Momo.com Inc (富邦媒), a local online, TV and catalogue shopping company, made its debut on the main bourse yesterday, rising as high as 30 percent from its initial public offering price of NT$230.

At the end of trading, shares closed at NT$283, up 23.04 percent, compared with the broader market’s 1.36 percent increase. The company raised about NT$3.3 billion (US$104.8 million) for future capital expenditure and dividend payouts.

“We aim to gain market share in Taiwan and accelerate expansion into overseas markets,” company chairman Howard Lin (林福星) said during a debut ceremony at the Taiwan Stock Exchange.

Momo’s consolidated revenue was NT$2.07 billion last month, slightly less than the previous month’s NT$2.09 billion, but up 19.53 percent from NT$1.73 billion in November last year.

The company’s cumulative revenue for the first 11 months of this year totaled NT$21.73 billion, rising 17.81 percent from NT$18.44 billion in the same period last year.

“As of November, earnings per share were NT$6.61,” Lin said.

Momo’s online shopping segment accounts for about 62 percent of the company’s total revenue, while TV shopping commands 28 percent and catalogues 7.8 percent, Lin said.

He said the company is set to enhance its logistics service, adding that Momo plans to invest NT$4 billion next year in building a logistics center in Taoyuan County with automatic wrapping machines for unit loads.

The center is scheduled to start operations in 2016, he added.

Momo expanded to the Chinese market in 2011 and to Thailand early this year.

Lin said the company would continue to expand its scale in Thailand and seek business opportunities elsewhere among ASEAN members.

Yuanta Investment Consulting Co (元大投顧) described the newly listed company as a rising star in the nation’s online shopping sector.

“What makes the company unique is the synergy offered by its three shopping platforms and support from its major shareholders,” Yuanta analyst Livia Wu (吳靚芙) said in a client note ahead of Momo’s debut.

Taiwan Mobile Co (台灣大哥大), the nation’s second-largest telecom operator, and South Korean retail giant Lotte Shopping Co hold 49.9 percent and 11.7 percent stakes in Momo respectively.

These two major shareholders would offer solid support to Momo on the back of their industry know-how, Wu said on Thursday.

Products that sell well on the company’s online shopping site momoshop.com.tw (Momoshop, 購物網) can be selected as products for TV shopping and catalogues, saving the firm market research costs, she said.

“We expect Momoshop will be the key growth driver for the company next year and source sharing can create synergy for the overall company,” Wu said.

Taiwan’s growing trend of online shopping will become even more marked in the coming years, benefiting companies like Momo, Tashin Securities Investment Advisory Co (台新投顧) said yesterday.

“The fact that Momoshop ranks as Taiwan’s third-largest online shopping Web site suggests that the company has won Taiwanese consumers’ approval,” Taishin said in a research report.

Anna Bhobho, a 31-year-old housewife from rural Zimbabwe, was once a silent observer in her home, excluded from financial and family decisionmaking in the deeply patriarchal society. Today, she is a driver of change in her village, thanks to an electric tricycle she owns. In many parts of rural sub-Saharan Africa, women have long been excluded from mainstream economic activities such as operating public transportation. However, three-wheelers powered by green energy are reversing that trend, offering financial opportunities and a newfound sense of importance. “My husband now looks up to me to take care of a large chunk of expenses,

SECTOR LEADER: TSMC can increase capacity by as much as 20 percent or more in the advanced node part of the foundry market by 2030, an analyst said Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) is expected to lead its peers in the advanced 2-nanometer process technology, despite competition from Samsung Electronics Co and Intel Corp, TrendForce Corp analyst Joanne Chiao (喬安) said. TSMC’s sophisticated products and its large production scale are expected to allow the company to continue dominating the global 2-nanometer process market this year, Chiao said. The world’s largest contract chipmaker is scheduled to begin mass production of chips made on the 2-nanometer process in its Hsinchu fab in the second half of this year. It would also hold a ceremony on Monday next week to

TECH CLUSTER: The US company’s new office is in the Shalun Smart Green Energy Science City, a new AI industry base and cybersecurity hub in southern Taiwan US chip designer Advanced Micro Devices Inc (AMD) yesterday launched an office in Tainan’s Gueiren District (歸仁), marking a significant milestone in the development of southern Taiwan’s artificial intelligence (AI) industry, the Tainan City Government said in a statement. AMD Taiwan general manager Vincent Chern (陳民皓) presided over the opening ceremony for the company’s new office at the Shalun Smart Green Energy Science City (沙崙智慧綠能科學城), a new AI industry base and cybersecurity hub in southern Taiwan. Facilities in the new office include an information processing center, and a research and development (R&D) center, the Tainan Economic Development Bureau said. The Ministry

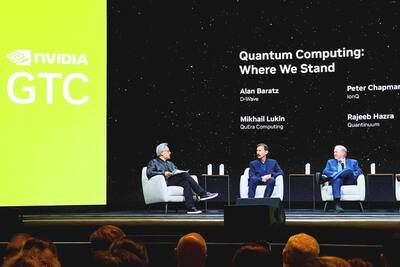

Nvidia is to open a quantum computing research lab in Boston, where it plans to collaborate with scientists from Harvard University and the Massachusetts Institute of Technology, Nvidia CEO Jensen Huang (黃仁勳) said on Thursday. Huang made the announcement at Nvidia’s annual software developer conference in San Jose, California, where the company held a day of events focused on quantum computing. Nvidia added the program after Huang in January said that useful quantum computers are 20 years away, comments that he sought to walk back on Thursday while joined onstage by executives from quantum computing firms. “This is the first event in history