10.5 million mobile subscribers to switch to the 5G network within three years, Sheih said.

The company expects to reach 1 million 5G subscribers in the first year of commercial launch, he said.

However, the company said 5G would not be a panacea for a persistent decline in telecom revenue.

Photo: Lisa Wang, Taipei Times

“It will be good enough to see a flat 5G telecom revenue,” Sheih said, responding to a reporter’s question about whether 5G would provide an opportunity for the company to reverse a revenue downtrend.

Chunghwa Telecom plans to double the number of its 5G base stations to 4,000 by the end of this year, compared with 2,000 now, he said.

The number would climb to more than 10,000 by 2022, he added.

The company plans to invest NT$27 billion (US$910.32 million) on its network infrastructure.

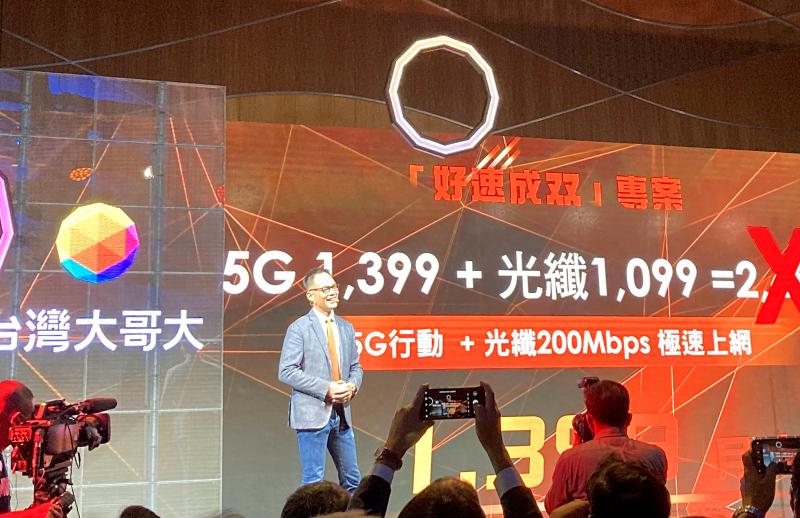

Separately yesterday, Taiwan Mobile Co (台灣大哥大) said that it would launch 5G services today.

It also aims to boost the 5G penetration rate among its subscribers to 50 percent within three years, company president Jamie Lin (林之晨) told reporters at a news conference in Taipei.

During the period, Taiwan Mobile is targeting expanding its 5G network by deploying more than 10,000 base stations to cover 90 percent of the nation’s population, Lin said.

With new 5G services on offer, such as instant playback for sports and virtual reality video streaming, the company expects non-telecom services to contribute NT$100 billion to its revenue over the period.

Taiwan Mobile also plans to offer tailor-made 5G rate plans for mobile game players later this year, Lin said.

Taiwan Mobile’s rate plans are similar to those of Chunghwa Telecom, with additional free high-speed broadband connection.

Far EasTone Telecommunications Co (遠傳電信) is to launch its 5G services on Friday.

MULTIFACETED: A task force has analyzed possible scenarios and created responses to assist domestic industries in dealing with US tariffs, the economics minister said The Executive Yuan is tomorrow to announce countermeasures to US President Donald Trump’s planned reciprocal tariffs, although the details of the plan would not be made public until Monday next week, Minister of Economic Affairs J.W. Kuo (郭智輝) said yesterday. The Cabinet established an economic and trade task force in November last year to deal with US trade and tariff related issues, Kuo told reporters outside the legislature in Taipei. The task force has been analyzing and evaluating all kinds of scenarios to identify suitable responses and determine how best to assist domestic industries in managing the effects of Trump’s tariffs, he

TIGHT-LIPPED: UMC said it had no merger plans at the moment, after Nikkei Asia reported that the firm and GlobalFoundries were considering restarting merger talks United Microelectronics Corp (UMC, 聯電), the world’s No. 4 contract chipmaker, yesterday launched a new US$5 billion 12-inch chip factory in Singapore as part of its latest effort to diversify its manufacturing footprint amid growing geopolitical risks. The new factory, adjacent to UMC’s existing Singapore fab in the Pasir Res Wafer Fab Park, is scheduled to enter volume production next year, utilizing mature 22-nanometer and 28-nanometer process technologies, UMC said in a statement. The company plans to invest US$5 billion during the first phase of the new fab, which would have an installed capacity of 30,000 12-inch wafers per month, it said. The

Taiwan’s official purchasing managers’ index (PMI) last month rose 0.2 percentage points to 54.2, in a second consecutive month of expansion, thanks to front-loading demand intended to avoid potential US tariff hikes, the Chung-Hua Institution for Economic Research (CIER, 中華經濟研究院) said yesterday. While short-term demand appeared robust, uncertainties rose due to US President Donald Trump’s unpredictable trade policy, CIER president Lien Hsien-ming (連賢明) told a news conference in Taipei. Taiwan’s economy this year would be characterized by high-level fluctuations and the volatility would be wilder than most expect, Lien said Demand for electronics, particularly semiconductors, continues to benefit from US technology giants’ effort

‘SWASTICAR’: Tesla CEO Elon Musk’s close association with Donald Trump has prompted opponents to brand him a ‘Nazi’ and resulted in a dramatic drop in sales Demonstrators descended on Tesla Inc dealerships across the US, and in Europe and Canada on Saturday to protest company chief Elon Musk, who has amassed extraordinary power as a top adviser to US President Donald Trump. Waving signs with messages such as “Musk is stealing our money” and “Reclaim our country,” the protests largely took place peacefully following fiery episodes of vandalism on Tesla vehicles, dealerships and other facilities in recent weeks that US officials have denounced as terrorism. Hundreds rallied on Saturday outside the Tesla dealership in Manhattan. Some blasted Musk, the world’s richest man, while others demanded the shuttering of his