CPC Corp, Taiwan (CPC, 台灣中油) yesterday said it has no plan to stop the sale of 92-octane unleaded gasoline, rejecting local media speculation of such a move to counter air pollution.

“Domestic supplies of 92, 95 and 98-octane unleaded gasoline are subject to market demand, and the 92-grade is still used by a certain portion of consumers,” CPC vice president Ann Bih (畢淑蒨) said in a statement posted on the company’s Web site.

SALES BREAKDOWN

Based on the state-run refiner’s statistics, the breakdown for unleaded gasoline products in Taiwan shows that 92-octane unleaded accounts for 20 percent of sales, 95-octane unleaded for 75 percent, and 98-octane unleaded for 5 percent, CPC said.

CPC guarantees it would continue providing a sufficient supply of the above-mentioned gasoline products, the statement said.

The company’s remarks came after the Chinese-language Commercial Times yesterday reported that CPC recently conducted an evaluation regarding whether to suspend the sale of 92-octane unleaded gasoline, in light of the worsening air pollution and the government’s plans to ban sales of motorcycles and cars with engines powered by fossil fuels in 2035 and 2040 respectively.

As the 92-octane product is less desirable than its 95 and 98 peers from an engine efficiency standpoint, CPC might consider stocking only the latter two at stations, the newspaper said.

POTENTIAL IMPACT

However, since 92-octane unleaded gasoline is mostly used by motorcycles and scooters, whose owners are mainly students and workers, and its price is NT$1.5 less than the 95-octane fuel per liter, CPC will need more time to consider the potential impact on this segment of consumers and might not implement the policy soon, the report said.

Moreover, any decision to stop the sale of 92-octane unleaded gasoline would need approval from the Ministry of Economic Affairs’ Bureau of Energy, the newspaper said.

FUEL PRICES

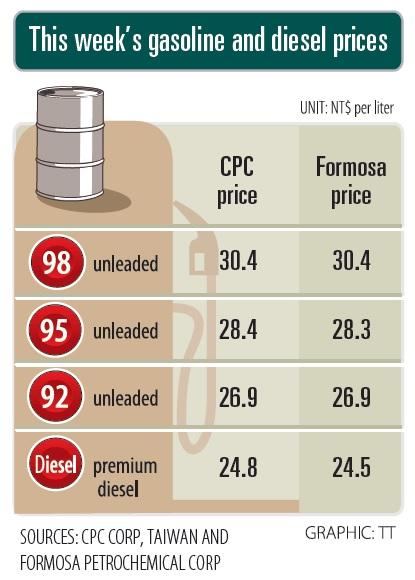

Separately, CPC yesterday announced domestic fuel prices are to rise this week for a fourth straight week, as sentiment in the global crude oil market last week remained cautious about the political situation in Iran and US crude oil inventories continued to decrease.

CPC said that its average cost of crude oil increased by US$1.26 per barrel to US$65.72.

This meant it had to increase gasoline and diesel prices by NT$0.2 per liter from today after factoring in the New Taiwan dollar’s appreciation of NT$0.323 against the US dollar, the refiner said.

Global crude prices also rose due to the increased fuel demand in the US amid cold weather, said Formosa Petrochemical Corp (台塑石化), which on Saturday announced similar hikes, effective from today.

Taiwan would remain in the same international network for carrying out cross-border payments and would not be marginalized on the world stage, despite jostling among international powers, central bank Governor Yang Chin-long (楊金龍) said yesterday. Yang made the remarks during a speech at an annual event organized by Financial Information Service Co (財金資訊), which oversees Taiwan’s banking, payment and settlement systems. “The US dollar will remain the world’s major cross-border payment tool, given its high liquidity, legality and safe-haven status,” Yang said. Russia is pushing for a new cross-border payment system and highlighted the issue during a BRICS summit in October. The existing system

Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) is expected to grow its revenue by about 25 percent to a new record high next year, driven by robust demand for advanced technologies used in artificial intelligence (AI) applications and crypto mining, International Data Corp (IDC) said yesterday. That would see TSMC secure a 67 percent share of the world’s foundry market next year, from 64 percent this year, IDC senior semiconductor research manager Galen Zeng (曾冠瑋) predicted. In the broader foundry definition, TSMC would see its market share rise to 36 percent next year from 33 percent this year, he said. To address concerns

Intel Corp chief financial officer Dave Zinsner said that a formal separation of the company’s factory and product development divisions is an open question that would be decided by the chipmaker’s next leader. Zinsner, who is serving as interim co-CEO following this month’s ouster of Pat Gelsinger, made the remarks on Thursday at the Barclays technology conference in San Francisco alongside co-CEO Michelle Johnston Holthaus. Intel’s struggles to keep pace with rivals — along with its deteriorating financial condition — have spurred speculation that the next CEO would make dramatic changes. That has included talk of a split of the company’s manufacturing

PROTECTIONISM: The tariffs would go into effect on Jan. 1 and are meant to protect the US’ clean energy sector from unfair Chinese practices, the US trade chief said US President Joe Biden’s administration plans to raise tariffs on solar wafers, polysilicon and some tungsten products from China to protect US clean energy businesses. The notice from the Office of US Trade Representative (USTR) said tariffs on Chinese-made solar wafers and polysilicon would rise to 50 percent from 25 percent and duties on certain tungsten products would increase from zero to 25 percent, effective on Jan. 1, following a review of Chinese trade practices under Section 301 of the US Trade Act of 1974. The decision followed a public comment period after the USTR said in September that it was considering