A noticeable trend over the past year has been the resurgence of the old Integrated Device Manufacturers (IDMs) using Taiwan's dedicated foundry services for more and more of their production needs.

Mostly, this has been a result of necessity. As Asia's economy and the IC industry slumped over the past two years, Taiwanese foundries such as Taiwan Semiconductor Manufacturing Co (TSMC, 台積1q, www.tsmc.com) and United Microelectronics Corp. (UMC, 聯1q, umc.com.tw) continued to buy the latest IC fabrication equipment. They thus put themselves in an advantageous position, being apply to supply first-tier IC fabrication capacity which the IDMs are now finding they need, but had not purchased equipment in sufficient volumes to do on their own.

Two Taiwanese IC fabrication companies, however, are bucking this trend away from the standard IDM model. Winbond Electronics Corp. (Winbond, 華?1q?l, www.winbond.com) and Macronix International Co. (Macronix, 旺宏1q?l, www.macronix.com) continue to both design and manufacture their own ICs.

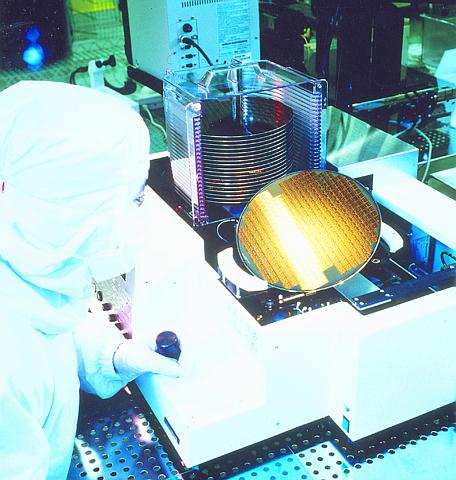

PHOTO: COURTESY OF TSMC

Winbond maintains that the IDM strategy is still the way to go. "We have developed over 100 new products," said Hander Chang, a Winbond spokesman. "We believe that the IDM strategy is still very viable."

Winbond does do some foundry work, however, and also makes DRAM under contract to Toshiba. Products that Winbond has designed include communication ICs, controller ICs, multi-media chipsets, SRAM, EPPROM, flash memory and RISC chips for peripheral devices.

A few years ago, UMC got out of the IDM business to concentrate on pure foundry work. "UMC couldn't compete," said Chang. "We have a very high quality design engineering staff that allows us to stay in the IDM business."

Macronix is Taiwan's largest maker of flash-memory chips. The company is poised to start building its third 8-inch silicon wafer plant in Taiwan during the first quarter of next year with a capital injection of US$967 million.

In addition, Macronix will start construction of a 12-inch silicon-wafer factory in 2001. The company is currently seeking partners to invest in the 12-inch factory.

The company said rising demand for mobile phones, digital cameras and Internet switching products has spurred the growth of the non-volatile IC market since the beginning of the year "Macronix has been seeing a steady inflow of orders for mask ROM and flash memory chips," said Tom Yu, a senior executive at Macronix. "The production lines are operating around the clock to meet demand, and are expected to remain that way until at least the second quarter of next year."

"Macronix has its own 16Mb SRAM design that it is now producing," said one securities analyst. "Currently, they are ramping the product up with volumes of about two to three thousand wafers per month. Capacity is the key in SRAM, since it now is a commodity product. In the short term, due to the earthquake, Macronix is going to have some packaging problems though."

Macronix's Fab 3 will supplement the deficient output of flash memory chips and embedded memory products. The new fab will be devoted to the production of 8-inch wafers. Monthly output is projected at 35,000 units at the initial stage of production.

Yu pointed out that Macronix has been enjoying a 20-30 percent growth in output in flash memory chips over the past two years. Since the prevalence of mobile phones, digital cameras and Internet switches is spurring the demand for the product, faster growth in orders and shipments is anticipated. Macronix therefore signed an OEM contract with Israel's Tower Semiconductor Ltd, which will serve as a second source for Macronix's 8Mb flash memory chip products for five years, beginning in the first quarter of 2000.

