State-run oil refiner CPC Corp, Taiwan (CPC, 台灣中油) yesterday announced that it would lower gasoline and diesel prices by NT$0.9 and NT$1 per liter respectively from today.

The cuts mark the second consecutive week that fuel prices have been lowered, leading domestic fuel prices to their lowest levels in two decades.

Based on CPC’s weighted oil price formula — comprised of 70 percent Dubai crude and 30 percent Brent crude — its average crude oil costs fell to US$17.05 per barrel last week, a decrease from US$20.38 a week earlier.

After factoring in the appreciation of the New Taiwan dollar, which was up NT$0.004 against the US dollar last week, fuel prices would be cut by 13.08 percent this week, CPC said in a statement.

CPC attributed the reduction to negative sentiment in the crude oil market due to lower US energy demand in the second quarter, an oversupply in US shale output and limited storage facilities for any excess inventories.

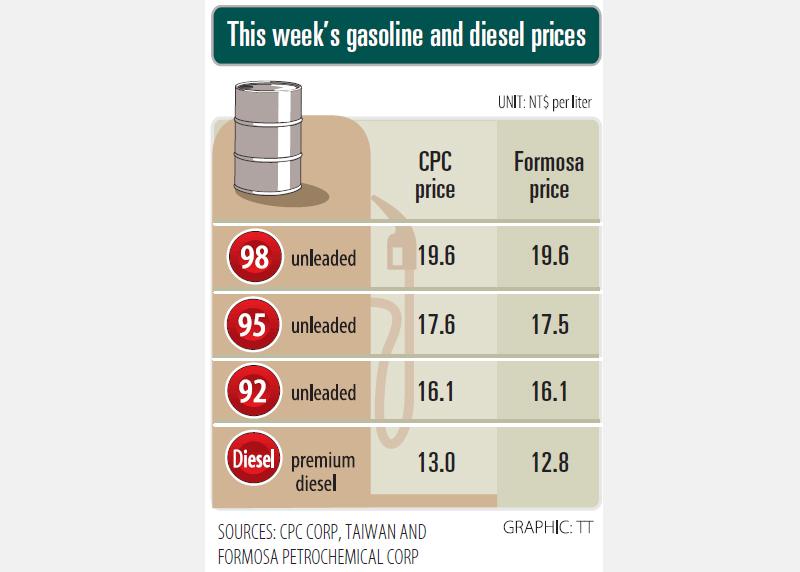

After the adjustments, prices at CPC stations are to drop to NT$16.1, NT$17.6 and NT$19.6 per liter for 92, 95 and 98-octane unleaded gasoline respectively, while premium diesel is to fall to NT$13 per liter, the company said.

Formosa Petrochemical Corp (台塑石化) in a separate statement yesterday said that the COVID-19 pandemic has sharply reduced energy demand and led to oversupply in the market.

Global crude prices last week also dropped after the West Texas Intermediate futures for delivery next month slid to negative territory for the first time, it said.

Formosa announced similar price cuts as CPC, effective today, with prices at its stations to be NT$16.1, NT$17.5 and NT$19.6 per liter for 92, 95 and 98-octane unleaded gasoline respectively, while premium diesel is to decrease to NT$12.8 per liter.

ADVANCED: Previously, Taiwanese chip companies were restricted from building overseas fabs with technology less than two generations behind domestic factories Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), a major chip supplier to Nvidia Corp, would no longer be restricted from investing in next-generation 2-nanometer chip production in the US, the Ministry of Economic Affairs said yesterday. However, the ministry added that the world’s biggest contract chipmaker would not be making any reckless decisions, given the weight of its up to US$30 billion investment. To safeguard Taiwan’s chip technology advantages, the government has barred local chipmakers from making chips using more advanced technologies at their overseas factories, in China particularly. Chipmakers were previously only allowed to produce chips using less advanced technologies, specifically

BRAVE NEW WORLD: Nvidia believes that AI would fuel a new industrial revolution and would ‘do whatever we can’ to guide US AI policy, CEO Jensen Huang said Nvidia Corp cofounder and chief executive officer Jensen Huang (黃仁勳) on Tuesday said he is ready to meet US president-elect Donald Trump and offer his help to the incoming administration. “I’d be delighted to go see him and congratulate him, and do whatever we can to make this administration succeed,” Huang said in an interview with Bloomberg Television, adding that he has not been invited to visit Trump’s home base at Mar-a-Lago in Florida yet. As head of the world’s most valuable chipmaker, Huang has an opportunity to help steer the administration’s artificial intelligence (AI) policy at a moment of rapid change.

TARIFF SURGE: The strong performance could be attributed to the growing artificial intelligence device market and mass orders ahead of potential US tariffs, analysts said The combined revenue of companies listed on the Taiwan Stock Exchange and the Taipei Exchange for the whole of last year totaled NT$44.66 trillion (US$1.35 trillion), up 12.8 percent year-on-year and hit a record high, data compiled by investment consulting firm CMoney showed on Saturday. The result came after listed firms reported a 23.92 percent annual increase in combined revenue for last month at NT$4.1 trillion, the second-highest for the month of December on record, and posted a 15.63 percent rise in combined revenue for the December quarter at NT$12.25 billion, the highest quarterly figure ever, the data showed. Analysts attributed the

Taiwan Semiconductor Manufacturing Co’s (TSMC, 台積電) quarterly sales topped estimates, reinforcing investor hopes that the torrid pace of artificial intelligence (AI) hardware spending would extend into this year. The go-to chipmaker for Nvidia Corp and Apple Inc reported a 39 percent rise in December-quarter revenue to NT$868.5 billion (US$26.35 billion), based on calculations from monthly disclosures. That compared with an average estimate of NT$854.7 billion. The strong showing from Taiwan’s largest company bolsters expectations that big tech companies from Alphabet Inc to Microsoft Corp would continue to build and upgrade datacenters at a rapid clip to propel AI development. Growth accelerated for