Asian stocks rose for a fourth week after the US Federal Reserve pledged to keep borrowing costs near zero for an “extended period” and as the Bank of Japan (BOJ) expanded a bank-loan program.

Sony Corp, which makes Bravia televisions and the PlayStation 3 video-game system, gained 4.1 percent. Sony Financial Holdings Inc, a subsidiary, surged 12 percent after saying it will boost bond holdings. Kia Motors Corp, South Korea’s No. 2 automaker, jumped 14 percent in Seoul on speculation profit will beat estimates. BYD Co (比亞迪), a Chinese carmaker, advanced 11 percent in Hong Kong after brokerages lifted earnings forecasts for the company.

“It’s clear that the Fed is going to keep rates very accommodative to stimulate the growth recovery,” said Chris Hall, who helps manage about US$3.3 billion at Argo Investments in Adelaide, Australia. “The million-dollar question is the consumer’s ability to step up to the plate to support the economy.”

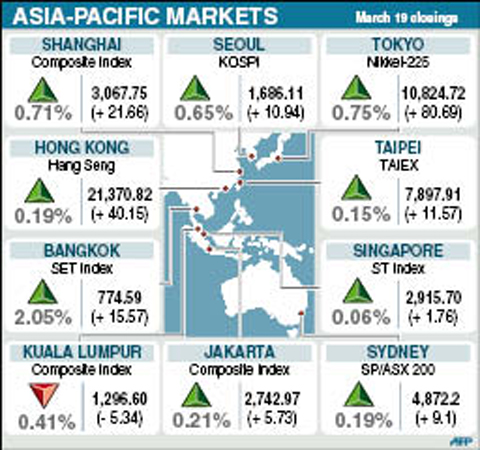

The MSCI Asia-Pacific Index climbed 1.4 percent to 124.92 this week. Stocks have rallied in the past six weeks as concern over monetary tightening and Greece’s debt receded, and as companies reported better-than-expected earnings.

Japan’s Nikkei 225 Stock Average rose 0.7 percent this week, compared with increases of 1.1 percent for Australia’s S&P/ASX 200 Index, 1.4 percent for South Korea’s Kospi index and 0.8 percent for Hong Kong’s Hang Seng Index. The Shanghai Composite Index advanced 1.8 percent.

The MSCI Asia-Pacific Index rose this week after the US Federal Reserve said it will leave its benchmark interest rate near zero to safeguard the economic recovery. Separately, a US Labor Department report showed first-time applications for jobless benefits dropped in the week ended March 13, while the Federal Reserve Bank of Philadelphia’s general economic index rose this month to the highest level this year.

“The US economy is improving day by day, and so is the global economy,” said Hiroichi Nishi, an equities manager at Nikko Cordial Securities Inc in Tokyo. “People are beginning to expect better corporate earnings.”

The BOJ on Wednesday doubled a lending program aimed at stoking credit growth after the government stepped up calls to arrest deflation that’s hampering the economic recovery. It also held the overnight lending rate at 0.1 percent.

“It’s good that the bank is showing its willingness to cooperate with the government to curb deflation,” said Hiroshi Morikawa, a senior strategist at MU Investments Co, which manages the equivalent of US$14 billion in Tokyo.

The MSCI Asia-Pacific Index has gained about 9.5 percent from its lowest level in more than two months on Feb. 8, as better-than-estimated US employment data and a pledge of support from French President Nicolas Sarkozy for debt-stricken Greece bolstered confidence in the global recovery. The average price of stocks in the index has risen to about 19 times estimated earnings from 18 at last month’s low.

In other markets on Friday:

Singapore was flat, ending 1.76 points higher from Thursday at 2,915.70.

Manila fell 0.12 percent, or 3.72 points, from Thursday to 3,097.23.

Wellington closed 0.30 percent, or 9.72 points, higher from Thursday at 3,230.40.

Mumbai rose 0.34 percent, or 58.97 points, from Thursday to end at 17,578.23.

CLASH OF WORDS: While China’s foreign minister insisted the US play a constructive role with China, Rubio stressed Washington’s commitment to its allies in the region The Ministry of Foreign Affairs (MOFA) yesterday affirmed and welcomed US Secretary of State Marco Rubio statements expressing the US’ “serious concern over China’s coercive actions against Taiwan” and aggressive behavior in the South China Sea, in a telephone call with his Chinese counterpart. The ministry in a news release yesterday also said that the Chinese Ministry of Foreign Affairs had stated many fallacies about Taiwan in the call. “We solemnly emphasize again that our country and the People’s Republic of China are not subordinate to each other, and it has been an objective fact for a long time, as well as

‘CHARM OFFENSIVE’: Beijing has been sending senior Chinese officials to Okinawa as part of efforts to influence public opinion against the US, the ‘Telegraph’ reported Beijing is believed to be sowing divisions in Japan’s Okinawa Prefecture to better facilitate an invasion of Taiwan, British newspaper the Telegraph reported on Saturday. Less than 750km from Taiwan, Okinawa hosts nearly 30,000 US troops who would likely “play a pivotal role should Beijing order the invasion of Taiwan,” it wrote. To prevent US intervention in an invasion, China is carrying out a “silent invasion” of Okinawa by stoking the flames of discontent among locals toward the US presence in the prefecture, it said. Beijing is also allegedly funding separatists in the region, including Chosuke Yara, the head of the Ryukyu Independence

‘VERY SHALLOW’: The center of Saturday’s quake in Tainan’s Dongshan District hit at a depth of 7.7km, while yesterday’s in Nansai was at a depth of 8.1km, the CWA said Two magnitude 5.7 earthquakes that struck on Saturday night and yesterday morning were aftershocks triggered by a magnitude 6.4 quake on Tuesday last week, a seismologist said, adding that the epicenters of the aftershocks are moving westward. Saturday and yesterday’s earthquakes occurred as people were preparing for the Lunar New Year holiday this week. As of 10am yesterday, the Central Weather Administration (CWA) recorded 110 aftershocks from last week’s main earthquake, including six magnitude 5 to 6 quakes and 32 magnitude 4 to 5 tremors. Seventy-one of the earthquakes were smaller than magnitude 4. Thirty-one of the aftershocks were felt nationwide, while 79

GOLDEN OPPORTUNITY: Taiwan must capitalize on the shock waves DeepSeek has sent through US markets to show it is a tech partner of Washington, a researcher said China’s reported breakthrough in artificial intelligence (AI) would prompt the US to seek a stronger alliance with Taiwan and Japan to secure its technological superiority, a Taiwanese researcher said yesterday. The launch of low-cost AI model DeepSeek (深度求索) on Monday sent US tech stocks tumbling, with chipmaker Nvidia Corp losing 16 percent of its value and the NASDAQ falling 612.46 points, or 3.07 percent, to close at 19,341.84 points. On the same day, the Philadelphia Stock Exchange Semiconductor Sector index dropped 488.7 points, or 9.15 percent, to close at 4,853.24 points. The launch of the Chinese chatbot proves that a competitor can