Renewed fears on the US economic recovery have shaken confidence on Wall Street, where stocks registered a fourth straight weekly decline, leaving the market looking for a catalyst to emerge from its malaise.

In the week to Friday, market action was volatile, with the Dow Jones Industrial Average losing 0.55 percent to 10,012.23.

Action was especially tense on Friday, with the blue-chip index plunging to as low as 9,835 before snapping back to hold above the key psychological level of 10,000.

The technology-dominated NASDAQ composite slipped 0.29 percent for the week to 2,141.12 and the broad Standard & Poor’s 500 index shed 0.72 percent to 1,066.19, amid roller-coaster market action.

Several rally attempts over the past week have faltered in the wake of disappointing US economic news and growing concerns about debt problems in Greece that appear to be spreading to other eurozone members.

“You are looking at a slow upturn in the eurozone ... which makes it harder for the rest of the world to grow,” said Jay Bryson, economist at Wells Fargo.

“If this crisis becomes more generalized you may see stock markets continue to retreat, with credit markets getting tougher. In the worst case scenario we could have another downturn,” Bryson said.

Kent Engelke, chief economic strategist at Capitol Securities Management, also cited fears of faltering global growth.

“Markets are concerned about massive deficits and the perceived lack of political and social will to rein in expenditures of the PIGS countries — Portugal, Italy, Greece and Spain,” he said.

Closer to home, markets failed to take comfort from US economic data including a disappointing report showing a loss of a further 20,000 jobs last month.

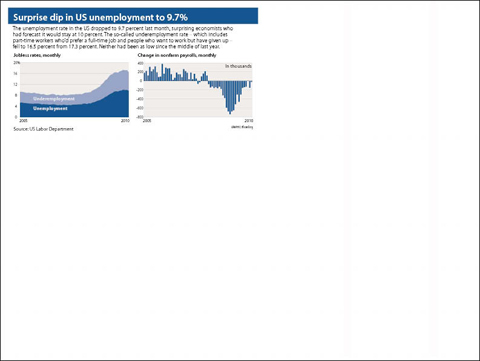

The monthly US Labor Department report contained mixed signals including a drop in the unemployment rate to 9.7 percent from 10 percent in December. However, many said the job market was still far from recovery.

“Taking a big picture viewpoint, the US labor market remains fundamentally weak,” said David Rosenberg, chief economist and strategist at Gluskin Sheff & Associates.

“Despite the clarion calls for recovery from the legions of Wall Street economists and strategists, the reality is that labor market gaps remain very wide; here we are more than two years after the recession officially started and the ranks of the long-term unemployed continue to swell,” Rosenberg added.

Others said the crisis was not quite over yet.

“It remains clear to us that the world simply cannot emerge from the worst financial crisis in modern history without working up a sweat and shaking investors out of any complacency that develops along the way to recovery,” John Stoltzfus at Ticonderoga Securities said.

Some analysts argue that the market is undergoing a normal “correction” and would steady once the selling pressure is exhausted.

“The correcting trend continues, and now that it is into an oversold condition, we watch for signs of a bottom,” Bob Dickey at RBC Wealth Management said. “Given the rapid increase in the bearish sentiment, we are more inclined to believe the correction will end in a selling climax, potentially sparked by a news event.”

Philip Orlando, chief equity strategist at Federated Investors, said “market psychology remains decidedly fragile and negative, as we now find ourselves mired in a sharp correction.”

However, he said he anticipates a recovery fueled by low interest rates, a steadying economy, solid corporate results and the relatively cheap valuation of stocks.

Bonds were favored as a haven from the stock market turmoil. The yield on the 10-year Treasury bond fell to 3.546 percent from 3.609 percent a week earlier and that on the 30-year bond dropped to 4.493 percent from 4.510 percent.

In the coming week, the key economic data will be Thursday’s release of US retail sales figures, while more earnings reports are due, notably from Walt Disney and Coca-Cola.

US President Donald Trump yesterday announced sweeping "reciprocal tariffs" on US trading partners, including a 32 percent tax on goods from Taiwan that is set to take effect on Wednesday. At a Rose Garden event, Trump declared a 10 percent baseline tax on imports from all countries, with the White House saying it would take effect on Saturday. Countries with larger trade surpluses with the US would face higher duties beginning on Wednesday, including Taiwan (32 percent), China (34 percent), Japan (24 percent), South Korea (25 percent), Vietnam (46 percent) and Thailand (36 percent). Canada and Mexico, the two largest US trading

AIR SUPPORT: The Ministry of National Defense thanked the US for the delivery, adding that it was an indicator of the White House’s commitment to the Taiwan Relations Act Deputy Minister of National Defense Po Horng-huei (柏鴻輝) and Representative to the US Alexander Yui on Friday attended a delivery ceremony for the first of Taiwan’s long-awaited 66 F-16C/D Block 70 jets at a Lockheed Martin Corp factory in Greenville, South Carolina. “We are so proud to be the global home of the F-16 and to support Taiwan’s air defense capabilities,” US Representative William Timmons wrote on X, alongside a photograph of Taiwanese and US officials at the event. The F-16C/D Block 70 jets Taiwan ordered have the same capabilities as aircraft that had been upgraded to F-16Vs. The batch of Lockheed Martin

GRIDLOCK: The National Fire Agency’s Special Search and Rescue team is on standby to travel to the countries to help out with the rescue effort A powerful earthquake rocked Myanmar and neighboring Thailand yesterday, killing at least three people in Bangkok and burying dozens when a high-rise building under construction collapsed. Footage shared on social media from Myanmar’s second-largest city showed widespread destruction, raising fears that many were trapped under the rubble or killed. The magnitude 7.7 earthquake, with an epicenter near Mandalay in Myanmar, struck at midday and was followed by a strong magnitude 6.4 aftershock. The extent of death, injury and destruction — especially in Myanmar, which is embroiled in a civil war and where information is tightly controlled at the best of times —

China's military today said it began joint army, navy and rocket force exercises around Taiwan to "serve as a stern warning and powerful deterrent against Taiwanese independence," calling President William Lai (賴清德) a "parasite." The exercises come after Lai called Beijing a "foreign hostile force" last month. More than 10 Chinese military ships approached close to Taiwan's 24 nautical mile (44.4km) contiguous zone this morning and Taiwan sent its own warships to respond, two senior Taiwanese officials said. Taiwan has not yet detected any live fire by the Chinese military so far, one of the officials said. The drills took place after US Secretary