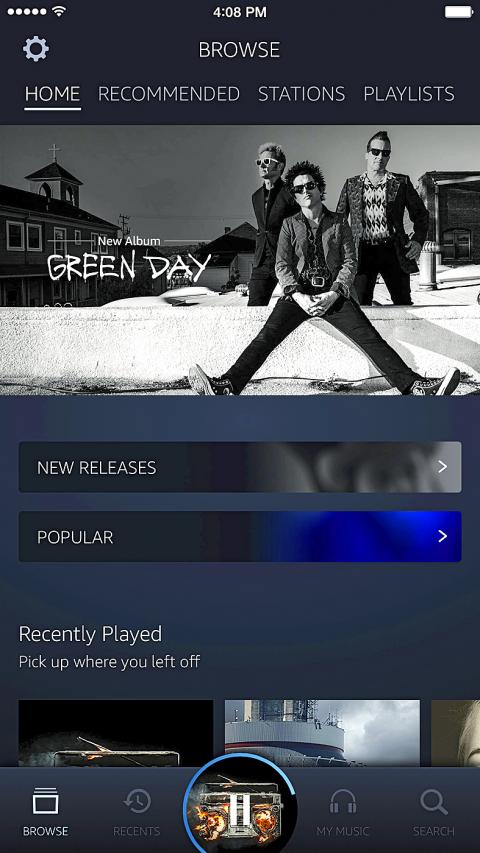

Amazon.com Inc yesterday introduced a full-fledged music streaming service with subscriptions as low as US$3.99 per month for owners of its Amazon Echo speaker, accelerating the industry trend toward more flexible pricing after years of sticking to US$9.99 subscriptions.

The new streaming service, called “Amazon Music Unlimited,” lets users access a vast catalog of songs on demand, similar to Spotify and Apple Music.

Subscriptions to play music on the Echo cost US$3.99 per month; for access beyond that device, subscriptions cost US$7.99 a month for members of Amazon’s Prime shipping and video service, and US$9.99 for non-members. Amazon will continue to offer Prime members a limited streaming service for free.

Photo: Amazon Music/AP

As it plunges deeper into the crowded streaming field, Amazon is counting on the Echo, a smart speaker that responds to voice commands, to set it apart.

Released broadly last year, the Echo has become a surprise hit, prompting many to predict that voice will become a key way users interact with technology — and music is central to the device’s appeal.

Amazon believes such smart home devices will be a key source of growth for the music industry, Amazon Music vice president Steve Boom said.

“The first phase of growth [in music streaming] was driven almost entirely by smartphones,” he said in an interview.

“We believe pretty strongly that the next phase of growth in streaming is going to come from the home,” he said.

The low price for Amazon’s streaming service is consistent with the firm’s reputation for undercutting the competition and signals the music industry is beginning to accommodate consumers who are unwilling to pay US$9.99 per month.

Boom said he was optimistic that the new prices would expand the market.

“We’re moving music away from a one-size-fits-all approach,” Boom said. “We are the ones who have been pushing this the hardest.”

The premium music service, following the release of a standalone video service, suggests Amazon will increasingly offer basic media options through Prime while selling additional subscriptions for consumers who want to go deeper, Jackdaw Research analyst Jan Dawson said.

Amazon is also hopeful that artificial intelligence will keep users tuned in. Recommendations based on listening habits have become a staple of streaming services, and Amazon has also woven artificial intelligence into the system so users can request songs that fit a particular mood or search with lyrics.

SEMICONDUCTORS: The firm has already completed one fab, which is to begin mass producing 2-nanomater chips next year, while two others are under construction Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), the world’s largest contract chipmaker, plans to begin construction of its fourth and fifth wafer fabs in Kaohsiung next year, targeting the development of high-end processes. The two facilities — P4 and P5 — are part of TSMC’s production expansion program, which aims to build five fabs in Kaohsiung. TSMC facility division vice president Arthur Chuang (莊子壽) on Thursday said that the five facilities are expected to create 8,000 jobs. To respond to the fast-changing global semiconductor industry and escalating international competition, TSMC said it has to keep growing by expanding its production footprints. The P4 and P5

DOWNFALL: The Singapore-based oil magnate Lim Oon Kuin was accused of hiding US$800 million in losses and leaving 20 banks with substantial liabilities Former tycoon Lim Oon Kuin (林恩強) has been declared bankrupt in Singapore, following the collapse of his oil trading empire. The name of the founder of Hin Leong Trading Pte Ltd (興隆貿易) and his children Lim Huey Ching (林慧清) and Lim Chee Meng (林志朋) were listed as having been issued a bankruptcy order on Dec. 19, the government gazette showed. The younger Lims were directors at the company. Leow Quek Shiong and Seah Roh Lin of BDO Advisory Pte Ltd are the trustees, according to the gazette. At its peak, Hin Leong traded a range of oil products, made lubricants and operated loading

Citigroup Inc and Bank of America Corp said they are leaving a global climate-banking group, becoming the latest Wall Street lenders to exit the coalition in the past month. In a statement, Citigroup said while it remains committed to achieving net zero emissions, it is exiting the Net-Zero Banking Alliance (NZBA). Bank of America said separately on Tuesday that it is also leaving NZBA, adding that it would continue to work with clients on reducing greenhouse gas emissions. The banks’ departure from NZBA follows Goldman Sachs Group Inc and Wells Fargo & Co. The largest US financial institutions are under increasing pressure

STIMULUS PLANS: An official said that China would increase funding from special treasury bonds and expand another program focused on key strategic sectors China is to sharply increase funding from ultra-long treasury bonds this year to spur business investment and consumer-boosting initiatives, a state planner official told a news conference yesterday, as Beijing cranks up fiscal stimulus to revitalize its faltering economy. Special treasury bonds would be used to fund large-scale equipment upgrades and consumer goods trade-ins, said Yuan Da (袁達), deputy secretary-general of the Chinese National Development and Reform Commission. “The size of ultra-long special government bond funds will be sharply increased this year to intensify and expand the implementation of the two new initiatives,” Yuan said. Under the program launched last year, consumers can