E Ink Holdings Inc (元太科技), a supplier of e-paper displays, expects a slight uptick in growth this quarter as demand for e-readers and electronic shelf labels (ESLs) improves amid the effects of the COVID-19 pandemic, it said yesterday.

The pandemic is having only a minor impact on its operations, the Hsinchu-based company said, adding that its fab in China is expected to return to 90 percent capacity by the end of this month, from between 70 and 80 percent, as supply chains disrupted in January and last month recover.

Remote work and schooling policies due to city lockdowns are stimulating demand for e-paper used in e-readers, information boards on public transportation and medical devices.

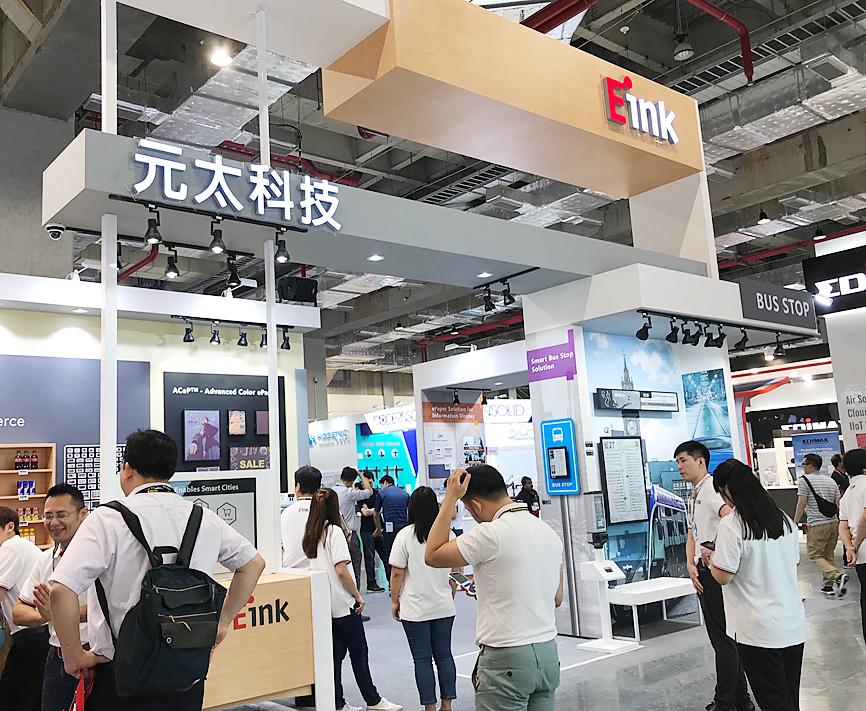

Photo: Chen Mei-ying, Taipei Times

The growth of e-readers this month in China would entirely offset January’s and last month’s declines, company chairman Johnson Lee (李政昊) told an investors’ teleconference yesterday.

Even retailers and grocery stores have started using ESLs to to restock and reprice supermarket shelves quickly and easily, Lee added.

Demand for ESLs “is growing even faster than the period before the pandemic,” Lee said.

However, installation of ESLs would temporarily be affected by the coronavirus in European and US cities that are in lockdown, Lee said.

Overall, “when we look at the outlook for the first quarter, we think it should be a bit better than last year,” Lee said, implying that revenue this quarter would surpass the NT$2.95 billion (US$97.57 million) in revenue made in the first quarter of last year.

The coronavirus is affecting the supply side, so customers are ordering in advance over fears of supply constraints, he said.

To cope with increasing demand, E Ink plans to spend NT$1.2 billion on expanding capacity in New Taipei City’s Linkou District (林口), a company investment plan submitted to the Ministry of Economic Affairs showed.

It also plans to add manufacturing tools at its fab in Hsinchu, which would add some capacity, E Ink said.

Last year’s downtrend in royalty income would likely extend into this year, the company said.

Royalty income is expected to fall at a faster pace than the 5 percent annual decline posted last year, as active-matrix organic light-emitting diode displays are replacing LCD displays on smartphones, chief financial officer Lloyd Chen (陳樂群) said.

Last year, E Ink took in NT$2.24 billion in royalty income by licensing advanced fringe field switching LCD technology to flat-panel makers.

To make up for the loss in royalty income, E Ink said that it is investing in the e-paper ecosystem, such as forming partnerships with flat-panel makers to promote the adoption of e-paper displays.

The company’s efforts have increased sales of higher-margin e-paper materials, propelling its gross margin to 48 percent in the final quarter of last year and bringing full-year gross margin to 44.4 percent, from 41.7 percent in 2018.

Zhang Yazhou was sitting in the passenger seat of her Tesla Model 3 when she said she heard her father’s panicked voice: The brakes do not work. Approaching a red light, her father swerved around two cars before plowing into a sport utility vehicle and a sedan, and crashing into a large concrete barrier. Stunned, Zhang gazed at the deflating airbag in front of her. She could never have imagined what was to come: Tesla Inc sued her for defamation for complaining publicly about the vehicles brakes — and won. A Chinese court ordered Zhang to pay more than US$23,000 in

Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) yesterday said that its investment plan in Arizona is going according to schedule, following a local media report claiming that the company is planning to break ground on its third wafer fab in the US in June. In a statement, TSMC said it does not comment on market speculation, but that its investments in Arizona are proceeding well. TSMC is investing more than US$65 billion in Arizona to build three advanced wafer fabs. The first one has started production using the 4-nanometer (nm) process, while the second one would start mass production using the

A TAIWAN DEAL: TSMC is in early talks to fully operate Intel’s US semiconductor factories in a deal first raised by Trump officials, but Intel’s interest is uncertain Broadcom Inc has had informal talks with its advisers about making a bid for Intel Corp’s chip-design and marketing business, the Wall Street Journal reported, citing people familiar with the matter. Nothing has been submitted to Intel and Broadcom could decide not to pursue a deal, according to the Journal. Bloomberg News earlier reported that Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) is in early talks for a controlling stake in Intel’s factories at the request of officials at US President Donald Trump’s administration, as the president looks to boost US manufacturing and maintain the country’s leadership in critical technologies. Trump officials raised the

From George Clooney to LeBron James, celebrities in the US have cashed in on tequila’s soaring popularity, but in Mexico, producers of the agave plant used to make the country’s most famous liquor are nursing a nasty hangover. Instead of bringing a long period of prosperity for farmers of the spiky succulent, the tequila boom has created a supply glut that sent agave prices slumping. Mexican tequila exports surged from 224 million liters in 2018 to a record 402 million last year, according to the Tequila Regulatory Council, which oversees qualification for the internationally recognized denomination of origin label. The US, Germany, Spain,