PCA Life Assurance Co Ltd (保誠人壽) is likely to face an uphill climb in the Taiwanese market, despite the company’s advertising blitz trying to improve its corporate image, industry watchers said.

In its latest “WeDo” advertising campaign, the local arm of UK-based Prudential aims to deliver the message that it helps customers achieve their dreams, as it is always listening to their needs.

PCA Life joined several other foreign insurance companies in either exiting Taiwan or scaling down their operations during the global financial crisis.

PCA Life entered Taiwan’s life insurance market in November 1999 through the acquisition of ChinFon Life Insurance Co (慶豐人壽). The company in 2009 sold its assets and liabilities — excluding its bancassurance and telephone marketing businesses — to China Life Insurance Co (中國人壽) for the nominal sum of NT$1 (US$0.03).

Aside from PCA Life, ING Groep NV in 2008 sold ING Antai Life Insurance Co (安泰人壽) to Fubon Financial Holding Co (富邦金控) for US$600 million through stock swaps, while Aegon NV in 2009 sold Aegon Life Insurance (Taiwan) Inc (全球人壽) to Taipei-based consortium Zhongwei Co (中瑋一) for 65 million euros (US$73.43 million at the current exchange rate).

US-based Metlife Inc in 2010 sold MetLife Taiwan Insurance Co (大都會人壽) to Waterland Financial Holdings Co (國票金控) for US$112.5 billion, Canadian firm Manulife International Ltd in 2011 sold Manulife Insurance Co (宏利人壽) to CTBC Financial Holding Co (中信金控) for NT$724 million, and American International Group (AIG) in that same year divested its 97.57 percent share in Nan Shan Life Insurance Co (南山人壽) to Ruen Chen Investment Holding Co (潤成投資) for US$2.16 billion, while New York Life Insurance Taiwan Corp (國際紐約人壽) was in 2013 acquired by Yuanta Financial Holding Co (元大金控) from New York Life Insurance Co for NT$100 million.

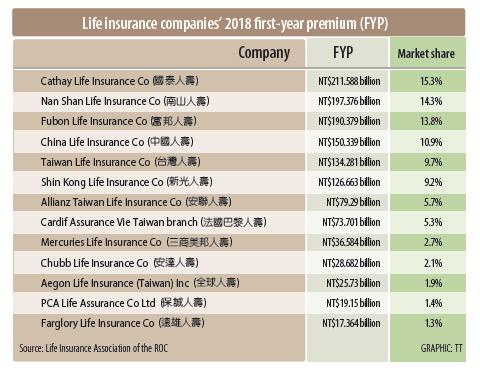

Last year, PCA Life reported first-year premiums (FYPs) of NT$19.15 billion through channels including telemarketing, bancassurance and brokering, accounting for 1.4 percent of total FYPs in Taiwan, Life Insurance Association of the ROC (壽險公會) statistics showed.

That was behind other foreign life insurance companies in terms of FYPs, such as Allianz Taiwan Life Insurance Co’s (安聯人壽) NT$79.29 billion, the Taiwan branch of Cardif Assurance Vie’s (法國巴黎人壽) NT$73.7 billion and Chubb Life Insurance Co’s (安達人壽) NT$28.68 billion, the data showed.

Relying on their own team of sales agents, in addition to other sales channels, local insurance companies Cathay Life Insurance Co (國泰人壽), Nan Shan and Fubon Life Insurance Co (富邦人壽) posted FYPs of NT$211.59 billion, NT$197.38 billion and NT$190.38 billion respectively last year, to take the top three spots, the data showed.

An executive at a local insurance company said that trust is fundamental to the insurance business, which requires long-term commitment and effort.

“PCA has good asset quality and product design, but it must improve its corporate image,” the unnamed executive told the Chinese-language Liberty Times (the Taipei Times’ sister newspaper) in a report published on Feb. 3.

The executive said that some foreign insurance companies have expressed an intention to move back to Taiwan, but consumers would have concerns over their long-term commitment to the local market.

Another issue is so-called “orphan policies” that have no active agent servicing the policyholder.

More than 4 million such policies were created in Taiwan during the global financial crisis, said Peng Jin-lung (彭金隆), an insurance professor at National Chengchi University.

While the rights and interests of holders of orphan policies are protected by law, consumers would have concerns about the quality of services being offered if their policies were to go into orphan mode, and that would impact their insurance company’s corporate image, Peng told the Liberty Times.

Taiwan will prioritize the development of silicon photonics by taking advantage of its strength in the semiconductor industry to build another shield to protect the local economy, National Development Council (NDC) Minister Paul Liu (劉鏡清) said yesterday. Speaking at a meeting of the legislature’s Economics Committee, Liu said Taiwan already has the artificial intelligence (AI) industry as a shield, after the semiconductor industry, to safeguard the country, and is looking at new unique fields to build more economic shields. While Taiwan will further strengthen its existing shields, over the longer term, the country is determined to focus on such potential segments as

UNCERTAINTY: Innolux activated a stringent supply chain management mechanism, as it did during the COVID-19 pandemic, to ensure optimal inventory levels for customers Flat-panel display makers AUO Corp (友達) and Innolux Corp (群創) yesterday said that about 12 to 20 percent of their display business is at risk of potential US tariffs and that they would relocate production or shipment destinations to mitigate the levies’ effects. US tariffs would have a direct impact of US$200 million on AUO’s revenue, company chairman Paul Peng (彭雙浪) told reporters on the sidelines of the Touch Taiwan trade show in Taipei yesterday. That would make up about 12 percent of the company’s overall revenue. To cope with the tariff uncertainty, AUO plans to allocate its production to manufacturing facilities in

COLLABORATION: Given Taiwan’s key position in global supply chains, the US firm is discussing strategies with local partners and clients to deal with global uncertainties Advanced Micro Devices Inc (AMD) yesterday said it is meeting with local ecosystem partners, including Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), to discuss strategies, including long-term manufacturing, to navigate uncertainties such as US tariffs, as Taiwan occupies an important position in global supply chains. AMD chief executive officer Lisa Su (蘇姿丰) told reporters that Taiwan is an important part of the chip designer’s ecosystem and she is discussing with partners and customers in Taiwan to forge strong collaborations on different areas during this critical period. AMD has just become the first artificial-intelligence (AI) server chip customer of TSMC to utilize its advanced

Chizuko Kimura has become the first female sushi chef in the world to win a Michelin star, fulfilling a promise she made to her dying husband to continue his legacy. The 54-year-old Japanese chef regained the Michelin star her late husband, Shunei Kimura, won three years ago for their Sushi Shunei restaurant in Paris. For Shunei Kimura, the star was a dream come true. However, the joy was short-lived. He died from cancer just three months later in June 2022. He was 65. The following year, the restaurant in the heart of Montmartre lost its star rating. Chizuko Kimura insisted that the new star is still down