Japanese Finance Minister Yoshihiko Noda yesterday sharpened his rhetoric on the yen’s steep gains after the Nikkei Shimbun reported Tokyo may consider selling the yen in solo intervention if speculators drive it up, threatening the economy’s recovery.

Noda told reporters he would respond appropriately as needed, an expression he has not previously used in his campaign to talk the currency down.

Noda was to meet Japanese Prime Minister Naoto Kan and other ministers later.

PHOTO: BLOOMBERG

Market players, however, questioned whether intervention alone would do much to stem a rise that took the yen to a 15-year high against the US dollar and a nine-year peak against the euro on Tuesday, battering share prices in turn.

“The dollar went to ¥83, so the chance of intervention has increased, but it would take more than intervention,” said Kiichi Murashima, an economist at Citigroup Global Markets in Tokyo. “It has to be coupled with easing by the BOJ [Bank of Japan] to have any impact.”

The sharp yen rise and declines in the Nikkei average have made it more likely that the BOJ will further ease its monetary policy before its scheduled rate review on Sept. 6 to Sept. 7, sources said.

However, speculators doubt the BOJ is ready for drastic steps.

“If they really want to do something on the yen ... they have to create inflation expectations,” said Martin Schulz, a senior economist at Fujitsu Research Institute.

“But I don’t think the BOJ would go in that direction,” he said.

The yen has risen nearly 10 percent against the dollar so far this year, with the US currency weighed down by doubts about the US recovery and falling US Treasury yields, along with other global factors that Tokyo has little power to influence.

The Nikkei Shimbun said the ministry would consider intervening unilaterally if its currency rose at a pace of several yen against the dollar in a single day.

The dollar sank as low as ¥83.58 at one point on Tuesday. By midday yesterday, it was around ¥84.40, helped by the Nikkei report.

The euro fell as much as 2.2 percent to ¥105.44 on Tuesday. It was around ¥106.90 yesterday.

Japanese policymakers have tried to stem the yen’s gains with verbal intervention, and Noda expressed Tokyo’s increased irritation with the currency’s climb on Tuesday.

That failed to keep traders from pushing the yen to new highs, and yesterday he toughened his rhetoric.

“When necessary we must respond appropriately,” Noda told reporters when asked about yen moves.

Japan has not acted in the currency market since ending in 2004 a massive yen-selling intervention aimed at keeping a rapid yen rise from deepening deflation and hammering the economy.

Annual growth in Japan’s exports slowed less than expected last month, finance ministry data showed yesterday, due to a pickup in shipments to the US and Europe.

The ministry’s latest figures showed that the value of exports climbed 23.5 percent from a year earlier to ¥5.98 trillion. Exports had expanded 27.7 percent in June and 32.1 percent in May.

The strong yen is responsible for much of the export slowdown, said Kyohei Morita, chief economist at Barclays Capital Japan, in a note to clients.

Exports to China, Japan’s trading partner rose 22.7 percent last month, while those to the US were up 25.9 percent. Shipments to the EU expanded 13.3 percent.

Demand for machinery jumped more than 53 percent, and motor vehicle exports expanded 27.1 percent.

Imports last month rose 15.7 percent to ¥5.18 trillion, resulting in a trade surplus of ¥804.2 billion.

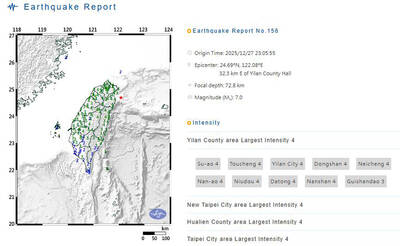

A magnitude 7.0 earthquake struck off Yilan at 11:05pm yesterday, the Central Weather Administration (CWA) said. The epicenter was located at sea, about 32.3km east of Yilan County Hall, at a depth of 72.8km, CWA data showed There were no immediate reports of damage. The intensity of the quake, which gauges the actual effect of a seismic event, measured 4 in Yilan County area on Taiwan’s seven-tier intensity scale, the data showed. It measured 4 in other parts of eastern, northern and central Taiwan as well as Tainan, and 3 in Kaohsiung and Pingtung County, and 2 in Lienchiang and Penghu counties and 1

A car bomb killed a senior Russian general in southern Moscow yesterday morning, the latest high-profile army figure to be blown up in a blast that came just hours after Russian and Ukrainian delegates held separate talks in Miami on a plan to end the war. Kyiv has not commented on the incident, but Russian investigators said they were probing whether the blast was “linked” to “Ukrainian special forces.” The attack was similar to other assassinations of generals and pro-war figures that have either been claimed, or are widely believed to have been orchestrated, by Ukraine. Russian Lieutenant General Fanil Sarvarov, 56, head

SAFETY FIRST: Double the number of police were deployed at the Taipei Marathon, while other cities released plans to bolster public event safety Authorities across Taiwan have stepped up security measures ahead of Christmas and New Year events, following a knife and smoke bomb attack in Taipei on Friday that left four people dead and 11 injured. In a bid to prevent potential copycat incidents, police deployments have been expanded for large gatherings, transport hubs, and other crowded public spaces, according to official statements from police and city authorities. Taipei Mayor Chiang Wan-an (蔣萬安) said the city has “comprehensively raised security readiness” in crowded areas, increased police deployments with armed officers, and intensified patrols during weekends and nighttime hours. For large-scale events, security checkpoints and explosives

‘POLITICAL GAME’: DPP lawmakers said the motion would not meet the legislative threshold needed, and accused the KMT and the TPP of trivializing the Constitution The Legislative Yuan yesterday approved a motion to initiate impeachment proceedings against President William Lai (賴清德), saying he had undermined Taiwan’s constitutional order and democracy. The motion was approved 61-50 by lawmakers from the main opposition Chinese Nationalist Party (KMT) and the smaller Taiwan People’s Party (TPP), who together hold a legislative majority. Under the motion, a roll call vote for impeachment would be held on May 19 next year, after various hearings are held and Lai is given the chance to defend himself. The move came after Lai on Monday last week did not promulgate an amendment passed by the legislature that