Singapore-based DBS Bank Ltd yesterday forecast Taiwan’s economy to grow 4.8 percent this year, the fastest among Asia’s newly industrialized economies, as sustained artificial intelligence (AI)-driven demand continues to underpin technology exports despite lingering trade and tariff risks.The outlo

SEASONAL DECLINE: The precision optics manufacturer is soldiering through the traditional slow season for the electronics industry as it looks ahead to diversify

Largan Precision Co (大立光), a major handset camera lens supplier for Apple Inc’s iPhones, yesterday reported a 22.4 percent year-on-year decline in net profit for last quarter and forecast further shipment weakness this month as the industry enters its traditional slow season.Net profit in the fourth

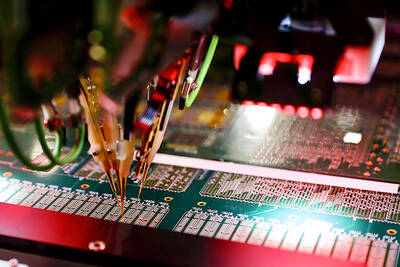

Major semiconductor material and failure analysis services providers Materials Analysis Technology Inc (MA-tek, 閎康) and Msscorps Co (汎銓科技) reported record annual revenue for last year, benefiting from strong demand amid an artificial intelligence (AI) boom.MA-tek’s revenue expanded 8.51 percent annu

Wistron Corp (緯創) yesterday reported revenue last month surged 141.59 percent year-on-year to NT$255.25 billion (US$8.1 billion), a company record for December, driven by strong demand for artificial intelligence (AI) servers.Fourth-quarter revenue grew 1.43 percent to NT$720.94 billion from the sam

China plans to approve some imports of Nvidia Corp’s H200 chips as soon as this quarter, people familiar with the situation said, giving the company access to a critical market.Chinese officials are preparing to allow local companies to buy the chips from Nvidia for select commercial use, the people

Eclat Textile Co (儒鴻) yesterday projected that sales this quarter would be flat or slightly higher than the previous quarter, as brand clients are expected to resume orders after reaching healthier inventory levels.The company’s optimistic outlook is also supported by some orders being deferred from

Taiwan’s stock market set six record highs in 2025 and is aiming to overtake Canada to become the world’s sixth-largest equity market by capitalization, the Taiwan Stock Exchange (TWSE) said yesterday.TWSE data showed that six key indicators reached all-time highs last year: the year-end benchmark i

An attendee waves at the Sentigent Technology ROVAR X3 outdoor companion robot as it is demonstrated during the annual CES in Las Vegas yesterday.

China yesterday announced an anti-dumping probe into imports from Japan of a key chemical used in making semiconductors, a day after it banned the export to the country of goods with potential military uses.The Chinese Ministry of Commerce in Beijing said that "from 2022 to 2024, the quantity of dic

STILL IN LINE: Full-year CPI grew 1.66 percent last year, the lowest in five years and the first time in four years that it was below 2 percent, a DGBAS official said

Taiwan’s inflation remained subdued last month, extending a prolonged period of price stability as falling vegetable and fuel prices continued to offset increases in housing and food-related expenses, the Directorate-General of Budget, Accounting and Statistics (DGBAS) said yesterday.The consumer pr

LOOKING ABROAD: Life insurers had been reluctant to invest in Taiwan, seeking higher-risk opportunities overseas, leading to rising costs, a DPP legislator said

Nan Shan Life Insurance Co’s (南山人壽) exposure to Colombia is NT$62.91 billion (US$2 billion), Financial Supervisory Commission (FSC) Chairman Peng Jin-long (彭金隆) said yesterday, as geopolitical tensions in Latin America drew legislative scrutiny.Peng made the remarks at a meeting of the Legislative Y

PentaPro Materials Inc (宇川精材), which produces metal organic precursors used in advanced chip production, yesterday said it plans to invest NT$3 billion (US$95.17 million) in a new factory in Taiwan to meet rising demand.The company’s main facility is approaching full capacity as customers continue t

Samsung Electronics Co expects memorychip supply shortages to raise prices across the electronics industry, including potentially among its own consumer products.The South Korean company is the world’s largest memory maker, but even its portfolio is not immune to the surging cost of the component es

The Ministry of Economic Affairs yesterday said it expects to sign two additional memorandums of understanding (MOUs) with European countries this year to promote research-and-development (R&D) collaboration under the A+ Corporate Innovation and R&D Enhancement program.The ministry has already signe

Chinese Nationalist Party (KMT) Legislator Lin Te-fu (林德福) yesterday raised concerns that the heavy weighting of contract chipmaker Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) is distorting the performance of the TAIEX.Speaking at a meeting of the Legislative Yuan’s Finance Committee, Lin said

Taiwan’s property market is expected to remain steady but subdued early this year, with transaction volumes staying flat and commercial real estate demand supported mainly by the technology sector, Cushman & Wakefield Taiwan said on Tuesday.The outlook for local property market remains cautious as c

A Sharpa robot deals cards for a game of blackjack during the annual CES trade show in Las Vegas on Tuesday.

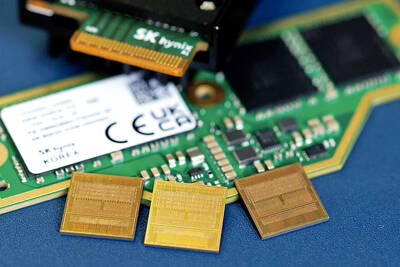

OPPORTUNITY: Supply of conventional DRAM chips tightened after the world’s major memory makers focused on manufacturing chips utilized in AI servers

DRAM chipmaker Nanya Technology Corp (南亞科技) yesterday reported a spike in revenue for last month, as severe supply constraints prompted chip price hikes, almost doubling the company’s annual revenue last year from the previous year. Revenue soared 444.87 percent last month to NT$12.02 billion (US$38

The central bank yesterday unveiled a set of Chinese zodiac commemorative coins for the Year of the Horse, available for online preorder until Monday next week or for purchase at Bank of Taiwan (臺灣銀行) branches from Jan. 29. The central bank said in a statement it aims to sell 90,000 sets of the coin

TREND? After six years of a landlord-driven market, the market could be shifting toward tenants, giving them greater choice and bargaining power, an analyst said

Taiwan’s commercial property market is entering a transitional and increasingly competitive phase this year, as rising office availability, regulatory changes, and demand from artificial intelligence (AI) and semiconductor industries reshape leasing dynamics, consultancy Jones Lang LaSalle Taiwan Lt