The yen strengthened for a fourth week against the US dollar, the longest rally since November, as investors sought a haven on speculation that the economic recovery is slowing.

The Japanese currency gained versus 15 of its 16 major peers as US payrolls fell the first time this year and data showed manufacturing weakened in Europe, China and the US. The euro rose after the European Central Bank (ECB) said it would lend the region’s banks less money than economists forecast, fueling optimism the firms are stronger than expected. US service industries likely slipped last, a report to be released today may show.

“The solid performance of the yen was not surprising,” said Nick Bennenbroek, head of currency strategy at Wells Fargo in New York. “A lot of the US numbers have been disappointing this week — we’re in for slow growth.”

The yen gained 1.7 percent to ¥87.75 per dollar, from ¥89.23 on June 25. It touched ¥86.97, its strongest level since December, on July 1. The Japanese currency rose 0.1 percent versus the euro to ¥110.27. Europe’s shared currency advanced 1.6 percent versus the US dollar to US$1.2566, touching a six-week high of US$1.2612 on Friday.

The euro tumbled to the lowest since 2001 versus Japan’s currency on June 29, ¥107.32, amid concern European banks’ demand for ECB loans when a 12-month facility expired this week would signal weakness in the region’s financial industry.

South Korea’s won and India’s rupee declined the most among Asian currencies this week on concern China’s economic slowdown and Europe’s debt crisis will deter investors from buying emerging-market assets.

The won fell 1.1 percent this week to close at 1,228.75 per US dollar in Seoul. The rupee declined by as much, completing the worst week in more than a month, to 46.79, after a central bank report on June 30 showed the nation’s current-account deficit widened to a record.

The New Taiwan dollar weakened 0.3 percent to NT$32.278 on signs the central bank intervened to help exporters.

Malaysia’s ringgit gained 0.3 percent on Friday and strengthened 0.8 percent this week to 3.2250 per US dollar.

Yuan forwards completed a fourth weekly gain. Twelve-month non-deliverable forwards jumped 0.2 percent to 6.6690 per US dollar and strengthened 0.14 percent in the week. The contracts reflect bets that the yuan will appreciate 1.5 percent in one year.

China’s central bank on Friday set the reference rate for yuan trading at 6.7720, 0.2 percent stronger than the previous day’s fixing.

Thailand’s baht, which was little changed this week, was at 32.41 per US dollar on Friday.

Elsewhere, Indonesia’s rupiah rose 0.1 percent this week to 9,063, for its third weekly gain. The Philippine peso traded at 46.49 against the US dollar and was down 0.1 percent from June 25.

SECURITY: The purpose for giving Hong Kong and Macau residents more lenient paths to permanent residency no longer applies due to China’s policies, a source said The government is considering removing an optional path to citizenship for residents from Hong Kong and Macau, and lengthening the terms for permanent residence eligibility, a source said yesterday. In a bid to prevent the Chinese Communist Party (CCP) from infiltrating Taiwan through immigration from Hong Kong and Macau, the government could amend immigration laws for residents of the territories who currently receive preferential treatment, an official familiar with the matter speaking on condition of anonymity said. The move was part of “national security-related legislative reform,” they added. Under the amendments, arrivals from the Chinese territories would have to reside in Taiwan for

CRITICAL MOVE: TSMC’s plan to invest another US$100 billion in US chipmaking would boost Taiwan’s competitive edge in the global market, the premier said The government would ensure that the most advanced chipmaking technology stays in Taiwan while assisting Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) in investing overseas, the Presidential Office said yesterday. The statement follows a joint announcement by the world’s largest contract chipmaker and US President Donald Trump on Monday that TSMC would invest an additional US$100 billion over the next four years to expand its semiconductor manufacturing operations in the US, which would include construction of three new chip fabrication plants, two advanced packaging facilities, and a research and development center. The government knew about the deal in advance and would assist, Presidential

‘DANGEROUS GAME’: Legislative Yuan budget cuts have already become a point of discussion for Democrats and Republicans in Washington, Elbridge Colby said Taiwan’s fall to China “would be a disaster for American interests” and Taipei must raise defense spending to deter Beijing, US President Donald Trump’s pick to lead Pentagon policy, Elbridge Colby, said on Tuesday during his US Senate confirmation hearing. The nominee for US undersecretary of defense for policy told the Armed Services Committee that Washington needs to motivate Taiwan to avoid a conflict with China and that he is “profoundly disturbed” about its perceived reluctance to raise defense spending closer to 10 percent of GDP. Colby, a China hawk who also served in the Pentagon in Trump’s first team,

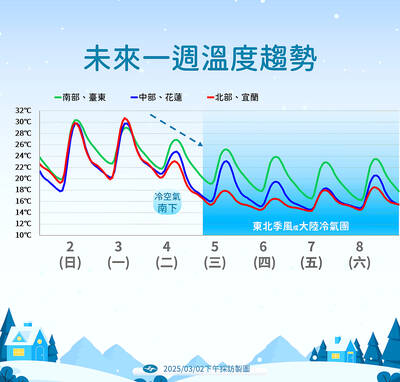

The arrival of a cold front tomorrow could plunge temperatures into the mid-teens, the Central Weather Administration (CWA) said. Temperatures yesterday rose to 28°C to 30°C in northern and eastern Taiwan, and 32°C to 33°C in central and southern Taiwan, CWA data showed. Similar but mostly cloudy weather is expected today, the CWA said. However, the arrival of a cold air mass tomorrow would cause a rapid drop in temperatures to 15°C cooler than the previous day’s highs. The cold front, which is expected to last through the weekend, would bring steady rainfall tomorrow, along with multiple waves of showers