Macronix is also branching out into the world of logic. In early October, they reported that they had secured a huge, long-term order of US$2 billion from Nintendo to supply custom designed application specific IC (ASIC) chipsets. The ASIC chipsets will be used mainly in Nintendo's DVD players. Macronix said the company is also negotiating for renewed orders with other leading Japanese companies like NEC, Sony and Toshiba.

"About 60 percent of Macronix sales are to Nintendo," said a secu-rities analyst. "They also are doing foundry for Mitsubishi and VLSI."

In order to meet the growing demand, Macronix has filed an application to float US$43.5 million worth of new shares to raise new funds at a premium of US$0.19 per share. The company will also issue global depository receipts (GDRs) worth US$55 million to boost the output of silicon wafers at its No. 2 plant.

Company executives said the Sept. 21 earthquake in Taiwan and the subsequent power supply blackout had forced a suspension of production operations for 10 days and caused a direct loss of about US$10 million.

But Macronix will not incur an actual loss since it will be compensated by insurance coverage. The company said full manufacturing operations had been resumed as of Oct. 1. It expects sales revenue for October may exceed the original projection of US$64 million because of the continuous surge in semiconductor prices. Winbond also has recovered from the earthquake. In fact, one of its fabs never actually went off line.

Though Winbond and Macronix (along with Taiwan's other fabs) have recovered from the quake, whether their sticking to their IDM strategy can pay off in the long run remains to be seen. Before the quake, TSMC and UMC were already turning away business as the demand for foundry services has soared this year. Even with the lost production due to the quake, TSMC was able to increase its sales in the third quarter by 75 percent on a year-on-year basis.

Al Kramer is a freelance writer based in Hsinchu.

Taiwan’s technology protection rules prohibits Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) from producing 2-nanometer chips abroad, so the company must keep its most cutting-edge technology at home, Minister of Economic Affairs J.W. Kuo (郭智輝) said yesterday. Kuo made the remarks in response to concerns that TSMC might be forced to produce advanced 2-nanometer chips at its fabs in Arizona ahead of schedule after former US president Donald Trump was re-elected as the next US president on Tuesday. “Since Taiwan has related regulations to protect its own technologies, TSMC cannot produce 2-nanometer chips overseas currently,” Kuo said at a meeting of the legislature’s

TECH WAR CONTINUES: The suspension of TSMC AI chips and GPUs would be a heavy blow to China’s chip designers and would affect its competitive edge Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), the world’s biggest contract chipmaker, is reportedly to halt supply of artificial intelligence (AI) chips and graphics processing units (GPUs) made on 7-nanometer or more advanced process technologies from next week in order to comply with US Department of Commerce rules. TSMC has sent e-mails to its Chinese AI customers, informing them about the suspension starting on Monday, Chinese online news outlet Ijiwei.com (愛集微) reported yesterday. The US Department of Commerce has not formally unveiled further semiconductor measures against China yet. “TSMC does not comment on market rumors. TSMC is a law-abiding company and we are

FLEXIBLE: Taiwan can develop its own ground station equipment, and has highly competitive manufacturers and suppliers with diversified production, the MOEA said The Ministry of Economic Affairs (MOEA) yesterday disputed reports that suppliers to US-based Space Exploration Technologies Corp (SpaceX) had been asked to move production out of Taiwan. Reuters had reported on Tuesday last week that Elon Musk-owned SpaceX had asked their manufacturers to produce outside of Taiwan given geopolitical risks and that at least one Taiwanese supplier had been pushed to relocate production to Vietnam. SpaceX’s requests place a renewed focus on the contentious relationship Musk has had with Taiwan, especially after he said last year that Taiwan is an “integral part” of China, sparking sharp criticism from Taiwanese authorities. The ministry said

US President Joe Biden’s administration is racing to complete CHIPS and Science Act agreements with companies such as Intel Corp and Samsung Electronics Co, aiming to shore up one of its signature initiatives before US president-elect Donald Trump enters the White House. The US Department of Commerce has allocated more than 90 percent of the US$39 billion in grants under the act, a landmark law enacted in 2022 designed to rebuild the domestic chip industry. However, the agency has only announced one binding agreement so far. The next two months would prove critical for more than 20 companies still in the process