The nation's motherboard sector expects to see a rosy outlook for the upcoming July-September quarter, in the wake of the busy Computex Taipei 2005 Technology Show and healthy desktop computers demand worldwide, analysts said yesterday.

As the trade show entered its third day at the exhibition halls of the Taipei World Trade Center, expectations and confirmations of orders secured by local manufacturers appeared to boost the sentiment across the tech sector, market watchers said.

"We are optimistic about the motherboard sector in the third quarter after seeing a smooth seasonality in the current quarter, where shipments should decrease marginally by only 3 percent quarter-on-quarter -- much less than the average decline of 10 percent," Jenny Lai (賴惠娟), a hardware analyst at JP Morgan Chase & Co said in a phone interview yesterday.

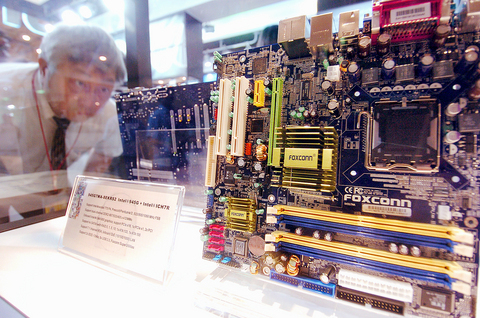

PHOTO: GEORGE TSORNG, TAIPEI TIMES

The total number of motherboards shipped by the nation's top four manufacturers, including Asustek Computer Inc (華碩電腦), Elitegroup Computer Systems Co (精英電腦), Gigabyte Technology Co (技嘉科技) and Micro-Star International Co (

She attributed the robust growth outlook to the busiest Computex trade show in the last four years, which also saw heavier visitor traffic.

According to the Taiwan External Trade Development Council (TAITRA, 外貿協會), the show attracted 23,309 visitors yesterday alone. For the first three days, it has attracted a total of 53,529 visitors, TAITRA said. Among that figure, 18,085 were foreign visitors, including foreign buyers and reporters, it said.

TAITRA expects to see 120,000 visitors with 28,000 from overseas this year.

Lai said the positive outlook is being partly boosted by a healthy demand for desktop computers worldwide, driven by a stable platform powered by Intel Corp's sufficient supply of affordable 915 chipsets.

Yet the eye-catching novel product of the dual-core microprocessor in the show may not become the market mainstream for the months ahead, as "CPU [central processing unit] availability and software optimization remain key issues to mass adoption, on top of pricing concerns," Lai said.

Meanwhile, JP Morgan recommended Asustek and Micro-Star as their overweight picks.

In contrast, Smith Barney equity research at Citigroup appeared to be less bullish about third-quarter prospects for the motherboard industry, citing concern on supply uncertainty.

The new Waste Electronics and Electrical Equipment (WEEE) and Restrictions on Hazardous Substances (RoHS) requirements, to take effect in the EU in August this year and July next year, will cost Taiwanese companies US$3 to US$4 more per board and reduce output speed by 10 percent to 20 percent, Kirk Yang (楊應超), said Smith Barney's head of Asia technology hardware research in a report released on Wednesday.

The potential chipset shortages from Intel Corp and the likely summer power shortages in China both cloud the third-quarter outlook, Yang said.

The researcher predicted the top four players plus the heavyweight newcomers Hon Hai Precision Industry Co (鴻海精密), the world's leading electronics manufacturing service (EMS) provider, to ship combined 134 million motherboards, accounting for 96.6 percent of forecasted global shipment of 138.7 million units this year.

Hon Hai this year will provide electronic components, primarily motherboards in the clone market under the brand name Foxconn, eying tech-savvy consumers who seek tailored PCs, Christin Wang (王文玉), Hon Hai's global marketing manager, told the Taipei Times in an interview last week.

"Hon Hai appears to be one of the most aggressive players this year," Yang said, adding that the EMS giant is aggressively building the clone motherboard business and showing some initial results, growing to estimated 6 million units this year from 1 million last year.

Hon Hai's total shipments are expected grow 25.7 percent year-on-year to 40 million motherboards, or 31.7 percent of global market, this year from 30 million, or 25.8 percent market share last year, the company said in a report.

Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) halted shipments to a customer this month after its semiconductors were sent to China’s Huawei Technologies Co (華為), potentially breaching US sanctions, a government official said. The US slapped sanctions on Huawei in 2019, and expanded them the following year, over fears its technology could be used for Beijing’s espionage operations. The restrictions prevent TSMC from selling semiconductors to Huawei. However, TSMC discovered on Oct. 11 that chips made for a “specific customer” had ended up with the Chinese company, a Taiwanese official with knowledge of the incident said on the condition of anonymity. TSMC “immediately activated

US SANCTIONS: The Taiwan tech giant has ended all shipments to China-based Sophgo Technologies after one of their chips was discovered in a Huawei phone Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) suspended shipments to China-based chip designer Sophgo Technologies Ltd (算能科技) after a chip it made was found on a Huawei Technologies Co (華為) artificial intelligence (AI) processor, according to two people familiar with the matter. Sophgo had ordered chips from TSMC that matched the one found on Huawei’s Ascend 910B, the people said. Huawei is restricted from buying the technology to protect US national security. Reuters could not determine how the chip ended up on the Huawei product. Sophgo said in a statement on its Web site yesterday that it was in compliance with all laws

TECH TITANS: Nvidia briefly overtook Apple again on Friday after becoming the world’s largest company for a short period in June, as Microsoft fell to third place Nvidia Corp dethroned Apple Inc as the world’s most valuable company on Friday following a record-setting rally in the stock, powered by insatiable demand for its specialized artificial intelligence (AI) chips. Nvidia’s stock market value briefly touched US$3.53 trillion, slightly above Apple’s US$3.52 trillion, London Stock Exchange Group data showed. Nvidia ended the day up 0.8 percent, with a market value of US$3.47 trillion, while Apple’s shares rose 0.4 percent, valuing the iPhone maker at US$3.52 trillion. In June, Nvidia briefly became the world’s most valuable company before it was overtaken by Microsoft Corp and Apple. The tech trio’s market capitalizations have been

Shares of Starlux Airlines Co (星宇航空) surged more than 53 percent on its debut on the Taiwan stock exchange yesterday. Starlux shares closed up 53.75 percent at NT$30.75 from its initial public offering price of NT$20 after retreating in late trading from a 60 percent rise. China Airlines Ltd (CAL, 中華航空) rose 0.90 percent to close at NT$22.35, while EVA Airways Corp (長榮航空) gained 0.40 percent to close at NT$37.70. In Taiwan, a newly listed stock is allowed to go beyond the 10 percent maximum increase or decline in its first five trading sessions. At the listing ceremony, Starlux chairman Chang Kuo-wei (張國煒) said