Most Asian stocks fell, sending the MSCI Asia-Pacific Index to its third weekly decline in four as a slump in US housing sales triggered concern growth in the world’s biggest economy is faltering.

James Hardie Industries SE, the biggest seller of home siding in the US, declined 2.4 percent in Sydney. Canon Inc, which got about 28 percent of sales in the Americas last year, dropped 6.6 percent in Tokyo. Elpida Memory Inc, the world’s third-biggest maker of computer memory chips, and Tokyo Electron Ltd, the world’s second-biggest market of semiconductor equipment, slumped following brokerage downgrades.

“People are somewhat circumspect about the prospects for global growth,” said Tim Schroeders, who helps manage about US$1.1 billion at Pengana Capital Ltd in Melbourne.

“Doubts about how strong the US recovery is and its trajectory, particularly for the second half of 2010, have increased,” he said.

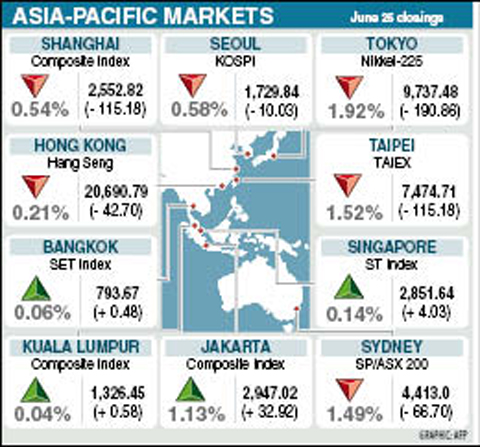

The MSCI Asia-Pacific Index dropped 0.5 percent. It has lost 4 percent this year on concern Greece and other European countries will struggle to curb their budget deficits and repay debt.

Australia’s S&P/ASX 200 Index dropped 3.1 percent, the most among major benchmark indexes in the Asia-Pacific region, as Macquarie Group Ltd, Australia’s biggest investment bank, declined 11 percent after saying increasingly uncertain markets are weighing on some parts of its business.

Japan’s Nikkei 225 Stock Average declined 2.6 percent as exporters dropped after the yen strengthened for a third week.

China’s Shanghai Composite Index climbed 1.6 percent and Hong Kong’s Hang Seng Index rose 2 percent, bucking the regional decline, after the People’s Bank of China signaled an end to the currency’s two-year-old peg to the dollar one week before a G20 Summit.

Taiwan’s TAIEX index declined 1.5 percent, or 115.18, on Friday to close at 7,474.71, after the central bank on Thursday unexpectedly raised interest rates for the first time since 2008 and told lenders to cap home loans. The index dropped 18.4 points this week.

Taiwanese property stocks declined, with the 35-member construction sub-index dropping 3.7 percent, the most since April 19. Farglory Land Development Co (遠雄建設), the nation’s biggest property developer by market value, slid 4.8 percent to NT$63, the most since April 19. Cathay Real Estate Development Co (國泰建設), the second-largest developer, fell 2.1 percent to NT$11.55, the lowest since June 18.

Chang Hwa Commercial Bank (彰化銀行) climbed 4.9 percent to NT$14.05, the most since June 24 last year, after the nation’s financial regulator approved its application to set up a branch in Kunshan, China.

Powerchip Technology Corp (力晶科技), a maker of computer-memory chips, lost 1.6 percent to NT$4.26 after its board approved plans to sell between 650 million and 800 million new shares locally and overseas, according to its stock exchange filing on Thursday.

Other markets on Friday:

Manila ended 0.55 percent, or 18.49 points, higher from Thursday at 3,352.46.

Wellington slipped 0.50 percent, or 15.36 points, from Thursday to 3,034.11.

Mumbai fell 0.88 percent, or 155.71 points, from Thursday to 17,574.53.

DISCONTENT: The CCP finds positive content about the lives of the Chinese living in Taiwan threatening, as such video could upset people in China, an expert said Chinese spouses of Taiwanese who make videos about their lives in Taiwan have been facing online threats from people in China, a source said yesterday. Some young Chinese spouses of Taiwanese make videos about their lives in Taiwan, often speaking favorably about their living conditions in the nation compared with those in China, the source said. However, the videos have caught the attention of Chinese officials, causing the spouses to come under attack by Beijing’s cyberarmy, they said. “People have been messing with the YouTube channels of these Chinese spouses and have been harassing their family members back in China,”

The Central Weather Administration (CWA) yesterday said there are four weather systems in the western Pacific, with one likely to strengthen into a tropical storm and pose a threat to Taiwan. The nascent tropical storm would be named Usagi and would be the fourth storm in the western Pacific at the moment, along with Typhoon Yinxing and tropical storms Toraji and Manyi, the CWA said. It would be the first time that four tropical cyclones exist simultaneously in November, it added. Records from the meteorology agency showed that three tropical cyclones existed concurrently in January in 1968, 1991 and 1992.

GEOPOLITICAL CONCERNS: Foreign companies such as Nissan, Volkswagen and Konica Minolta have pulled back their operations in China this year Foreign companies pulled more money from China last quarter, a sign that some investors are still pessimistic even as Beijing rolls out stimulus measures aimed at stabilizing growth. China’s direct investment liabilities in its balance of payments dropped US$8.1 billion in the third quarter, data released by the Chinese State Administration of Foreign Exchange showed on Friday. The gauge, which measures foreign direct investment (FDI) in China, was down almost US$13 billion for the first nine months of the year. Foreign investment into China has slumped in the past three years after hitting a record in 2021, a casualty of geopolitical tensions,

‘SOMETHING SPECIAL’: Donald Trump vowed to reward his supporters, while President William Lai said he was confident the Taiwan-US partnership would continue Donald Trump was elected the 47th president of the US early yesterday morning, an extraordinary comeback for a former president who was convicted of felony charges and survived two assassination attempts. With a win in Wisconsin, Trump cleared the 270 electoral votes needed to clinch the presidency. As of press time last night, The Associated Press had Trump on 277 electoral college votes to 224 for US Vice President Kamala Harris, the Democratic Party’s nominee, with Alaska, Arizona, Maine, Michigan and Nevada yet to finalize results. He had 71,289,216 votes nationwide, or 51 percent, while Harris had 66,360,324 (47.5 percent). “We’ve been through so