US stock markets, beaten down by negative economic reports, will have a holiday-shortened week to regroup before the company earnings season gets underway.

Over the past week, the Dow Jones Industrial Average shed 4.51 percent, closing on Friday at 9,686.48 points, its lowest level since Oct. 5.

The tech-heavy NASDAQ composite index dropped 5.92 percent to 2,091.79 points. The Standard & Poor’s 500 index, a broad measure of the markets, slumped 5.03 percent to 1,022.58 points.

US markets will be closed tomorrow in observance of the Independence Day holiday.

Only one key economic report is due in the holiday-shortened week: the Institute for Supply Management’s index on activity in the services sector, on Tuesday.

The major market indices spent this week mired in red, under pressure from a slew of poor economic indicators.

“It was one ugly week, and the recent data raises serious questions about the overall state of the economy,” Ryan Detrick at Schaeffer’s Investment Research said.

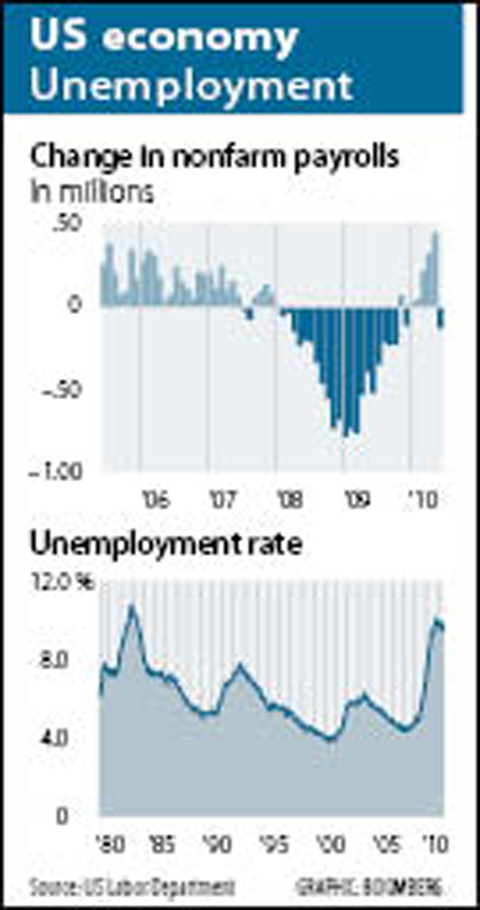

The US Labor Department’s jobs report on Friday did not help to dampen recovery fears.

The economy shed 125,000 jobs, more than expected, while the unemployment rate fell to 9.5 percent from 9.7 percent as more than a half million workers exited the workforce.

Most analysts had expected it to rise to 9.8 percent.

“The unemployment rate dropped because the labor force shrank even more rapidly as discouraged workers stopped looking for work,” analysts at Societe Generale said.

Patrick O’Hare, chief market analyst at Briefing.com, said that several indicators are flashing warning signs that an economic slowdown is on the way.

“We see a slowdown coming, but we do not see another recession,” he said. “The feeling of negativity in the market is palpable, which is why one needs to respect the possibility of a counter-trend rally of decent size in the near term that is fueled by short-covering activity.”

Lindsay Piegza at FTN Financial called last month “a pretty bad month.”

“We basically stalled. We’re not falling off a cliff but we slowed from the two previous months,” Piegza said.

The blue-chip Dow plunged 10 percent in the April-June period, the first quarterly decline since the indices rebounded from March last year’s lows.

“This does not bode well for starting out into the second half of the year. We’ve initiated a new trend,” Piegza added.

Investors will have the week to prepare for the unofficial start of earnings season on July 12, when Alcoa reports results.

“With corporate balance sheets — particularly stateside — in good shape and with dividend trends on the rise, opportunities for investors to be paid while they wait appear attractive,” John Stoltzfus of Ticonderoga Securities said.

“The message looks clear: Spare the party hats for now, keep the seat belts fastened, make shopping lists and keep an eye out for babies that’ve been and will continue to be thrown out with the bath water on down days,” Stoltzfus said.

AT RISK: The council reiterated that people should seriously consider the necessity of visiting China, after Beijing passed 22 guidelines to punish ‘die-hard’ separatists The Mainland Affairs Council (MAC) has since Jan. 1 last year received 65 petitions regarding Taiwanese who were interrogated or detained in China, MAC Minister Chiu Chui-cheng (邱垂正) said yesterday. Fifty-two either went missing or had their personal freedoms restricted, with some put in criminal detention, while 13 were interrogated and temporarily detained, he said in a radio interview. On June 21 last year, China announced 22 guidelines to punish “die-hard Taiwanese independence separatists,” allowing Chinese courts to try people in absentia. The guidelines are uncivilized and inhumane, allowing Beijing to seize assets and issue the death penalty, with no regard for potential

STILL COMMITTED: The US opposes any forced change to the ‘status quo’ in the Strait, but also does not seek conflict, US Secretary of State Marco Rubio said US President Donald Trump’s administration released US$5.3 billion in previously frozen foreign aid, including US$870 million in security exemptions for programs in Taiwan, a list of exemptions reviewed by Reuters showed. Trump ordered a 90-day pause on foreign aid shortly after taking office on Jan. 20, halting funding for everything from programs that fight starvation and deadly diseases to providing shelters for millions of displaced people across the globe. US Secretary of State Marco Rubio, who has said that all foreign assistance must align with Trump’s “America First” priorities, issued waivers late last month on military aid to Israel and Egypt, the

‘UNITED FRONT’ FRONTS: Barring contact with Huaqiao and Jinan universities is needed to stop China targeting Taiwanese students, the education minister said Taiwan has blacklisted two Chinese universities from conducting academic exchange programs in the nation after reports that the institutes are arms of Beijing’s United Front Work Department, Minister of Education Cheng Ying-yao (鄭英耀) said in an exclusive interview with the Chinese-language Liberty Times (the Taipei Times’ sister paper) published yesterday. China’s Huaqiao University in Xiamen and Quanzhou, as well as Jinan University in Guangzhou, which have 600 and 1,500 Taiwanese on their rolls respectively, are under direct control of the Chinese government’s political warfare branch, Cheng said, citing reports by national security officials. A comprehensive ban on Taiwanese institutions collaborating or

France’s nuclear-powered aircraft carrier and accompanying warships were in the Philippines yesterday after holding combat drills with Philippine forces in the disputed South China Sea in a show of firepower that would likely antagonize China. The Charles de Gaulle on Friday docked at Subic Bay, a former US naval base northwest of Manila, for a break after more than two months of deployment in the Indo-Pacific region. The French carrier engaged with security allies for contingency readiness and to promote regional security, including with Philippine forces, navy ships and fighter jets. They held anti-submarine warfare drills and aerial combat training on Friday in