Wall Street, hesitant about the pace of recovery, will receive a fresh batch of corporate earnings and economic data this week that may help set the tone for a skittish market.

The choppy trade of the past week highlights a lack of confidence in the economic recovery and mixed signals from earnings and economic data, analysts said.

The market will open a holiday-shortened week on Tuesday after the Martin Luther King observance, with a handful of economic reports expected, including on housing starts and wholesale prices.

“That will leave the focus squarely on corporate earnings results,” said Avery Shenfeld at CIBC World Markets.

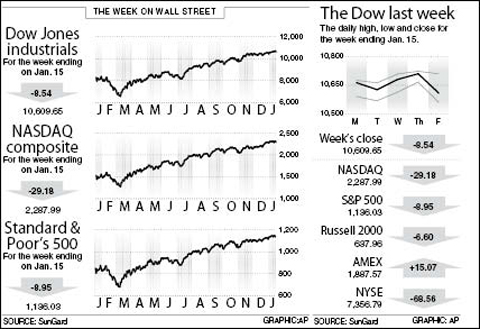

Over the week to Friday, the Dow Jones Industrial Average lost a modest 0.08 percent to 10,609.65, after hitting fresh 15-month highs earlier in the week.

The technology-heavy NASDAQ composite dropped 1.26 percent to 2,287.99 and the broad Standard & Poor’s 500 index shed 0.78 percent to 1,136.03.

The market saw roller-coaster action last week, with disappointment over weak results from aluminum giant Alcoa on Monday souring the mood at the start of the corporate earnings season.

This was offset in part by robust profits reported by chipmaker Intel Corp and banking giant JPMorgan Chase, which “should help revive investor confidence that the global economy is turning around,” said Fred Dickson, market strategist at DA Davidson & Co.

Yet some analysts say it will be harder to push the market higher in the wake of the stunning 60 percent gains since last March, in anticipation of a recovery in economic and profit growth.

Kent Engelke, chief economic strategist at Capitol Securities Management, said he sees doubts about whether the economy can stand on its own when stimulus from government spending and ultra-low interest rates ends.

“I think equities will experience a period of tough sledding as it will take time for investors to gain confidence the world will not come to an end as the economy begins to be weaned off of its high octane energy,” he said.

But Stephen Auth at Federated Investors said many market players are too pessimistic.

“Our positive economic outlook continues to proceed virtually on schedule,” he said.

“The all-important housing market bottomed four to five months ago, and somewhere in the future we expect dramatic improvements in home construction to try to catch up with nearly four years of pent-up demand,” he said.

Auth said the labor market is close to job creation and consumer spending “has begun to rebound.”

“Given all this, we remain above-consensus for economic growth this year. Importantly, evidence suggests that this strong cyclical growth could last well into 2011,” he said.

Robert Kavcic at BMO Capital Markets said traders may have pushed the stock market up too far in anticipation of the earnings recovery.

“Earnings expectations have continued to rise and sentiment has made a significant move into the bullish camp,” he said.

“While stocks still have a strong profit recovery to feast on, they might just need a little time to digest,” he said.

Hugh Johnson at Johnson Illington Advisors said too much cannot be read into the past week’s action.

“What seems to be happening is that the stock market this year continues to advance but the gusto has been taken out of the market,” he said.

“It’s too early in the earnings season to reach any conclusion about earnings, and as a result the investors have paused until they have a better idea. Participants are looking for signs of sustainable growth going forward. It is not enough anymore to beat [forecasts] on the bottom line,” Johnson said.

Bonds rallied in the week.

The yield on the 10-year Treasury bond fell to 3.6767 percent from 3.808 percent a week earlier and that on the 30-year bond dropped to 4.575 percent against 4.695 percent. Bond yields and prices move in opposite directions.

SECURITY: As China is ‘reshaping’ Hong Kong’s population, Taiwan must raise the eligibility threshold for applications from Hong Kongers, Chiu Chui-cheng said When Hong Kong and Macau citizens apply for residency in Taiwan, it would be under a new category that includes a “national security observation period,” Mainland Affairs Council (MAC) Minister Chiu Chui-cheng (邱垂正) said yesterday. President William Lai (賴清德) on March 13 announced 17 strategies to counter China’s aggression toward Taiwan, including incorporating national security considerations into the review process for residency applications from Hong Kong and Macau citizens. The situation in Hong Kong is constantly changing, Chiu said to media yesterday on the sidelines of the Taipei Technology Run hosted by the Taipei Neihu Technology Park Development Association. With

CARROT AND STICK: While unrelenting in its military threats, China attracted nearly 40,000 Taiwanese to over 400 business events last year Nearly 40,000 Taiwanese last year joined industry events in China, such as conferences and trade fairs, supported by the Chinese government, a study showed yesterday, as Beijing ramps up a charm offensive toward Taipei alongside military pressure. China has long taken a carrot-and-stick approach to Taiwan, threatening it with the prospect of military action while reaching out to those it believes are amenable to Beijing’s point of view. Taiwanese security officials are wary of what they see as Beijing’s influence campaigns to sway public opinion after Taipei and Beijing gradually resumed travel links halted by the COVID-19 pandemic, but the scale of

A US Marine Corps regiment equipped with Naval Strike Missiles (NSM) is set to participate in the upcoming Balikatan 25 exercise in the Luzon Strait, marking the system’s first-ever deployment in the Philippines. US and Philippine officials have separately confirmed that the Navy Marine Expeditionary Ship Interdiction System (NMESIS) — the mobile launch platform for the Naval Strike Missile — would take part in the joint exercise. The missiles are being deployed to “a strategic first island chain chokepoint” in the waters between Taiwan proper and the Philippines, US-based Naval News reported. “The Luzon Strait and Bashi Channel represent a critical access

Pope Francis is be laid to rest on Saturday after lying in state for three days in St Peter’s Basilica, where the faithful are expected to flock to pay their respects to history’s first Latin American pontiff. The cardinals met yesterday in the Vatican’s synod hall to chart the next steps before a conclave begins to choose Francis’ successor, as condolences poured in from around the world. According to current norms, the conclave must begin between May 5 and 10. The cardinals set the funeral for Saturday at 10am in St Peter’s Square, to be celebrated by the dean of the College