Asian stocks rose this week, driving the MSCI Asia-Pacific Index to its highest level in 11 weeks as economic reports spurred confidence in the global recovery, boosting commodity prices.

Datong Coal Industry Co (大同煤業股份), China’s third-largest coal producer, jumped 14 percent in Shanghai as an index of the country’s manufacturing industry rose last month. Lihir Gold Ltd soared 31 percent in Sydney after rejecting a bid from Australia’s largest gold producer. Dai-ichi Life Insurance Co, which completed the world’s largest initial public offering in two years, rose 1.6 percent on its first full day of trading in Tokyo. Hyundai Motor Co jumped 10 percent in Seoul, as South Korean government’s exports report beat economist estimates.

“Growth is starting to look more and more entrenched,” said Nader Naeimi, an investment strategist in Sydney at AMP Capital Investors, which oversees about US$90 billion globally. “Investors are now looking for the recovery to turn into an outright expansion.”

The MSCI Asia-Pacific Index advanced 1.7 percent this week as economic reports from the US and Asia showed signs of global recovery, and as commodity prices rose.

Japan’s Nikkei 225 Stock Average rose 2.6 percent this week to its highest close since October 2008, as the yen continued to weaken from the previous week, boosting the earnings outlook for companies dependent on overseas demand.

Hong Kong’s Hang Seng Index gained 2.3 percent this week, and China’s Shanghai Composite Index advanced 3.2 percent. Australia’s S&P/ASX 200 Index climbed 0.2 percent, while South Korea’s KOSPI index rose 1.5 percent. Markets in Australia, Hong Kong, New Zealand, Singapore, India, the Philippines and Indonesia were closed on April 2 for holidays.

China’s Purchasing Managers’ Index rose to a seasonally adjusted 55.1 from 52 in February, according to Li & Fung Group (利豐), a Hong Kong-based company that releases data for the Federation of Logistics and Purchasing. The figure was in line with the median estimate in a Bloomberg News survey of 13 economists. Readings above 50 indicate expansion.

“The economy is in a good shape and growth is still gaining momentum,” said Dai Ming, a fund manager at Shanghai Kingsun Investment Management & Consulting Co. “We are definitely in a growth cycle.”

The MSCI Asia-Pacific Index climbed 3.9 percent last quarter, compared with 2.7 percent for the MSCI World Index, as economic data improved. The Asian gauge’s increase was its fourth-straight quarterly advance, lifting the average price of companies to 1.66 times corporate net worth, the highest level since September.

Taiwanese share prices closed higher on Friday, with the TAIEX moving up 12.84 points, or 0.16 percent, from Thursday to close at 8,025.93.

The local bourse opened at 8,046.29 and fluctuated between a low of 8,021.91 and a high of 8,050.99 during the day’s trading. Market turnover totaled NT$108.12 billion (US$3.41 billion).

Five of the eight major stock categories lost ground, with textile issues dropping the most at 0.36 percent. Construction shares plunged 0.25 percent, paper and pulp issues were down 0.19 percent, foodstuff shares moved down 0.05 percent and banking and financial stocks were down 0.02 percent.

Markets were closed for a public holiday in Australia, Hong Kong, India, Indonesia, New Zealand, the Philippines and Singapore.

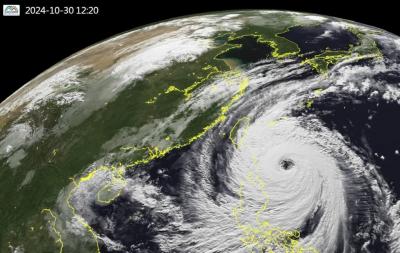

Super Typhoon Kong-rey is the largest cyclone to impact Taiwan in 27 years, the Central Weather Administration (CWA) said today. Kong-rey’s radius of maximum wind (RMW) — the distance between the center of a cyclone and its band of strongest winds — has expanded to 320km, CWA forecaster Chang Chun-yao (張竣堯) said. The last time a typhoon of comparable strength with an RMW larger than 300km made landfall in Taiwan was Typhoon Herb in 1996, he said. Herb made landfall between Keelung and Suao (蘇澳) in Yilan County with an RMW of 350km, Chang said. The weather station in Alishan (阿里山) recorded 1.09m of

NO WORK, CLASS: President William Lai urged people in the eastern, southern and northern parts of the country to be on alert, with Typhoon Kong-rey approaching Typhoon Kong-rey is expected to make landfall on Taiwan’s east coast today, with work and classes canceled nationwide. Packing gusts of nearly 300kph, the storm yesterday intensified into a typhoon and was expected to gain even more strength before hitting Taitung County, the US Navy’s Joint Typhoon Warning Center said. The storm is forecast to cross Taiwan’s south, enter the Taiwan Strait and head toward China, the Central Weather Administration (CWA) said. The CWA labeled the storm a “strong typhoon,” the most powerful on its scale. Up to 1.2m of rainfall was expected in mountainous areas of eastern Taiwan and destructive winds are likely

The Central Weather Administration (CWA) yesterday at 5:30pm issued a sea warning for Typhoon Kong-rey as the storm drew closer to the east coast. As of 8pm yesterday, the storm was 670km southeast of Oluanpi (鵝鑾鼻) and traveling northwest at 12kph to 16kph. It was packing maximum sustained winds of 162kph and gusts of up to 198kph, the CWA said. A land warning might be issued this morning for the storm, which is expected to have the strongest impact on Taiwan from tonight to early Friday morning, the agency said. Orchid Island (Lanyu, 蘭嶼) and Green Island (綠島) canceled classes and work

KONG-REY: A woman was killed in a vehicle hit by a tree, while 205 people were injured as the storm moved across the nation and entered the Taiwan Strait Typhoon Kong-rey slammed into Taiwan yesterday as one of the biggest storms to hit the nation in decades, whipping up 10m waves, triggering floods and claiming at least one life. Kong-rey made landfall in Taitung County’s Chenggong Township (成功) at 1:40pm, the Central Weather Administration (CWA) said. The typhoon — the first in Taiwan’s history to make landfall after mid-October — was moving north-northwest at 21kph when it hit land, CWA data showed. The fast-moving storm was packing maximum sustained winds of 184kph, with gusts of up to 227kph, CWA data showed. It was the same strength as Typhoon Gaemi, which was the most